Wow, what a year. In December the market was anticipating as many as 4 rate cuts this year. At the same time the federal reserve was doing a victory dance on pulling of a soft landing. Fast forward and inflation is still hot and there is now a question of if there will be any rate cuts this year as the federal reserve move towards a new mantra “higher for longer”. What does this change mean for real estate, interest rates, and the economy?

Why the rapid U turn on the economy

In hindsight, the last 6 months prove that we have not even yet started to land the plane as the economy continues to keep moving along with inflation outpacing every prediction regardless of what metric you are looking at (core, trimmed, or any other variation). Consumers continue spending beyond any predictions or expectations, the labor market remains tight, and real estate is showing little impact from higher rates.

What does higher for longer actually mean?

The term “higher for longer” continues to be thrown around but what does this actually mean? In economic terms it means that the federal reserve will keep the federal funds rate constant as opposed to moving it down as the market had originally anticipated. The purpose of higher for longer is to try to engineer a soft landing with slower consumer and business spending due to increased interest rate costs.

Higher for longer means that consumer and commercial rates will remain higher (or possibly head higher). Rates on cars, credit cards, etc.. will remain high. On a positive note this also means that savings rates should increase as well.

When will mortgage rates fall?

Unfortunately the better question over the next 6-12 months is if mortgage rates will fall or will they actually increase more. Currently inflation is trending over double the federal reserves target of 2% which means there is a case for a surprise upside in interest rates.

First, it is important to note that the federal reserve does not directly control mortgage rates. The fed controls the “federal funds rate”. The federal funds rate is the rate at which banks and credit unions lend reserve balances to other banks and credit unions overnight. In a nutshell this is the rate banks get on the money they are holding in cash/reserves.

So how are mortgage rates set? Unfortunately, mortgage rates are not “set”. There is no government or private party that can set rates per se. Mortgage rates are typically based on the 10-year treasury yield.

The 10 year treasury yield is flashing a warning sign as yields continue trending higher and in turn mortgage rates have recently turned higher.

I do not see a scenario in the next 6 months where rates fall substantially. The rate reset will come when consumer spending slows down and there is a reset in the economy via a recession/correction. Until then, look for rates to stay constant and possibly climb even further. Here is a chart showing the huge change in treasuries higher.

What does higher for longer mean for residential real estate?

Prior to Covid, if interest rates basically doubled, you would see a huge correction in real estate prices. We have not seen this yet as wage growth remains strong and the unemployment rate stays low. Currently prices are flat/increasing which is the opposite of what I would expect.

Just because residential real estate is appreciating now does not mean it will continue. Unfortunately the party will not last forever, the longer rates stay high eventually unemployment will tick up and real estate will ultimately reset.

What does higher for longer mean for commercial real estate?

The party is already over for many commercial properties especially in the office sector. Higher interest rates combined with higher vacancies and lower rental rates are the death knell for many properties.

The Trepp Commercial Mortgage-Backed Securities (CMBS) Delinquency rate for all commercial properties rose to 4.66%, up from 4.51% in December and just 2.94% in January 2023. That represents a 59% increase in the past year.1

Trepp CMBS Research. “CMBS Delinquency Rate Resumes Rise to Start 2024, Office Delinquency Rate Jumps.”

Office properties remain the most troubled sector of the commercial property market, as they did throughout last year. Delinquencies in that space rose to 6.30% in January, more than three times the rate of 1.86% in the same month a year ago.

The big changes in commercial real estate are just getting started. Higher for longer will continue resetting commercial property prices lower. Look for this trend to only accelerate with high interest rates.

Does higher for longer predict a recession?

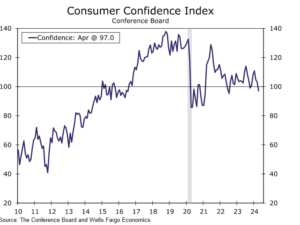

It is amazing that less than 6 months ago it seemed that the market was pricing in an almost 100% chance of a soft landing. At the same time consumers keep opening their wallets, consumer sentiment (in the chart above) seems to be trending downward which is opposite of what you would expect with all the good economic news. Is this a red flag for what comes next?

Higher for longer increases exponentially the likelihood of financial accidents and the list is very long. The million-dollar question is with huge risks in various sectors, will one ultimately bring down the economy: commercial real estate, banks, the stock market, over leveraged companies, over leveraged consumers, or something we aren’t even thinking about yet?

As rates remain higher, it becomes increasingly likely that one (or several) of the risks above turn into full blown problems for the economy which will be tougher as the market is predicting just the opposite, a soft landing.

Summary

Higher for longer is not good for the economy or real estate, it essentially like slowly pealing a band aide of versus just ripping it and getting it over with. The longer higher for longer stays in place, the more likelihood of a soft landing as the risks throughout the economy continue to multiply.

One of the leading risks is commercial real estate and especially the office market currently. But, as rates stay higher for longer, other property types that are extremely rate sensitive like multifamily could be drawn into the downward spiral.

Currently residential real estate is holding up well which makes the higher for longer scenario even more complicated as higher hope prices are driving inflation. For inflation to cool and higher for longer to lead to lower rates, housing prices and in turn rents must adjust downward substantially which is not being priced into the markets currently.

Although the federal reserve is trying the higher for longer strategy to lower inflation and engineer a soft landing, it might do just the opposite by ingraining inflationary pressures and ultimately leading to a recession. As higher for longer continues the economic risks are increasing exponentially but we likely will not see the true impacts until either very late this year or next year.

Additional Reading/Resources:

- https://www.wsj.com/economy/central-banking/federal-reserve-meeting-interest-rates-inflation-6dcb05e8

- https://www.bloomberg.com/news/articles/2024-04-29/gold-xauusd-holds-drop-as-hot-data-supports-higher-for-longer-outlook

- https://www.usatoday.com/story/money/2024/04/30/fed-interest-rates-likely-higher-longer/73500373007/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender