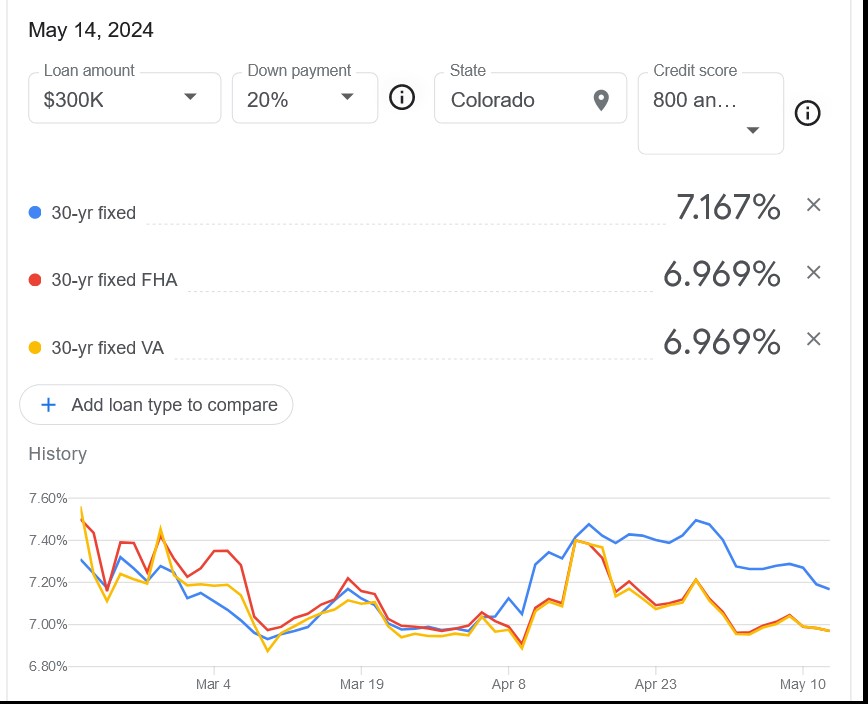

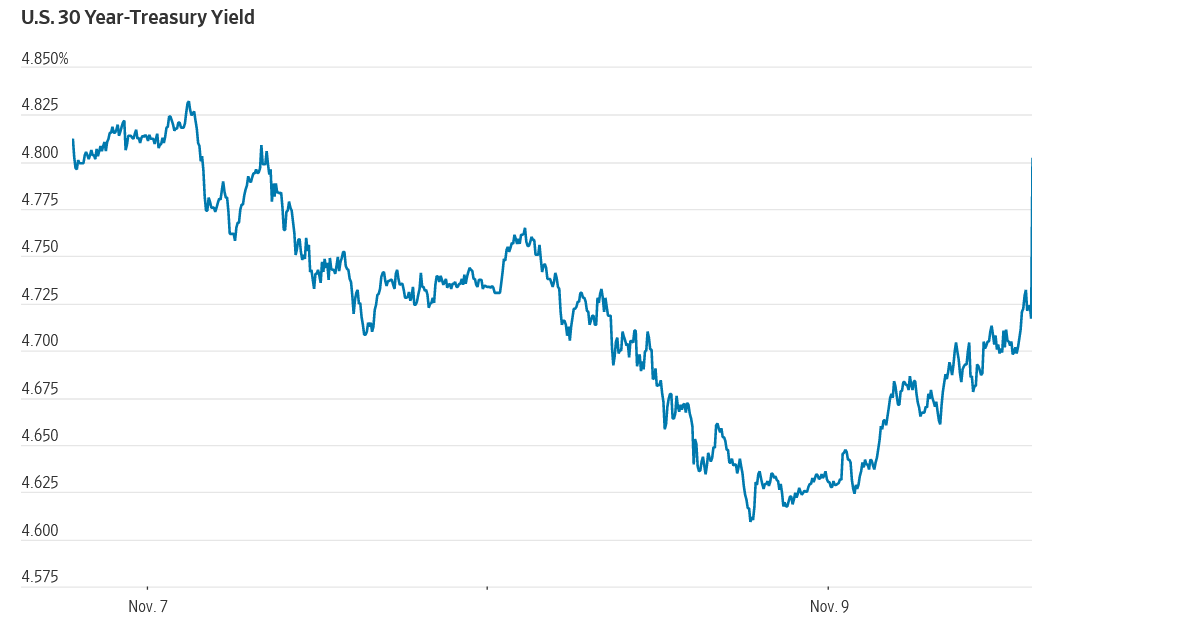

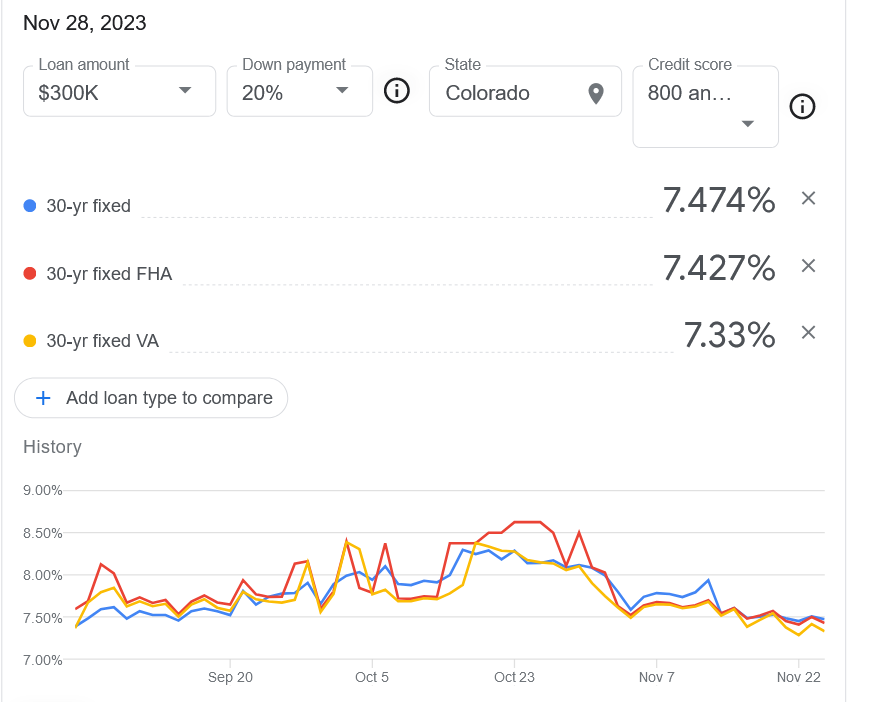

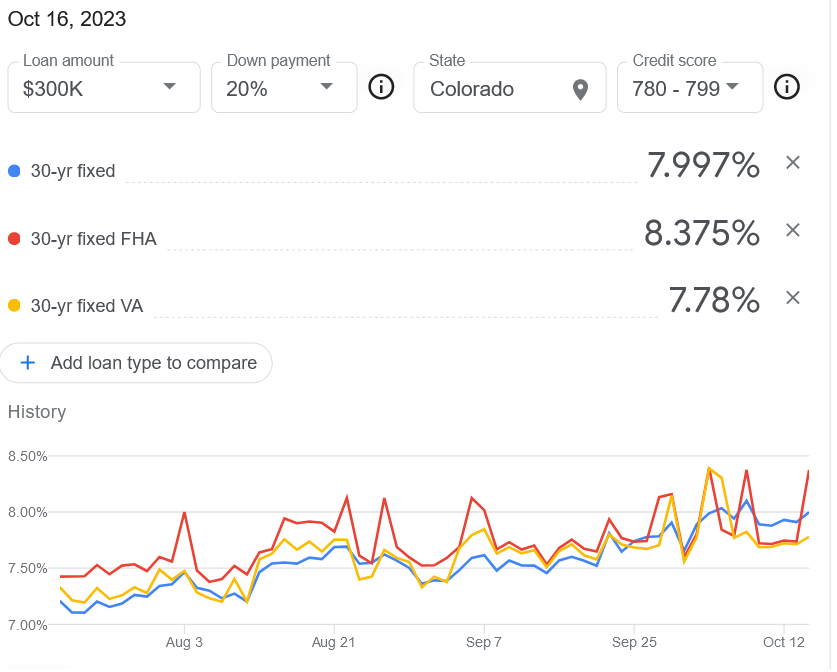

Fed cuts rates half percentage, Why did mortgage rates rise?

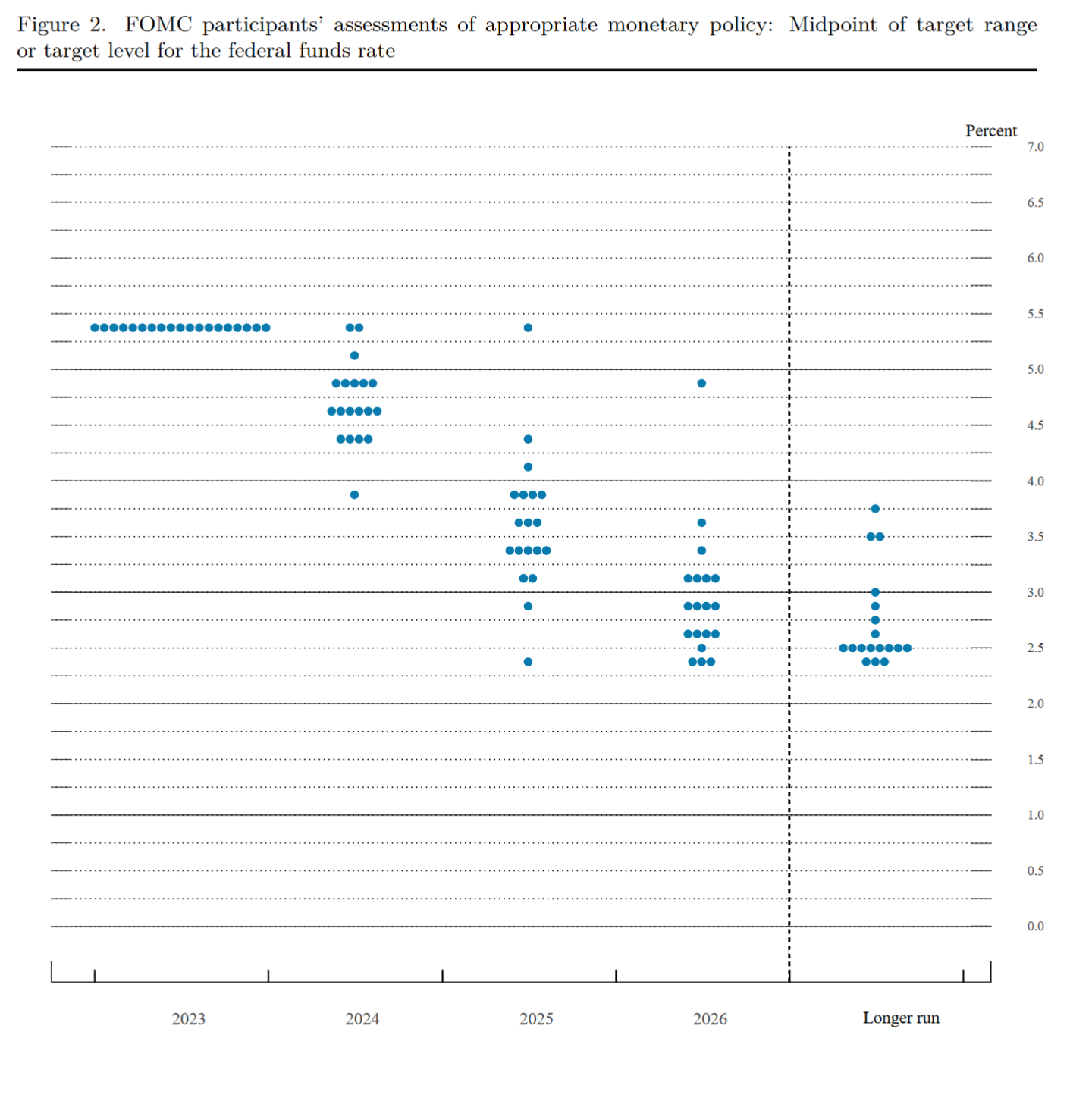

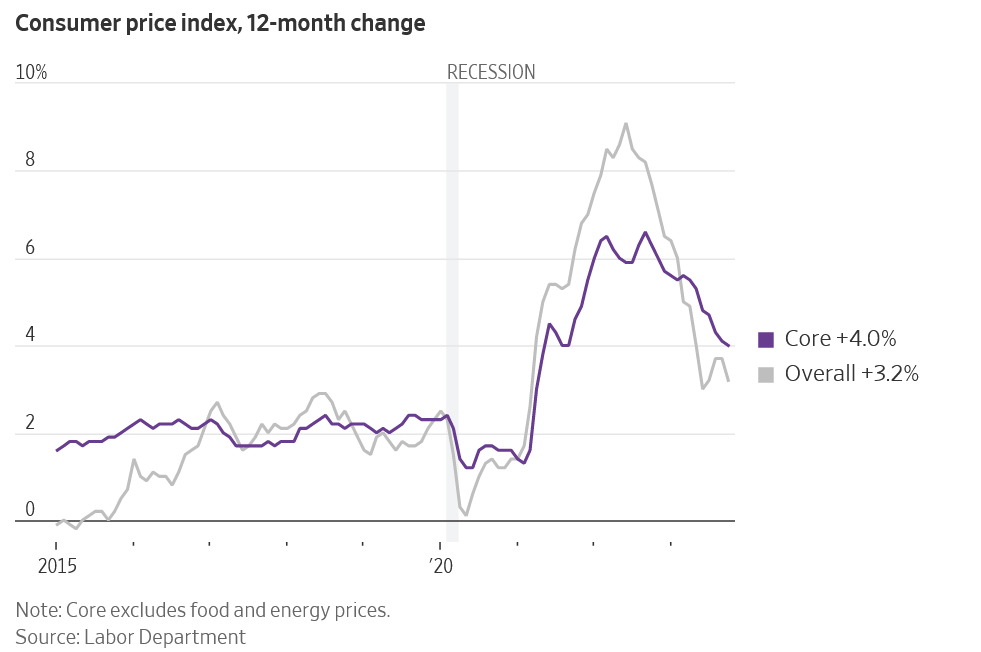

The market was anticipating a much smaller cut by the federal reserve as inflation is still high and employment and spending is holding up. The odds were about 75% for a smaller cut, but the federal reserve definitely surprised with…