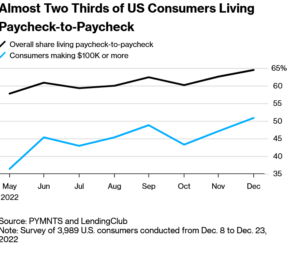

The share of Americans who say they live paycheck-to-paycheck climbed last year, and most of the new arrivals in that category were among the country’s higher earners (greater than 100k), a new study shows. Furthermore 24% had issues paying their bills in December. What are the real estate implications? What step must you take today? Why is the bond market giving a radically different assessment of the economy as opposed to consumers?

More People Living on the edge:

Lending Club’s report highlights that 64%% are living close to the financial edge. What this says is that 64% of all Americans are living pretty close to paycheck to paycheck with little in savings for the unexpected than inevitably happen (car breaks down, need a new furnace on the house, rent increases, medical bill, etc.…). What happens when there is a hiccup in the economy like in 07 where many lost jobs and those that kept their jobs might have taken pay cuts.

Furthermore, it found that 24% of respondents had issues paying their bills in December. Among those earning more than $100,000 and living paycheck-to-paycheck, the share living paycheck to paycheck rose to 16% from 11% a year earlier.

100k families living paycheck to paycheck is a huge change

Coronavirus has changed the economy in unexpected ways. This study was surprising that 16% of respondents making greater than 100k are living on the financial edge. This is a very worrisome trend as this group is more likely to own a house which would be impacted if there is any hiccup in the economy.

Leverage brings Increased Volatility:

The shear number living paycheck to paycheck increases volatility both in the overall economy and ultimately real estate. When an economic hiccup occurs auto, credit cards, and rent payments will likely be missed. This will create a cascading effect through the economy as recipients of these payments are impacted as well. For example, if a rental payment is missed on a property, the property owners cash flow will be impacted and therefore economic spending throughout the economy will be curtailed. With 64% of adults in this predicament, the cascading impact of an economic hiccup is amplified.

How will Real Estate be impacted by the rise in paycheck to paycheck

- Home Owners:

- The homeownership rate is around 65% now and peaked at almost 70% during the last recession. Assuming that 50% of all adults will be on the financial edge during an economic cycle (in 2013 50% were paycheck to paycheck), then off the bat 20% of mortgages will default (in the last cycle government sponsored mortgages peaked at a default rate of around 35%). If 20% of mortgages default, prices will fall. Note this default will not be uniform in all markets just like we saw in the last cycle, certain markets fared considerably better than others. Furthermore in this cycle homeowners are considerably more equity rich which should cushion the downward pull on prices. It is important to remember that prices will still fall in most markets and anyone that is in a situation where they have to sell and they recently bought a house will be underwater.

- Renters:

- With the large number of adults living paycheck to paycheck, during the next economic cycle, there will also be elevated levels of non payments on rent. The vast majority of rental homes are owned by small investors who will have their cash flow severely strained. This will also impact larger apartment/multifamily property owners. This reduction in rents collected will place huge financial strain on the property owners and many could subsequently default on their underlying mortgage.

What should you do?

Do not be part of the 64%! . Increase your cash reserves! Anyone involved in real estate must be keeping ample cash to weather hiccups. Property owners cannot live on the financial edge as there are too many variables that could go wrong. The last recession should be a warning and showed how badly it ended for many who were asset rich and cash poor.

Summary

Currently the stock and bond markets are signaling all clear with the economy with odds increasing for a soft landing. The markets and in turn property owners should not get complacent. With 64% population living on the financial edge, it raises the probability of a very swift change in the economy that few, if any, are forecasting. Now is the time to be careful!

Resources/Additional Reading

- https://www.bloomberg.com/news/articles/2023-01-30/even-on-100k-plus-more-americans-live-paycheck-to-paycheck?srnd=premium&leadSource=uverify%20wall

- https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf

- https://fred.stlouisfed.org/series/RHORUSQ156N

- http://money.cnn.com/2018/05/22/pf/emergency-expenses-household-finances/index.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender