The market currently has a fixation on interest rates. Senators are now jumping on the bandwagon pushing the federal reserve to “immediately” cut rates to help the real estate market and affordability. Unfortunately, the senators do not fully grasp how interest rates are “set” and are drastically oversimplifying the real estate market. Why are mortgage rates rising again even though the federal reserve has announced future cuts? What is really driving mortgage rates now?

What did the Senate propose on interest rates?

Sen. Elizabeth Warren, D-Mass., and three other Democratic lawmakers are pushing Federal Reserve Chairman Jerome Powell to lower interest rates at the upcoming Fed meeting to make housing more affordable.

“As the Fed weighs its next steps in the new year, we urge you to consider the effects of your interest rate decisions on the housing market,” the senators wrote in a letter to Powell on Sunday.

“The direct effect of these astronomical rates has been a significant increase in the overall home purchasing cost to the average consumer,” the letter said.

A basic lesson in economics would do wonders for many of our legislators as trying to influence the federal reserve by either political party is misguided at best.

Federal reserve does not control mortgage rates:

First, it is important to note that the federal reserve does not directly control mortgage rates. The fed controls the “federal funds rate”. The federal funds rate is the rate at which banks and credit unions lend reserve balances to other banks and credit unions overnight. In a nutshell this is the rate banks get on the money they are holding in cash/reserves. Here is a more detailed explanation from Wikipedia .

So how are mortgage rates set? Unfortunately, mortgage rates are not “set”. There is no government or private party that can set rates per se. Mortgage rates are typically based on the 10-year treasury yield. So how does this work?

Before discussing rates, it is important to understand how bond yields work. The most important piece of this equation is the relationship between a bond price and its return. For treasuries, it is critical to note that a bond price and its yield move in inverse. What this means is that a higher bond price results in a lower yield and vice versa where a higher yield results in a lower bond price. For simplification purposes, I will not get into the full details of why bonds function the way that they do. Rest assured that it works this way and will always work this way.

With this key piece of information, we can now understand why mortgages do not move in direct correlation with the federal funds rate. This is now very apparent as the federal reserve has pledged low rates and yet the 10 year treasury just reached its highest level in over a year.

Why are mortgage rates rising now?

Long and short, the “market” is not believing the federal reserve that inflation will stay at historic lows and there is worry about the supply of bonds coming on the market from the recent 1.9 trillion stimulus coupled with talks of even more government spending.

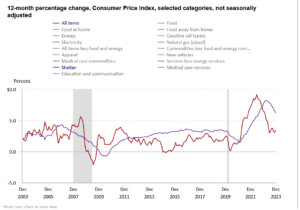

- Inflation expectations: Inflation is not coming down as quickly as assumed by the market. The recent jobs report was a blow out with continued job growth along with raises double the current inflation target of 2%. Long and short the market does not believe that the federal reserve will cut as deeply or quickly as hoped only a month or so ago

- Supply of bonds: The supply of bonds is getting allot less attention than inflation expectations but is even more important that inflation expectations. With the various stimulus bills enacted, the federal government is forced to sell trillions of dollars in new bonds to finance all these items. A good way to understand this is to think of a car lot, if you are going to buy a new car and there are three hundred on the lot, your chance of getting a better deal is greatly increased due to the supply. The same for bonds, as more bonds hit the market, the prices will decrease. Remember yields work in inverse to price so as prices decrease the yields will increase which in turn leads to higher rates.

Ultra low rates distorted the real estate market

To focus solely on rates is a drastic oversimplification of the real estate market. Over the past several years historically low rates were driven in part by the federal reserve buying mortgages in their quantitative easing program. This allowed rates to precipitously fall to below 3%. With rates below 3% leverage was cheap and housing demand went through the roof.

For example, with a 3% rate, you could buy a million dollar house for 4200/month. This is cheaper than renting in many areas. Furthermore, investing in real estate became very profitable with such low rates. Assume you bought a 300k property, the mortgage payment would be 1200/mo and the rent would be close to 1600 a month which is more than enough to debt service.

These ultra low rates ultimately skewed the market as there was so much demand for real estate as the returns were huge on the investing side and properties were not that expensive with such low rates. Unfortunately the party always comes to an end as interest rates have more than doubled.

Don’t believe the headlines that interest rates are the only metric to watch

With rates now back at historical levels (5-7% range is the long term average) market fundamentals matter even more and rates are no longer the only driver or real estate. At the end of the day basic economics is now the driver of the market as prices are ultimately driven by supply and demand. Don’t get me wrong, higher interest rates substantially impact demand, but they are not the only driver of demand and we must also factor in supply.

- Demand

- Demand pulled forward: with ultra low rates years of demand was suddenly pulled forward. The pandemic created a frenzy for new household formations for more space, privacy, etc… This huge shift in the market compressed 5 years of demand into 2 or three years. With so much demand pulled forward, it is not possible for the amount of household formation and demand to continue. I think of it like the auto industry. It seems like everyone needed a new vehicle in the last two years. Now they have one, they will not need another one for another 5 years or so. As a result, auto sales are drastically slowing along with prices

- Wages not keeping up with prices: With prices pushed up so high from ultra low rates now that the economy is normalizing, allot less buyers can afford a million dollar home. On the same example above of a million dollars, the same homes payment would now cost 6700/mo (3500 more a month); most workers did not get a 42k bump in pay in one year.

- Supply

- Considerable supply coming on the market: I’m seeing supply increase to 2019 levels in many markets and come spring will likely eclipse 2019. There was considerable speculation causing demand to spike beyond normal due to the ultra low rates which is starting to unwind. Look for this trend to accelerate in the spring.

- Labor market will eventually soften later this year which will further increase supply. At the same time speculation on real estate is waning, actual supply is going to be increasing soon as the labor market begins to soften. This softening so far is hitting higher earners harder with layoffs at google, salesforce, etc… many of these workers could be forced to sell to relocate to other areas or because they no longer have the same income to service their debt which will further increase supply.

Summary:

Focusing solely on rates is misguided. Ultra-low interest rates concealed the demand and supply issues above. Focusing solely on interest rates is a drastic oversimplification of the real estate market and it is extremely dangerous for senators to get involved with influencing rate decisions. Remember that housing makes up 34% of the CPI, if the federal reserve cuts rates prematurely demand will come roaring back along with prices and in turn negate much of the inflation progress that has been made. This increase in turn would lead to even higher rates in the future creating even bigger issues for the economy down the road.

It is important to note that over the past several years historically low interest rates distorted the market and as the market normalizes market fundamentals will play a prominent role in guiding real estate prices. Even with declining mortgage rates, the real estate market is in for a tough 2024 as supply is increasing at the same time demand is waning.

Furthermore, with inflation remaining stubbornly high and a very tight labor market, rates likely will stay higher at least through the first half of the year. Even when they fall, they will not return to the pandemic lows as the federal reserve does not have the appetite or capacity for another large-scale quantitative easing.

Additional Reading/Resources

- https://www.cnbc.com/2024/01/29/warren-pushes-fed-chair-powell-to-cut-rates-ease-housing-pressure-.html

- https://www.cnbc.com/2023/01/04/mortgage-demand-plunges-interest-rates-rise.html

- https://www.bloomberg.com/news/articles/2023-01-04/fed-affirms-inflation-resolve-signals-concern-on-market-views

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender