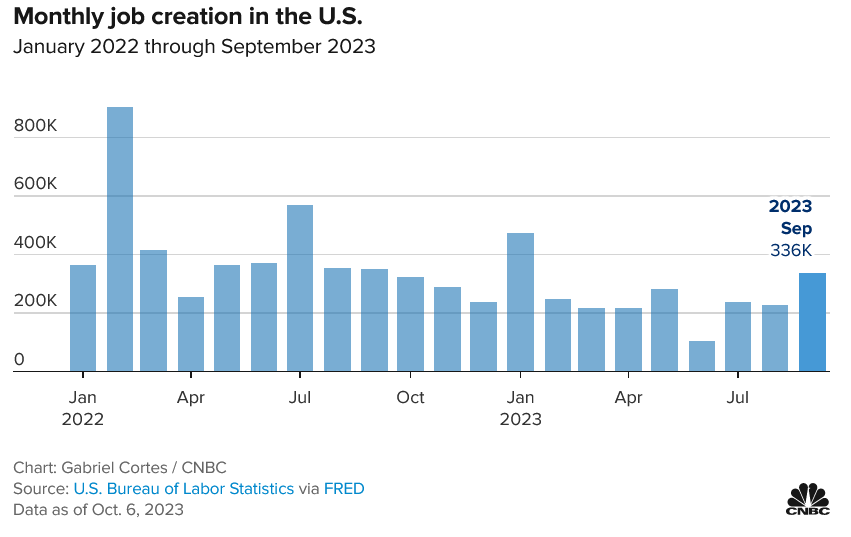

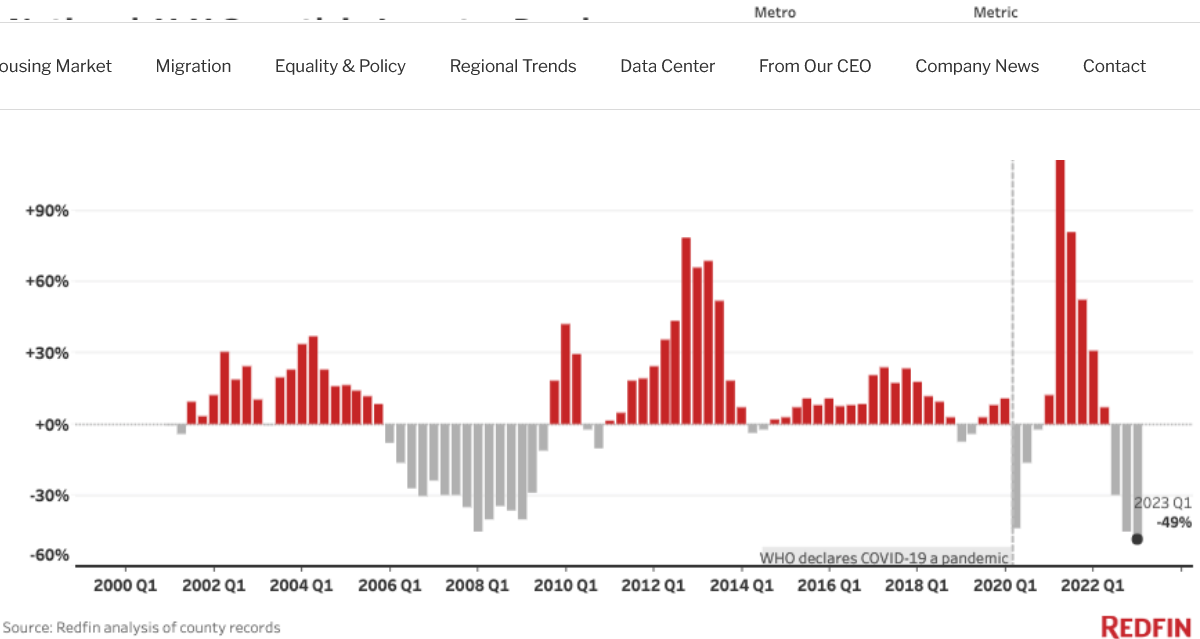

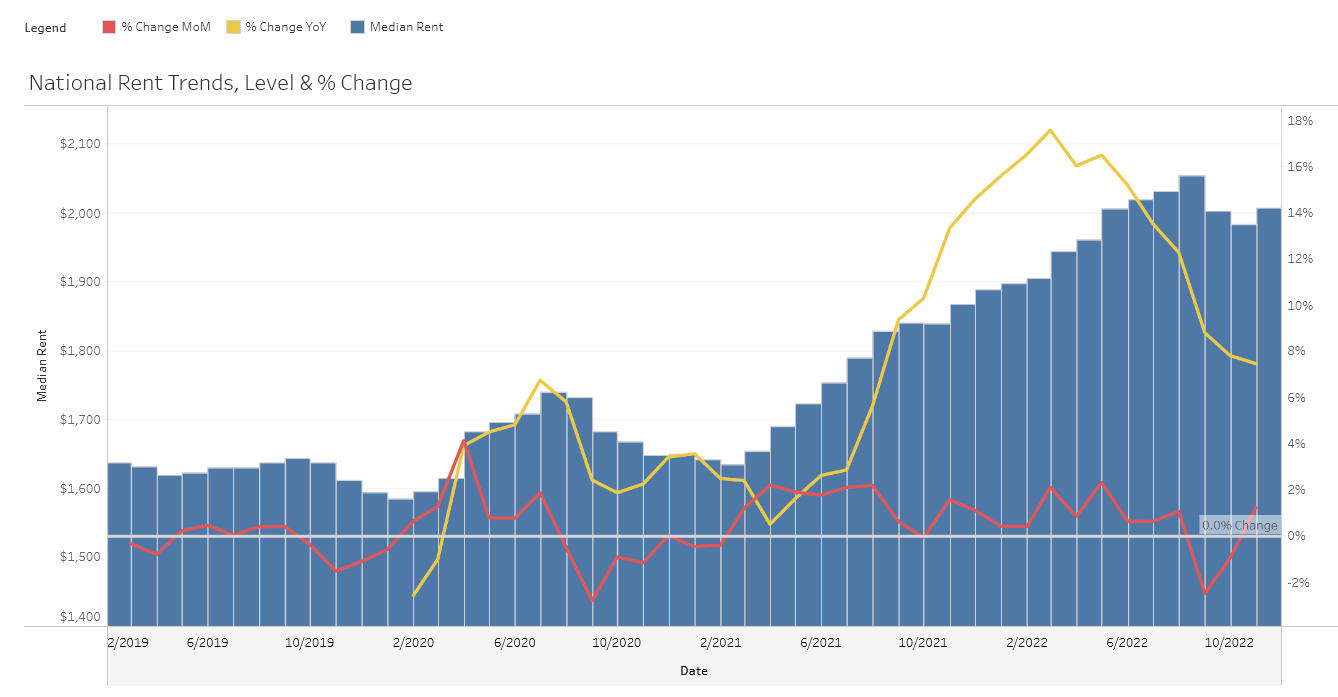

Job gains shatter expectation; impact on real estate

The economists forecasting the jobs data missed big time, with the recent jobs report almost double their predictions. Why is job growth still surging while interest rates hit 20 year highs. What does this mean for future interest rate increases? …