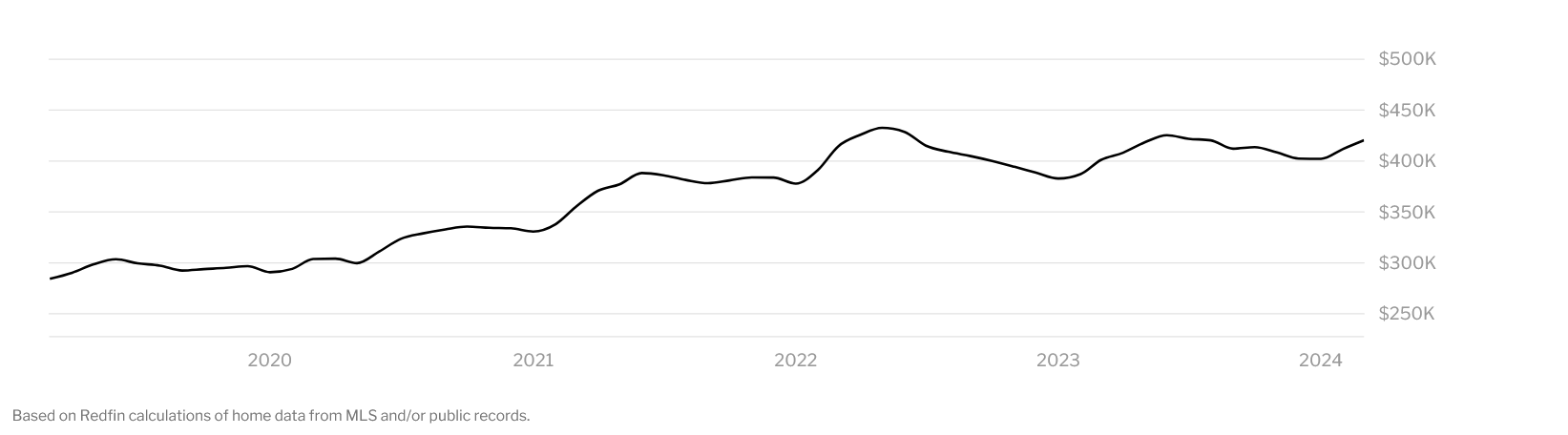

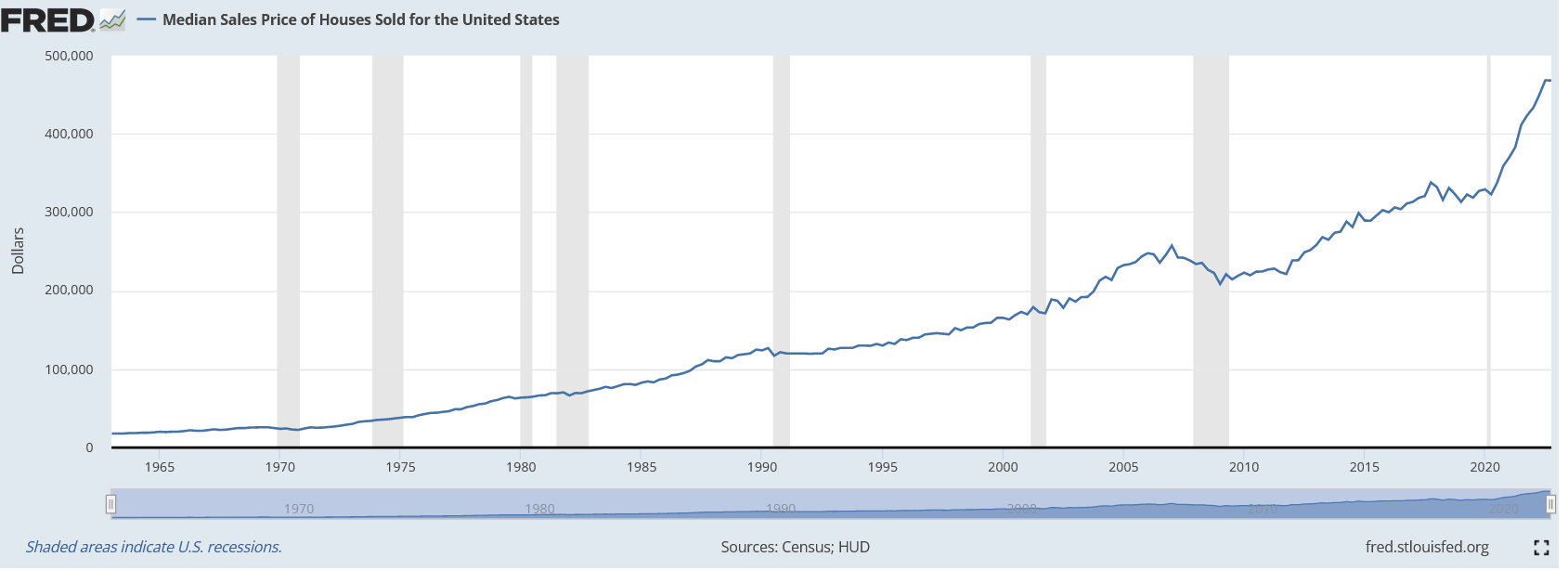

House prices hit another record, what is now driving house prices?

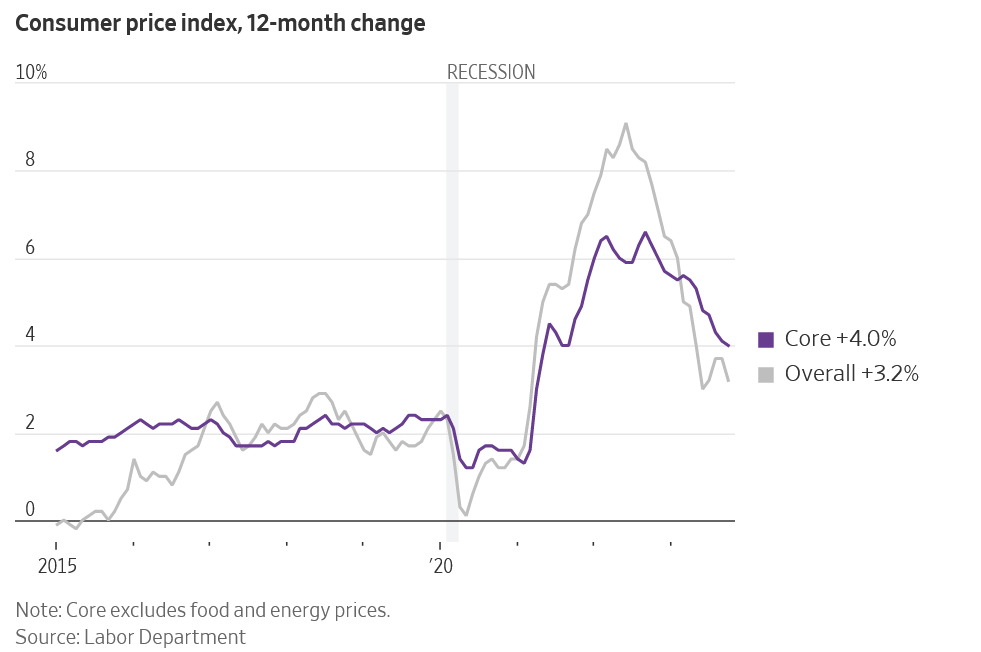

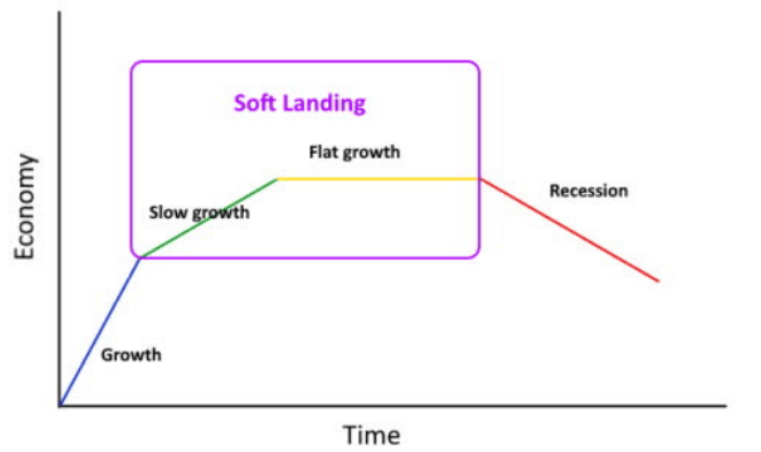

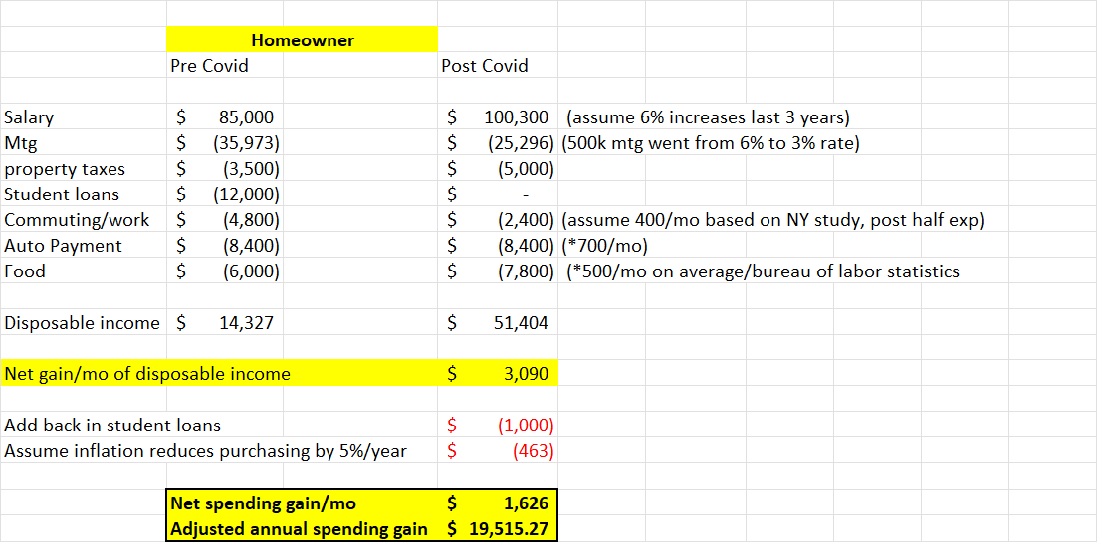

It is astonishing that house prices continue higher in the face of high interest rates and a slowing economy. The media keeps pinning the continued appreciation on lack of supply even while listings in places like Denver have jumped 33%…