No this is not a joke, I had to read the recent Fannie Mae press release multiple times to actually believe what I was reading. Who would have ever thought that someone with a high credit score above 740 would be penalized for having a high score. Under a new rule by the federal housing finance agency, which governs the buyers of most residential mortgages, will now require borrowers with a higher credit score to pay more when purchasing a house while substantially reducing fees for lower credit score higher risk borrowers.

What is in the new FHFA rule?

The changes, which take effect May 1, are part of the Biden administration’s plan to expand access to homeownership. They involve the fees charged to borrowers by Fannie Mae and Freddie Mac, which back roughly half of US mortgages.

Before the rule change, a borrower with a credit score of 740 and a 15% down payment would have faced a 0.25% fee on their mortgage. After the change, that fee will rise to 1%. It’s the opposite story for some borrowers with lower credit ratings: Someone with a score of 640 putting down 15% would have paid a 3.25% fee before. After the change, it will fall to 2.5%.

What will the new government fees cost borrowers?

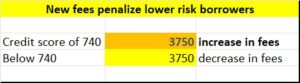

Assuming a five hundred thousand dollar loan, high credit score borrowers would pay 3750 more than someone with a low credit score. The way this is setup someone with a 600 would get a 3750 reduction in fees versus someone with a nearly perfect credit score of 800

The new fees defy all sense of logic and fairness

The reason that lenders use credit scores is to gauge risk of default, late payments, etc… This is used throughout the economy. When someone buys a car with a perfect credit score, they pay less than someone who has missed every payment in the past leading to a lower credit score.

This is further ingrained in the secondary markets that ultimately buy the financing notes. For example, the lower credit score house loan will sell for less (or have a higher interest rate) than a higher quality note secured by a prime borrower.

The recent proposed rules reward riskier borrowers by giving them a fee reduction while penalizing more well qualified borrowers. This defies all sense of fairness and logic. Why should someone who has done the right things by paying on time, not taking out to much credit, etc.. be penalized for good habits.

Change in fees will ultimately lead to more defaults

As the new law subsidizes higher risk borrowers that might not have qualified it does nothing to fundamentally change the circumstances that led to lower credit scores in the first place. Someone with a 600 credit score is substantially more likely to default on their loan than someone with an 800 score. We have seen this in every single economic cycle without fail.

New FHFA Rule incentivizes bad choices

Furthermore, this rule incentivizes borrowers to make bad choices. For example, a borrower who has a 740 score could mis one credit card payment before closing to drop their credit score 30 points thereby saving them 3750 in fees. Why would the government want to encourage and ultimately reward this behavior?

Congress is not standing by

There is prospective legislation in Congress to attempt to block the new fee structure. As of this writing nothing has passed and with the divided government, it is unlikely that this will get signed into law.

Summary

Penalizing low risk borrowers for having good credit is absolutely insane and makes no logical or economic sense. Furthermore, the government subsidies of high-risk borrowers does not change the probably of default, it will merely increase the quantity of defaults in the future.

This new rule is grossly misguided and will ultimately backfire as costs will need to increase further to cover the losses from the increased defaults. It is ironic that the best solution would be to implement a rule that does just the opposite where higherr risk borrowers fees are increased to cover the increased risk of default while lowering fees for the least likely credit risks.

Additional Reading/Resources:

- https://singlefamily.fanniemae.com/media/9391/display

- https://www.housingwire.com/articles/lawmakers-introduce-bill-to-block-llpa-fee-changes/

- https://www.bloomberg.com/news/articles/2023-04-28/mortgage-fees-rise-for-homebuyers-with-good-credit-scores-under-biden-plan?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender

[…] Originally published on Fairview Lending […]