What does the recent CPI fall mean for mortgage rates and real estate prices?

A broad slowdown in inflation continued in October, likely ending the Federal Reserve’s historic interest rate increases. The slowdown came below most median estimates and the stock market roared after the news and in turn bond yields fell leading to lower mortgage rates. What does the end of the fed cycle mean for interest rates going forward? How will real estate prices be impacted by falling rates?

What was in the recent data?

Consumer prices overall were flat last month and rose 3.2% from a year earlier, a slower pace than in September as prices for gasoline fell, the Labor Department said Tuesday.

So-called core prices, which exclude volatile food and energy items, rose a modest 0.2% in October from the prior month and increased 4% from a year earlier, the smallest annual change since September 2021.

The slowdown reflected lower prices for cars and airfares and milder growth in housing costs. Core inflation is often viewed as a better predictor of inflation’s future trajectory than the overall numbers.

What happens to mortgage rates now?

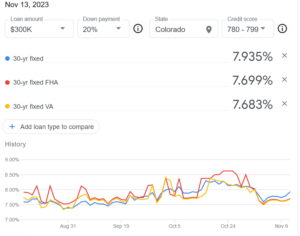

Mortgage rates do not move in lockstep with the 10 year treasury. We should see mortgage rates come off their highs and drop a little, but do not look for rates to fall back to the pandemic lows anytime soon. Below is a screenshot of rates when the October CPI came out. Also remember that the buyers of mortgages also have an impact on rates as they are requiring a higher “risk premium” due to future uncertainty on inflation and the economy. Look for rates to settle into a range lower than their peak of 8.4% to about 7.5-8% range. Rember this is still about 2.5 times the pandemic lows.

What happens to real estate prices as the fed is likely done raising rates?

Many think that as mortgage rates fall, real estate prices will take off. Unfortunately, this is not the case in real life as mortgage rates are not going to be drastically altered from the recent change in stance by the federal reserve.

Real estate prices will likely not make a major move from the recent slowdown in the CPI. Real estate is still “expensive” as prices have risen substantially in the last 3 years and rates are still 2.5 times higher than they were during the pandemic lows. I don’t see much if any upside on real estate prices and the real story is the downside risk even with the moderation of mortgage rates.

The employment wild card

The market seems to be fixated with interest rates, but this is not the entire story. The employment rate is another key metric that will have an outsize impact on prices. Unfortunately, employment is the wildcard that could drastically alter real estate predictions.

Here is an interesting analysis from Bloomberg: “Even though the layoff rate is low, the number of unemployed people is rising because hiring has slumped. The non-seasonally adjusted series of continuing jobless claims, or people who are collecting unemployment benefits, is now up by more than 25% from a year ago.”

If the unemployment rate ticks up as predicted, you will see a loosening in the housing market leading to more supply and ultimately a bit lower pricing even with the federal reserve done with this hiking cycle.

Summary

The trending down of CPI and the end of the fed hiking cycle in sight is definitely good news, but we are still a long way from declaring victory as we still have substantial ground to cover for inflation to fall back to the 2% target. In the interim, look for mortgage rates to come off their highs, but still settle in around the 7.5% range. On the flip side real estate volumes will remain low with limited upside on pricing. The wildcard for all these predictions is the unemployment rate. The market is pricing in a soft landing with limited impact on employment. Based on historical records, this should not be the base case scenario as unemployment has ticked up in every past cycle. And increase in unemployment could lead to lower mortgage rates (in the 6.5 to 7.5 range and housing prices to fall a bit 5-10 % range. Although I am at odds with the overwhelming majority of the market, this is my base case projection. Do you agree?

Additional Reading/Resources

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender