Who is better for real estate Harris or Trump ?

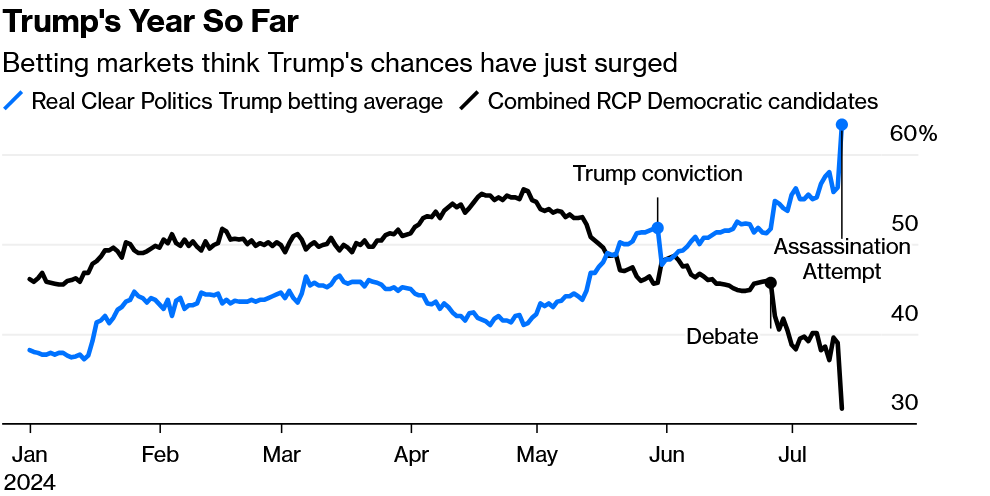

Wow, it is amazing how quickly tides have changed. Look at the chart above of the betting market on the next presidential election right after the assassination attempt. Fast forward and another twist happened over the weekend with President…