In the past recessions, especially in 2008, just prior to the crash we saw a big pull back in luxury purchases. This was an early indicator of huge drops in real estate prices. Currently we are seeing a resounding change in luxury spending, does this mean luxury real estate will also have a large pull back? What does this mean for the rest of the real estate industry. When will real estate prices finally feel the tug of the slowing economy and higher interest rates?

What has happened in luxury spending recently?

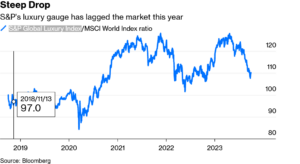

For the past four years, investors have indulged in European luxury stocks given their strong revenue growth, said Bank of America Corp.’s Candace Browning. But growth started decelerating in the second quarter and the card data the firm tracks suggest US luxury fashion spend is down 16% year-on-year in the third quarter.

Why look at luxury spending to predict real estate prices?

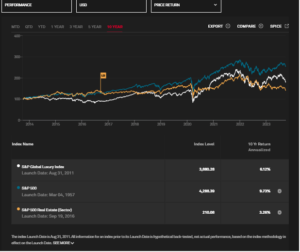

Spending by high net worth individuals is a leading indicator of broader changes in the economy. If we study the last cycle, the ultra-wealthy saw the writing on the wall of the imminent downturn before general America and began taking steps to protect themselves months before the rest of general America. Based on the chart above, you can see two very distinct recent drops. First in Q1 of 2021, the Luxury index (white trendline) pulled back about a month before the S&P (blue trendline) went down substantially. We are also seeing this today with the luxury index preceding a pullback in the stock market.

I also thought it would be interesting to track the luxury index vs the real estate index (the yellow trendline), they follow almost in lockstep. So as the luxury index goes down so does the S&P real estate index.

If luxury spending is pulling back what does that mean for luxury real estate?

Sales of luxury homes nationwide, defined as the top 5% of homes based on estimated market value, declined by 24.13% in the three months ended June 30, compared with the same period last year, according to a new report by brokerage Redfin. Inventory of luxury homes was down 2.39% during that same period, while the median sales price for a luxury home was up by 4.55%.

“The luxury market is definitely hurting in terms of transactions,” said Daryl Fairweather, Redfin’s chief economist. “Even when you compare it to the rest of the market, it’s looking like luxury has really cooled off.” I’m seeing the same trends in Colorado with sales down 16 percent, but median sales price is still up 8% year to date.

Luxury sales leading indicator for real estate

Based on the charts above, luxury sales fall shortly before the rest of the stock market. We are seeing this play out today, with the S&P continuing to fall. At the same time real estate continues to hold up even in the face of the highest mortgage rates in almost 25 years. As of this writing they were hovering around 8%. This begs the question, with interest rates surging to new highs and wealthy luxury buyers pulling back, how is real estate price not impacted?

BMW, the luxury automaker provides clues

Unfortunately the S&P luxury index did not start until 2011, but if I go back and look at BMW (chart below) it can provide some clues to what we can expect in real estate. In the last cycle BMW peaked in about May which was 6-8 months before the recession (depending on who you ask of when it officially started). If I look at this cycle, BMW’s stock peaked around July of this year which would mean we should start seeing some price adjustments in real estate late q1 or early q2 of 2024.

We will be able to start seeing the first ripples of what is to come early Q1 in markets like Vail, Aspen, and Telluride. These markets will start declining before the broader market as the ultra-wealthy pull pack. So far we haven’t seen any indications of price resets, just a reduction in sales, but it is too early to really see this as we are just now seeing the economy start biting into luxury sales.

History doesn’t repeat, but rhymes

Although we will likely not see a repeat of 2008 there are some similarities with luxury spending starting to fall substantially prior to an economic downturn. At the same time the stock market is finally beginning to reset after an amazing run while ten year treasury yields and in turn interest rates are hitting highs not seen in the last twenty years.

A recent Bloomberg piece summed it up nicely:

When everyone expects a soft landing, brace for impact. That’s the lesson of recent economic history — and it’s an uncomfortable one for the US right now.

Soft Landing Calls Always Precede Recessions…

“The most likely outcome is that the economy will move forward toward a soft landing.” So said then-San Francisco Fed President Janet Yellen in October 2007, just two months before the Great Recession began. Yellen wasn’t alone in her optimism. With alarming regularity, soft landing calls peak before hard landings hit.

A soft landing remains possible. Is it the most likely outcome, though? With the US confronting the combined impact of Fed hikes, auto strikes, student loan repayments, higher oil prices, and global slowdown we think not.”

Summary

The pullback in luxury spending is a warning sign that should not be taken lightly. Based on prior cycles, we are about 6 months away from a price reset. Look for prices to begin adjusting downward after the first quarter of 2024 as higher mortgage rates and other consumer and business rates bite into spending and the economy finally starts to slow under increased federal reserve tightening.

Based on what I am seeing in the markets, 6 months seems like a reasonable time period as I am also watching credit card and auto defaults start to tick up which typically occurs 4-6 months before a recession. I’ll check back in early 2024 and we can see if my prediction is correct. I’d be interested to hear if you agree with my assumption and/or when you think a price reset will occur or not occur.

Additional Reading/Resources

- https://www.wsj.com/articles/u-s-luxury-real-estate-market-b5ab35c5?mod=hp_lead_pos9

- https://www.spglobal.com/spdji/en/indices/equity/sp-global-luxury-index/#overview

- https://www.bloomberg.com/opinion/articles/2023-10-03/bond-yields-keep-spiking-while-luxury-bets-on-china-lose-luster?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender