There is a theory that locked in low mortgage rates will force owners to stay in their houses. This has led to a huge shortage of inventory throughout the country. Why is the “lock in effect” starting to wind down? What does this mean for real estate prices over the next few years? Will the thawing of the lock in effect lead to a glut of inventory?

What is the lock in effect and how is this impacting prices?

One of the key economic theories as to why housing prices have remained high is that borrowers locked in historically low interest rates and will be unwilling to sell. For example, many locked in rates below 3% and now rates are double what they were prior, on top of higher rates; prices have also increased substantially. This has led to property owners sitting on the sidelines waiting for a change. The data from Zillow shows the lock in effect is starting to substantially thaw and there will be huge implications for real estate.

What was in the Zillow data on the “thawing” of the lock in effect?

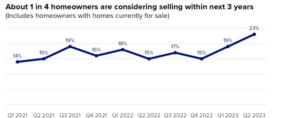

Nearly a quarter of homeowners say they are considering selling their home in the next three years or have their home currently listed for sale, a significant increase from a year ago. In a market in desperate need of more for-sale listings, this new finding, from Zillow Group Population Science’s Quarterly Survey of Homeowner Intentions and Preferences (QSHIP), suggests that inventory levels dragged down by rate-locked homeowners might soon be on the rise.

Overall, 23% of homeowners surveyed in June of 2023 say they are either listing their home for sale or considering selling their home in the next three years, up from 19% in Q1 and 15% a year ago. Among those, four in 10 said they are considering selling in the next year.

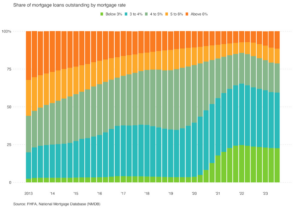

Homeowners with a mortgage rate above 5% are nearly twice as likely to say that they plan to sell their home than those paying a rate below 5%. About 90% of mortgage holders surveyed reported having a rate below 6%, while almost a third reported a rate less than 3%.

Redfin’s data backs up the lock in thawing effect

Nationwide, 88.5% of U.S. homeowners with mortgages have an interest rate below 6%, down from a record high of 92.8% in mid-2022.

That means more than 88.5% of homeowners with mortgages have a rate below the current weekly average of 6.66%, prompting many to stay put instead of selling and buying another home at a higher rate—a phenomenon called the “lock-in effect.”

But for most people, it’s not realistic to stay put forever. The share of homeowners with a rate below 6% has fallen from its record high partly because some homeowners are opting to bite the bullet and give up their low rate in order to move.

Why are owners that have low mortgage rates willing to sell?

The short answer is that eventually life happens and people can’t stay put forever. For the past four years many have been “stuck” in their house and over time life events happen from births, new jobs, hiring, firing, divorce, etc… Eventually property owners will have to make the move.

Furthermore, many homeowners have substantial equity due to the pandemic boom so they can sell their house and move to a lower cost area and pay substantially less or even pay cash for a property. As time elapses eventually owners take action based on what is occurring in their lives which is “thawing” the lock in effect of low rates over the last 4 years.

What does a thawing of the lock in effect mean for inventory and prices

As more movement begins to occur within the market we should see substantially more inventory coming online sometime in the spring. This will enable prices to come off their highs. The next question is how far will prices fall?

How will the lock in effect impact price: two factors to watch

- How many homes come on the market: Currently the thawing of the lock in effect is a small trickle that should accelerate throughout the year. How quickly inventory comes on the market will be largely dependent on what happens in the labor market. If the labor market weakens substantially we will see the amount of inventory pick up substantially. If the labor market stays tight we will still see an uptick in inventory but it will not be a tsunami.

- Interest rates in the Spring/Summer: What happens to prices will depend a lot on what happens to interest rates. The realtors association is predicting a steep decline in rates. I’m not buying that theory as inflation, spending, and the labor market remain robust so rates should stay in about a half point range of where they are today.

Summary

I don’t see a huge wave of inventory just yet as the economy remains healthy. This should limit a huge downside in prices. My prediction is that prices will still decline over the coming year, but in the 5-10% range. There is still a probability that the economy doesn’t perform as expected. The risks are endless from trade disruption, inflation increases, consumer credit weakens, etc… so rest assured we are not out of the wood yet on a hard landing. If one of the factors above come to fruition then we could see a rapid increase in inventory which would lead to a larger correction in prices.

Additional Reading/Resources

https://www.zillow.com/research/home-sellers-three-years-32909/

https://www.redfin.com/news/mortgage-rate-lock-in-housing-2023/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender