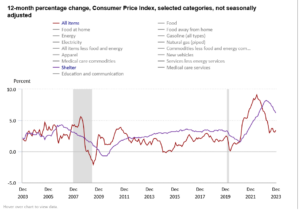

We have heard a ton of good news recently regarding inflation. Inflation has come down dramatically from its peak and the market is pricing in almost a 100% probability of an elusive soft landing. Is inflation really coming down as fast as the consumer price index shows? How is housing impacting the consumer price index and will the impact last?

Consumer price index (CPI) is used to drive the economy

The CPI is currently the most watched number in the economy and hugely market moving. For example, as the CPI has come down, mortgage rates have come well off their highs plummeting from over 8.5% to around 7% an almost 20% drop. At the same time the federal reserve continues citing the CPI in its inflation fight and the path to lower interest rates later this year.

How accurate is the CPI index

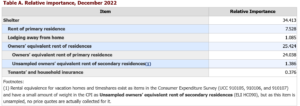

With so many people and organizations relying on the CPI, it is important to question its accuracy. Is the CPI truly capturing what is happening with inflation. It is important to note that the largest “basket” in the CPI calculation is shelter coming in at 34% of the CPI calculation.

After looking at what is included in the CPI for shelter, I have some big questions of whether shelter is accurately capturing what is happening in the real world. For example, property insurance and taxes have each risen substantially, yet shelter inflation has done just the opposite and declined as rents declined.

What is captured Owners equivalent rent?

To answer the accuracy of CPI, let’s go through how it is calculated and what is included in it currently From the Bureau of Labor Statistics: “Owned housing units themselves are not priced in the CPI Housing Survey. Like most other nations’ economic statistics programs, the CPI program views owned housing units as capital (or investment) goods distinct from the shelter service they provide, and therefore not as consumption goods. Spending to purchase and improve houses and other housing units is treated as investment and not consumption in the CPI. Interest costs (such as mortgage interest), property taxes, real estate fees, most maintenance, and all improvement costs are part of the cost of the capital good and are also not treated as consumption items. These non-consumption costs of owned housing are out of scope for the CPI under the cost-of-living framework that guides the index.”

The theory of owners equivalent rent is that all the fees for homeownership is basically captured by flowing through to the rent. For example, assume property taxes go up, this in turn should lead to higher rents, unfortunately this is not what occurs in real life.

Is owners equivalent rent/shelter accurately capturing inflation?

Owners equivalent rent/shelter does not accurately capture inflation for a number of reasons:

- Lagging indicator: rents typically only change once a year so the impact of rents is always going to be delayed as we can see in the chart above

- Owners equivalent rent misses/under weights big items:

- Taxes: property taxes are not factored into the shelter category. Throughout the country property taxes have gone up substantially. For example, in Colorado taxes are up over 20% in most markets and this is not captured in the CPI calculation

- Insurance: Insurance is also up huge throughout the country and a large expense for many homeowners and yet the weight of this item is only .376%. For example in Colorado my insurance has increased from 2k to almost 5k, this is a huge jump adding huge expenses to home ownership and shelter costs that are not factored in

- Maintenance costs: Like everything else in the economy, prices have gone up substantially to maintain a house from increased materials costs to huge jumps in labor, none of this is captured in the shelter category.

- Rents were artificially low in the past due to lower rates: over the last 10 years or so rents have been artificially low due to rock bottom interest rates. For example, when you are borrowing below 3% it is not too difficult to make money which allows rents to stay low. Fast forward with higher borrowing costs and rents jumped during the pandemic to start declining recently.

CPI is not truly capturing inflation and giving a false read

Based on the above, CPI is not accurately capturing what is going on with inflation as rents are falling for now due to distress in the market and oversupply of units at certain price points. If 34% of the CPI is based on shelter and the metric is not accurately capturing the huge inflation in Shelter then the entire index is off.

It is hard to say exactly how far off the CPI index is due to the discrepancies in the Shelter category, but is a large number. Let’s look at insurance for example. On my house, insurance is now about 10% a month of my payment and property taxes are about 15% of my payment, neither of these are accurately captured. My property taxes went up 36% last year in Colorado and my property insurance is up about 15% from last year, but somehow shelter inflation is falling to 2-3% a year? It makes absolutely no sense!

Summary

Do not believe the headlines that inflation is magically coming down. Shelter inflation is one of the largest contributors to the CPI number and it is not even close to accurately capturing what is going on in the market. I understand that shelter inflation is a lagging indicator due to less renewals, but shelter costs are soaring due to higher property taxes, higher insurance, higher maintenance costs, and higher interest rates.

Ironically when you look at the charts, Shelter is bringing the CPI number down. None of this makes any sense based on what I see on my own properties and hundreds of other properties we are servicing. I our portfolio we are seeing escrows for taxes and insurance increased on the low side 15% on the high side 200%. This trend is occurring in every market throughout the country.

It is a bit scary that basically every major economic decision is being influenced by the CPI number that is questionable at best in capturing what is occurring in the housing market. I would caution against going out on a limb with the smoothly decelerating inflation narrative as there are bound to be some surprises to the upside over the next year.

Additional Reading/Resources

- https://www.bls.gov/cpi/factsheets/tenants-household-insurance.htm

- https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.htm

- https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

- https://coloradohardmoney.com/colorado-property-taxes-increase-35/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender