Fairview Commerical Lending

HARD MONEY LOANS WHEN THE BANK SAYS “NO”

Direct Private Real Estate Lender

No upfront fees

All credit OK

Loans up to 10 years

Closing in 10 days or less

Call us at 866-634-1270

Newsletter Sign Up: Join 25k+ real estate/ finance pros weekly to learn expert tips/trends

Fairview Commercial Lending is a privately funded direct hard money lender

Hard Money Blog:

Recent Posts

What does the Iran war mean for real estate?

I was a bit surprised at the market reaction, check out the 10 year treasury (above) on the Monday after the war began. I would have predicted the opposite reaction with yields falling. What are...

Get your own house in order to solve affordability

The Trump administration hasn’t been short of proposals in recent months it says will improve affordability in the housing market and boost Americans’ chances of taking out a mortgage. “All of the...

Supreme court nullifies tariffs, 3 big changes to real estate

The supreme court throws out president Trump’s tariffs. What does this mean for real estate building costs and interest rates? Why is the chart above so important? Will this decision...

Hard Money / Private Money Loan Programs

Residential Hard Money Loans

Commercial Hard Money Loans

We focus on bridge loan/private loans/ asset based lending on general purpose commercial properties: Office, retail, light industrial, mixed use, multifamily, and Marijuana properties (Colorado only). No appraisals or upfront fees required saving the borrowers thousands. See why Fairview is the leader in Commercial hard money loans. Closings typically in 5-10 days.

Recently Closed Loans

See What Our Clients Are Saying About Us

Over 40 years Of Expertise

- Loans on Residential Investment, Commercial, Agricultural, and Marijuana properties

- Closing and funding in 5-10 days

Newsletter Sign Up: Join 25k+ real estate/ finance pros weekly to learn expert tips/trends

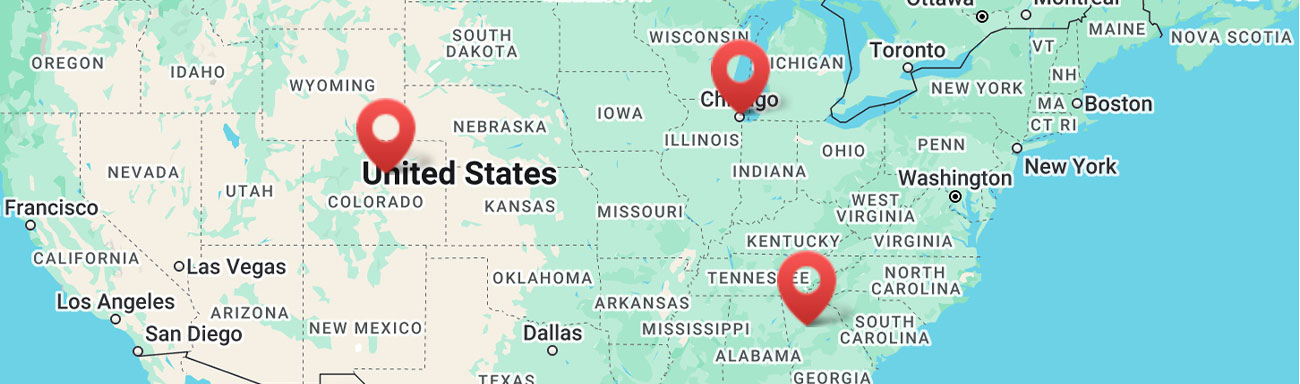

Hard Money / Private Money : Where we lend

Georgia Hard Money Loans

We are headquartered in Atlanta (Sandy Springs). We are experts in Atlanta Georgia real estate as we are 5th generation natives of Georgia and have over 100 years of Georgia commercial and residential real-estate lending experience. We can assist on your private lending needs throughout GA.