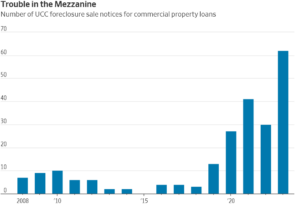

Foreclosures are surging in a risky corner of commercial real-estate finance, offering one of the most profound signs yet that turmoil in the commercial property market is just beginning. Lenders this year have issued a record number of foreclosure notices for high-risk property loans, according to a Wall Street Journal analysis. What debt is getting foreclosed, why is this such a clear warning for commercial real estate values?

Mezzanine financing foreclosures surge:

These loans took off in the decade following the 2008-09 financial crisis as regulators cracked down on big banks and they became more conservative lenders. Many property owners made up the financing shortfall by borrowing from smaller banks, or by taking out these second loans from debt funds and other nonbank lenders, often on top of bank mortgages.

Essentially Mezzanine loans are similar to second mortgages on the residential side. A borrower would get a first mortgage and need additional capital so they would bring in a mezzanine lender to fund any shortfall. Just like the residential side, these loans are considerably riskier than first mortgages.

Why are defaults on Mezzanine loans surging

As interest rates have surged and remained high, many properties no longer cash flow. A property owner would typically pay the first mortgage holder and then if cash available the mezzanine lender. With not enough cash to go around the mezzanine lender is the first to get shorted. This has led to a surge in defaults on Mezzanine loans

Most of the Mezzanine loans will be worthless

Mezzanine loans are different than first mortgages so there is no official source to track how many have been made and who actually owns what as they are sold via various bond instruments to a myriad of players that were seeking higher yields than government treasuries. Unfortunately the party has come to a crashing end. Most of the mezzanine lenders will be totally wiped out. Let’s assume that a bank did a loan of 70% on a large office building. A mezzanine lender then did a second for 15% and the owners had equity of 15%. At the end of the day with cap rates rising substantially, the value of the property has fallen about 30% wiping out the owners equity along with the mezzanine lender.

Remember, Mezzanine lenders are subordinate to the first mortgage lender meaning that at the end of the day they are likely left with nothing even if they foreclose out the mezzanine debt as the first would still have to be paid back.

Why are Mezzanine loans a harbinger of what is to come in commercial real estate?

The large surge in Mezzanine defaults is a harbinger for considerable pain yet to come in commercial real estate. Many banks are taking a wait and see approach and not really pushing the envelope with foreclosures as they feel that time will be on their side. Unfortunately mezzanine lenders by their aggressive actions are essentially stating that the present is going to be better than the future in regards to real estate values. If Mezzanine lenders really thought they could get more in the future, they would be much more apt to sit tight and try to ride out the market as opposed to taking a considerable haircut today.

Will commercial real estate bring the economy down?

The probability of a recession has now dropped well below 50% and yet at the same time commercial real estate values in most major markets is in a free fall especially in the office and multifamily sector. It is tough to believe that banks and investors can absorb billions of dollars in losses without some impact to the overall economy.

I think the market has ruled out the lag effect of commercial real estate to the broader economy. Commercial real estate takes a while to work through the economy. Currently today there are a lot of “zombie” buildings that could take years to finally work through the economy. For example a company might have a 5 or 10 year lease for a property even though they are not using the space they are still paying. But, at the end of the day, the building could be close to worthless once the large tenant vacates. Very few of the large commercial buildings have reckoned with this future.

On the residential side, if there is a huge drop in prices, there is an immediate pull back in spending that will be felt throughout the economy. This same one to one relationship does not hold for commercial real estate. As prices fall, it is first banks and other high net worth investors that feel the brunt. As losses mount, lending decreases to other businesses as we are seeing today. Without capital, eventually businesses will pull back on hiring leading to a slow down in the economy.

This cycle could take another 12-18 months to actually flow through the economy due to the lag of commercial real estate. Don’t worry, it will eventually happen and lead to a correction in the economy regardless of what the odds say.

Summary

Many lenders think that the market will ultimately work itself out as they wait the storm out. Unfortunately the federal reserve has clearly signaled that they will keep rates higher than the market is anticipating for much longer due to the stickiness of inflation. These higher rates for longer will ultimately lead to a reckoning in the economy.

Mezzanine lenders’ actions show that they are anticipating considerably more pain in commercial real estate as vacancies remain high along with cap rates leading to substantially lower values. Conventional lenders would be wise to take head to what the market is saying that today is considerably better than what the future holds for commercial real estate values.

Furthermore, although recession probabilities have decreased, the increase in commercial defaults will eventually change these expectations of a soft landing. Remember commercial real estate has a lagged effect on the economy as opposed to residential real estate so we are not out of the woods yet. The old saying of don’t count your chickens until they hatch is wise advice with what we are seeing in commercial real estate.

Additional reading/Resources

- https://www.wsj.com/real-estate/the-clearest-sign-yet-that-commercial-real-estate-is-in-trouble-cb8dfafa?mod=mhp

- https://www.fairviewlending.com/lock-in-effect-thawing-more-houses-coming-on-the-market/

- https://www.fairviewlending.com/is-inflation-really-coming-down/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender