Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued surge in consumer spending and how long will it last? Why the big divergence amongst retailers? Is there a divergence in consumer spending as well? What does this mean for real estate?

Consumers keep spending against the odds

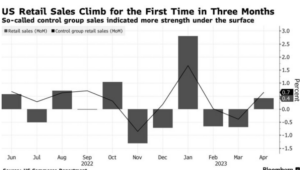

Against all odds of a slowing consumer, the numbers continue to impress. US retail sales increased in April, suggesting consumer spending is holding up in the face of economic headwinds including inflation and high borrowing costs.

The value of retail purchases rose 0.4% after an upwardly revised 0.7% decrease in March, Commerce Department data showed Tuesday. Excluding autos and gasoline, sales increased 0.6%.

Home Depot sales drop

Although consumers continue to spend, Home Depot was not a beneficiary of the increased spending as sales were 2.7% below Wall Street’s expectations ($37.26B vs. $38.28B est. from Refinitiv) – its biggest revenue miss since November 2002. It is also the second straight revenue miss for the home improvement retailer – which follows 12 straight revenue beats. It’s also the biggest revenue drop since the financial crisis (revenue down 4.2% YOY in the latest quarter). It highlights that consumers are finally shifting their spending from goods to services that has long been predicted. Although the markets reacted forcefully with Home Depot’s stock declining, I don’t think Home Depot is indicative of the general economy.

Consumers are considerably healthier than markets are forecasting

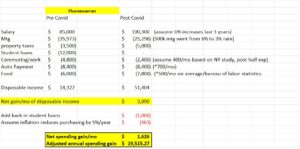

Below is a quick model I put together that shows the huge increases in cash flow for consumers that are homeowners. Consumers who bought a house and locked in a low rate are faring considerably well. Along with the low mortgage, salaries have been increasing while at the same time student loans have been paused. All of these changes have led to a 260 percent increase in household cash flow. This cash flow has been used to buy goods like autos, travel, eat out, etc….

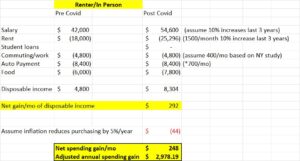

On the flip side, renters and lower income consumers have not benefitted much from the rock bottom interest rates, the work from home, and the deferral of student loan payments for 3 years. Although they are better off than before the pandemic, their monthly gains were muted compared to homeowners.

Recession not imminent

Looking at the models above is it clear that there is a huge divergence occurring within the economy. First class tickets are in high demand as consumers have the money and “splurge” while at the same time many consumers are watching their budget will grocery shopping. With this huge divergence in spending, I don’t see an imminent recession in the next 120 days or so as higher end consumers still have a very healthy cash flow. On the other hand lower income consumers are already starting to feel the pinch, but I don’t think it will be enough to tip us into a recession.

What happens the end of the year and into next year

Based on my models, everything looks rosy, but there are troubled waters ahead:

- Inflation will remain high due to higher end consumer spending: Consumers are still spending readily and this trend will likely continue a bit longer which will keep inflation higher than the models are forecasting today.

- Interest rates will remain high or head higher: As inflation remains robust, rates will need to head higher or at a minimum stay where they are today to bring inflation down. As interest rates remain high ultimately business spending will pull back leading to a general pullback in the economy.

- Ultimately unemployment will increase further for white collar jobs: We have seen a unique trend this cycle where service workers are in high demand while white collar jobs are facing layoffs. Look for this trend to accelerate as we get into the next economic cycle.

What will happen to real estate prices later this year?

By any account real estate is outperforming all predictions. Other than pockets of commercial properties, the bottom has not fallen out on real estate. Although consumers continue spending even considering inflation and higher rates, it would be premature to call all clear. Look for real estate in most markets to kick around a narrow window of around 5% increases/decreases until later this year.

Summary

Consumers are still flush with cash from the pandemic “lock-in” effect of low rates and decreasing costs not commuting and paying student loans for three years. As we have seen with the latest earnings, consumers will keep spending but are shifting away from hard goods to services, experiences, and other soft goods.

Unfortunately, the good times will ultimately end but the end is still at least 6 months out. The three factors I highlighted above: inflation, higher rates, and upcoming employment woes will eventually alter the market later this year or early in 2024 so enjoy the party while it is still going but start looking for the exit ramps as it will be winding down early next year.

Additional Reading/Resources

- https://www.cnbc.com/2023/05/16/what-home-depots-poor-outlook-means-for-the-stock-market-and-economy.html

- https://www.bloomberg.com/news/articles/2023-05-16/us-retail-sales-increase-in-sign-of-steady-consumer-spending

- https://www.cnbc.com/2023/05/17/target-tgt-earnings-q1-2023.html

- https://libertystreeteconomics.newyorkfed.org/2023/05/the-great-pandemic-mortgage-refinance-boom/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender