It is a bit perplexing; mortgage rates are over 7%, well over double their lows, and yet real estate prices are once again heading higher after a minor pullback late last year. Prices have pivoted from last fall to make a strong comeback and approach new highs. What is driving the recent rise in prices? Is this sustainable? What does this mean for inflation?

What was in the Case Schiller data?

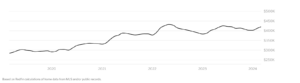

The S&P CoreLogic Case-Shiller National Home Price Index reaccelerated and grew by 6.4% year over year in February, marking the index’s eighth straight month of annual growth.

The increase, which was up from 6.0% one month prior, was the fastest yearly rise since November 2022. Home prices nationwide are now largely at or near all-time highs again after some short-term decline last year. Prices are now up by 1.3% compared to the recent high in June 2022.

“Since the previous peak in prices in 2022, this marks the second time home prices have pushed higher in the face of economic uncertainty,” said Brian D. Luke, head of commodities, real & digital assets at S&P Dow Jones Indices. “The first decline followed the start of the Federal Reserve’s hiking cycle. The second decline followed the peak in average mortgage rates last October. Enthusiasm for potential Fed cuts and lower mortgage rates appears to have supported buyer behavior, driving the 10- and 20-city composites to new highs.”

Why are home prices now rising again?

- Lock in effect: there is still limited inventory due to low rates “locking in “ homeowners

- Strong labor market wage gains: Labor market remains robust which continues to drive spending

- Very few defaults/distress in residential: With a strong labor market and locked in low rates, the distress in the market is very low/non existent

- Extremely high building costs: As labor rates and materials continue to increase coupled with higher land costs in desirable areas building costs have increased substantially. This means that house prices also will be higher as to buy a “replacement” will be expensive. Furthermore, the high building costs are making it difficult to build affordable units which is further driving up prices especially on the affordable end of the price curve.

Take the recent data with a grain of salt

Although there are several factors continuing to drive up costs, I would take the recent data with a grain of salt. During the first 5 months of the year sales are usually softer than the spring/summer season. Remember there is also a lag as a house could go under contract but not close for 30-60 days. At the end of the summer, we will have a much better feel on pricing.

Are the price gains sustainable?

In the short term the price gains might continue a bit longer, but long term they are not sustainable. Here are the primary drivers that will eventually change the tide on house appreciation.

- High rates will eventually break the market

- Labor market must correct

- Lock in effect will eventually fade

The Federal reserve has continued to emphasize higher for longer and interest rates have been hovering between 7-7.5%. At these rates, income gains cannot keep up with the increased costs. Higher rates will eventually slow down the residential real estate market. Furthermore, the longer rates stay higher, the more likelihood that unemployment increases which will lead to more inventory due to distress.

Will house prices continue higher?

It is important to remember that housing makes up about 30% of the consumer price index. For the CPI to fall to the federal reserve’s target, there must be a major change in housing. Currently housing is continuing to appreciate leading to increases in the CPI. To reverse the inflation increases, the federal reserve has vowed to keep rates higher for longer.

Although we are not seeing any impact of rates on the housing market yet, it will eventually happen. As rates remain high, financial stress will ultimately filter through the economy from a slow down in spending, to higher unemployment, to less business investment, etc… Each of these items will eventually place downward pressure on prices.

We aren’t seeing much if any financial stress in the economy today, but storm clouds are brewing. Look for prices to come off their highs later this year as higher for longer rates finally slow things down.

Additional Reading/Resources

- https://www.cnbc.com/2024/04/30/sp-corelogic-case-shiller-home-prices-index-february.html

- https://www.fairviewlending.com/why-are-mortgage-rates-rising-again/

- https://www.fairviewlending.com/clearest-sign-yet-commercial-real-estate-is-in-big-trouble/

- https://coloradohardmoney.com/colorado-property-values-soften-property-taxes-increased-36-82/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender