There is a huge premium to buying a property compared to renting. It is now 70% more expensive to buy vs rent a property, which is considerably higher than at any time in the last fifty years. What is causing the large divergence in renting vs buying? What does this mean for the future of rents and home prices? How will this impact mortgage rates?

Historical relationship between rents and sales prices

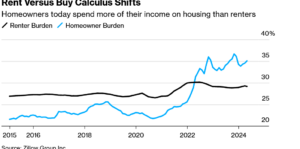

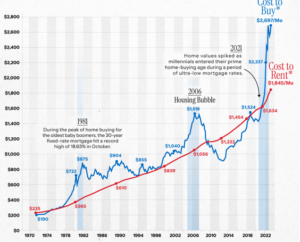

Looking back to the 1970s, other than in times of bubbles like 2008, historically rents and cost of buying have been within 15% or so of each other. As you fast forward to now, it is 70% more expensive to buy a house vs rent one. It is now cheaper to pay for an apartment than to own the typical home in all but one of the 35 major metros in the US, Zillow data show.

Why has the rent vs buy been upended in this cycle

In typical cycles we would see home prices rise, then a recession would follow that would allow home prices to drop at the same time interest rates also would drop as the federal reserve worked to stimulate the economy. This historical event has not occurred in this cycle. House prices continue to rise in most markets while interest rates have more than doubled. This has led to a huge affordability gap. Furthermore inflation is driving up the cost of home ownership with higher costs for repairs/remodels, higher insurance, and property taxes due to higher home prices.

Rents and prices must trade in a tight range.

If you think of a house as a commercial property, there is a formula to justify the price: Net Operating income/ Cap Rate (rate of return). This allows an investor to see their return on their investment. The same is true for housing, the income approach should come close to the value. Currently house prices are trading well above any reasonable pricing via the income approach. As a result, corporate buyers have pulled out of the market for existing homes as the prices don’t justify the amount of rent that can be collected. Unfortunately, it is not possible for the current scenario to last.

Looking at the charts, our current divergence of rent vs housing costs is extreme. Currently the difference between the two is running almost 3 times the historical average which means that something must happen to either rents or housing costs. Rent and the cost to buy cannot diverge this much forever and eventually they must come closer to historical norms. Either rents must rise substantially, or housing prices have to fall or a combination of the two.

Why focus on rents and housing for inflation predictions?

In the Consumer Price Index “Shelter” is the largest variable in the index. Rents have always been important in measures of inflation, due to their outsize share in most household budgets: They comprise a little over 30% of the headline consumer price index, and about 40% of the core index.

The CPI does not directly measure housing price increases but attempts to capture this indirectly via rents. As housing prices rise, rents in turn must rise to keep up (or vice versa as rents rise, housing prices rise). Regardless of which happens first there is a historic link between housing prices and rents. You see this link most profoundly on commercial properties as the key metric to evaluate commercial properties is the income approach (revenue-expenses)/cap rate. As rents rise, property values rise as the net operating income is higher.

On the residential side, the same is occurring. As residential housing prices have risen profoundly rents in turn have risen to keep pace. This is intuitive as one would expect to pay more to rent a home that is worth 200k vs. 400k. With rents rising due to rising home prices, inflation in turn is remaining high

What does this mean for interest rates and in turn real estate prices?

The hiking cycle by the federal reserve will be longer than is currently priced into the markets. With rents/shelter, food, medical, and other categories continuing to run higher the federal reserve will have a harder time taming inflation. Currently the recent interest rate hikes have done little to cool the economy as housing prices are remaining high and rents are also still running strong. As the divergence between rents and housing costs continues well above historical means, look for rents to continue increasing and either they will increase substantially, or housing prices will have to come down.

Summary

There is no scenario where rent prices do not increase while at the same time housing prices remain high. One of the two variables must move which means either inflation will continue substantially higher due to higher rents or there is a big reset in the market as housing prices come down substantially. One other scenario is a two-step process where initially rents rise leading to higher inflation and in turn higher mortgage rates. As mortgage rates stay higher eventually housing prices will reset. It will be a two-step process that could take another 6-12 months to flow through the economy. Unfortunately, I don’t foresee a soft-landing scenario that has been advertised as there is no way to break the inflation cycle of housing without a reset in prices and in turn lower rents.

Additional Reading/Resources

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender