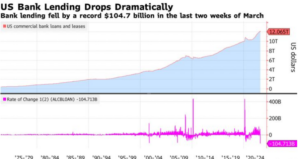

US bank lending contracted by the most on record in the last two weeks of March, indicating a tightening of credit conditions in the wake of several high-profile bank collapses. Why the sharp pullback in lending? What does this mean for commercial and residential lending and prices? What is the federal reserve talking about later this year?

What was in the data on bank lending?

Commercial bank lending dropped nearly $105 billion in the two weeks ended March 29, the most in Federal Reserve data back to 1973. The more than $45 billion decrease in the latest week was primarily due to a drop in loans by small banks.

The pullback in total lending in the last half of March was broad and included fewer real estate loans, as well as commercial and industrial loans.

- The Headline Credit Index fell in Q2 to 5.8, decreasing 6.7 points to its lowest point since the onset of the pandemic. The reading indicates broad-based expectations for weaker credit market conditions over the next six months among bank economists, and banks are likely to grow more cautious about extending credit.

- The Consumer Credit Index fell 7.9 points to 5.8 in Q2. EAC members expect credit availability to deteriorate more than credit quality, though almost all expect both to decline. The sub-50 reading indicates that consumer credit conditions are likely to weaken over the next six months.

- The Business Credit Index fell 5.6 points to 5.8 in Q2. All EAC members expect business credit availability will deteriorate in the next six months, and most expect business credit quality to deteriorate. The sub-50 reading indicates that EAC members expect that overall credit conditions for businesses will continue to weaken over the next two quarters.

Why have banks sharply decreased their lending?

Small/Mid size banks are large commercial real estate lenders. The model is you take in deposits and pay low rates and then lend the money back out via commercial real estate loans. With the recent bank collapses, the amount of deposits at small and midsize banks have decreased as people moved their money to larger institutions.

Not only have deposits declined, but banks have gotten nervous about having enough liquidity to ensure they do not have a bank run like what occurred to Silicone Valley Bank. With less funds available it is no surprise that lending has declined dramatically.

What is the impact of decreased credit availability on real estate volume and in turn prices?

Initially commercial property will feel the pain the most as the overwhelming majority of residential loans are government backed so the banks can easily pass them through to Fannie/Freddie. Commercial loans on the other hand are typically held by the banks (some larger ones are securitized or sold to life insurance companies) which ties up substantial capital.

With capital at small and midsize banks constrained there has been a sharp pullback in commercial real estate lending. This will first lead to much lower commercial real estate volumes due to lack of financing.

Ultimately there will be a major reset in commercial real estate prices as financing is more expensive and harder to obtain, many deals will no longer cash flow/ make sense at their current pricing.

Residential should not initially be impacted too much by the reduction in credit, but ultimately the reduction in credit will flow through to the residential market.

What does the pullback in lending mean for the general economy?

Fallout from the U.S. banking crisis is likely to tilt the economy into recession later this year, according to Federal Reserve documents released Wednesday.

Minutes from the March meeting of the Federal Open Market Committee included a presentation from staff members on potential repercussions from the failure of Silicon Valley Bank and other tumult in the financial sector that began in early March.

Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years,” the meeting summary said.

How accurate is the new federal reserve prediction?

I take everything with a grain of salt now. The federal reserve for years has said that inflation was transitory, then they said the inflation would recede quickly. Neither of these items occurred as they had predicted which leads me to question their recent predictions.

I think the recession starts early 2024 and will end up deeper than they anticipate as inflation remains far stickier and they are unable to quickly drop rates. Furthermore, we are likely going to see a commercial real estate market blow up to the tune of 20-40% declines on many office properties and also a reset in apartments as rents stagnate and cap rates rise due to inflation. This will eventually flow into residential real estate as well as unemployment ticks up. This will lead to defaults/distress situations.

Summary

We are just at the beginning of the reset in the market. A decline in credit availability/ bank lending is just the tip of the iceberg. With the recent blow up in small banks, look for credit availability to continue to decline. In the short term, real estate closing volumes will decline, but the real pain will be in the long term with a substantial reset in prices as credit continues to dry up which will ultimately lead to a cooling economy. The slowing of the economy will not happen as the federal reserve predicts.

Recall, the federal reserve has severely missed in predicting the stickiness of inflation and they are unlikely to get the “soft landing” correct.

When credit availability quickly declines like we are seeing now, there will be a 100% probability of a recession and in every single recession it always happens radically different than is predicted.

Additional Resources/Reading

- https://www.aba.com/about-us/press-room/press-releases/q2-2023-credit-conditions-index

- https://www.bloomberg.com/news/articles/2023-04-07/us-bank-lending-declines-sharply-for-a-second-straight-week?srnd=premium

- https://www.cnbc.com/2023/04/12/fed-expects-banking-crisis-to-cause-a-recession-this-year-minutes-show.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender