Inflation cools in June, what about interest rates and house prices?

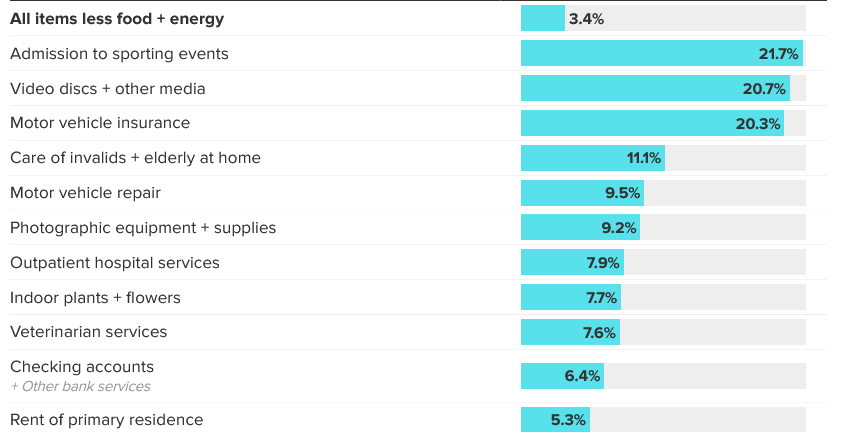

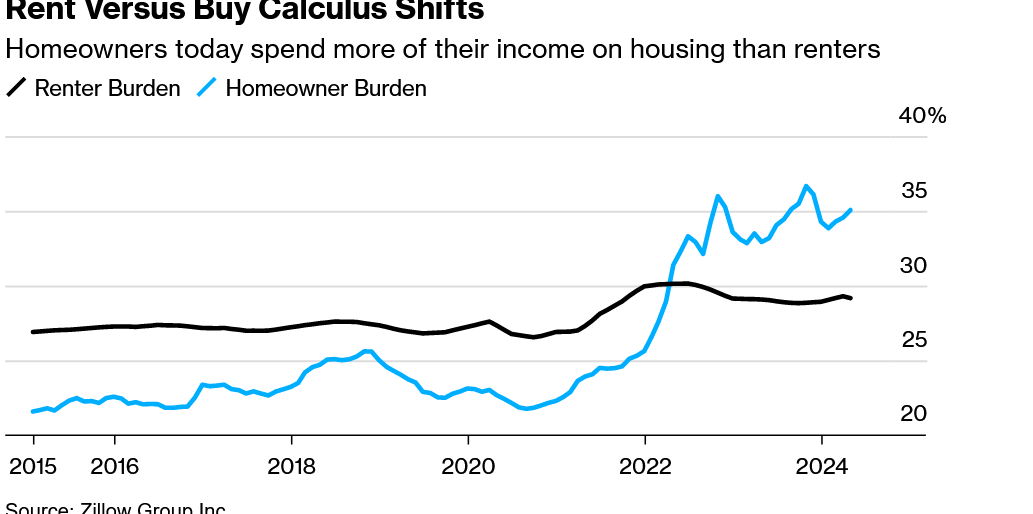

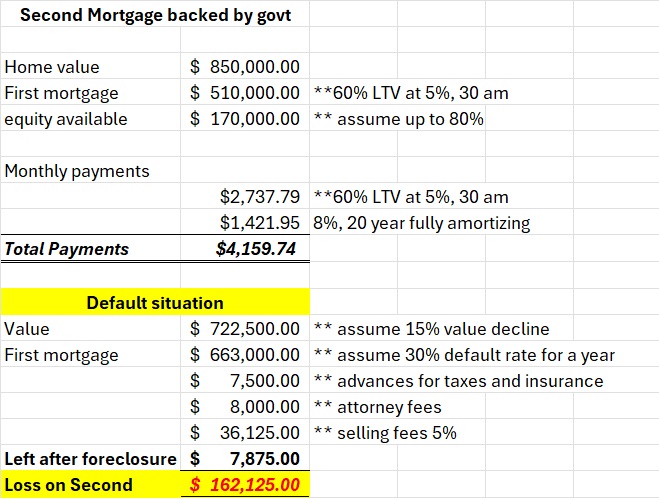

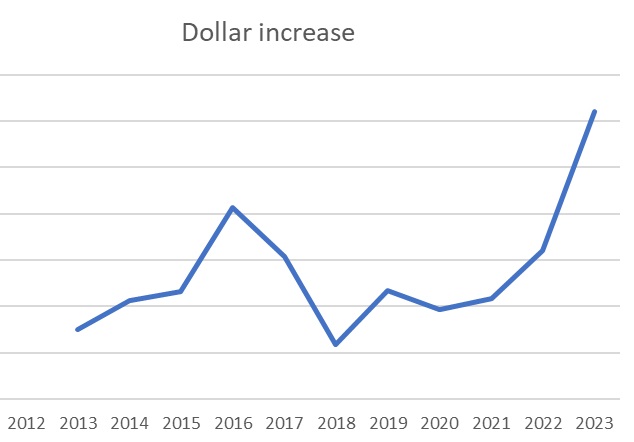

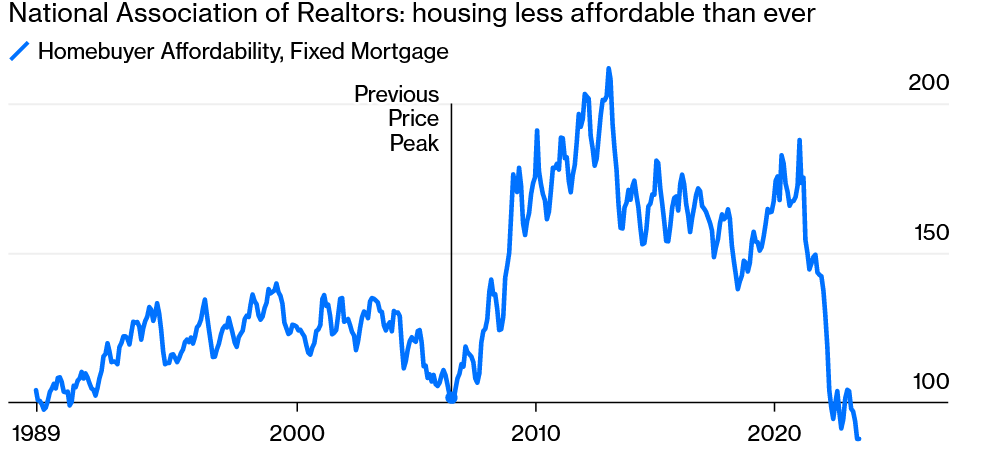

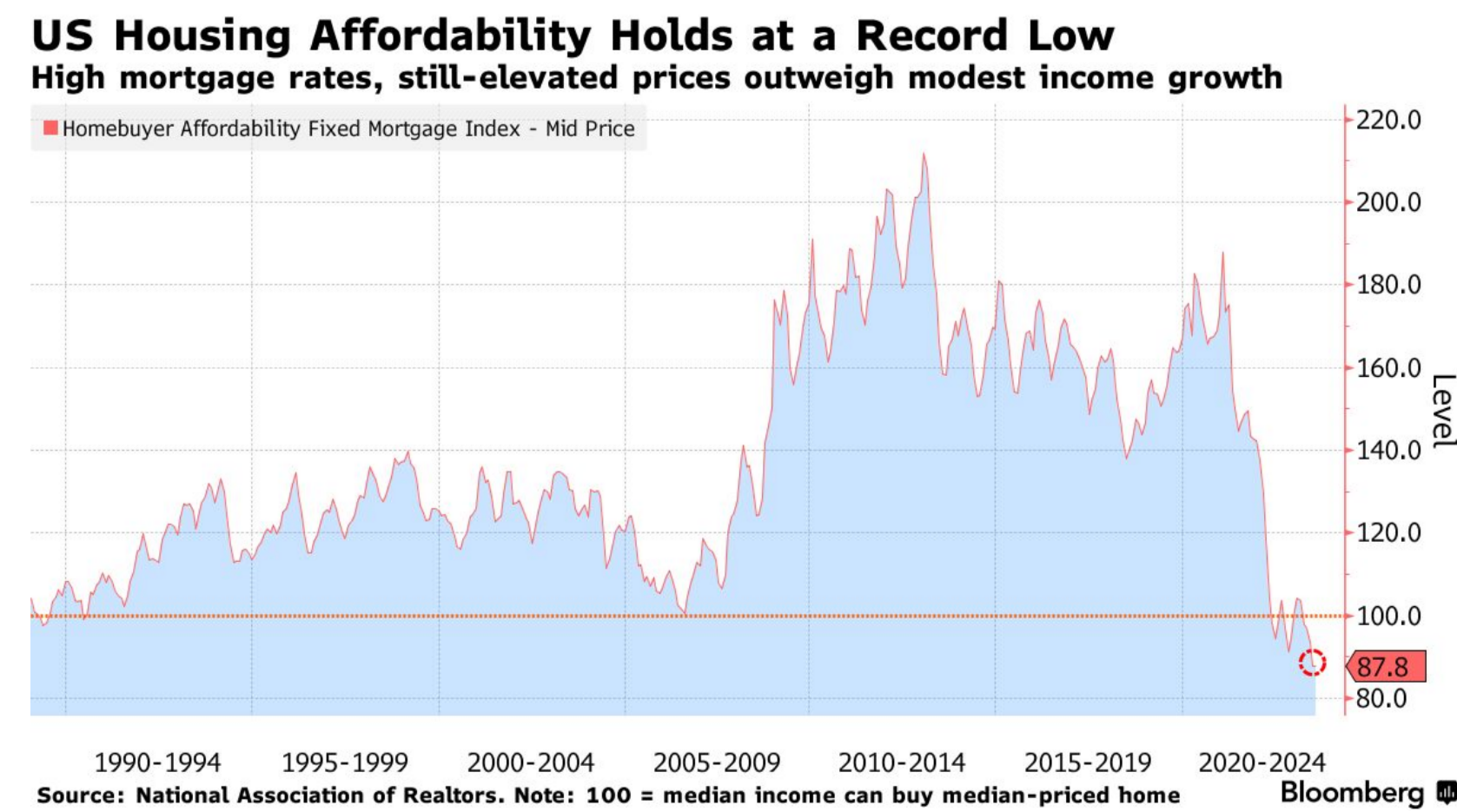

When I was writing this article mortgage rates were hovering right around 7%. At the same time June showed the first real slowdown in inflation in the last year. The stock market soared on the slowdown in inflation while the…