Inflation continues to stick around with core CPI running near record highs. This will keep the federal reserve on a likely path to hike rates once again in May. What does this mean for interest rates and real estate? What happens when interest rates finally “bite” into the economy? What does this mean for the risk of recession and real estate prices?

A recent white paper put out by the federal reserve gives us a hint of what it to come. The white paper highlights that there is a 100% probability of a recession based on past instances of “disinflation”. At the same time, most members of the federal reserve continue to put a soft landing as their baseline case. What do these polar opposite predictions mean for real estate? Which scenario will win in the tug of war? Why will interest rates continue rising?

What was in the Federal reserve whitepaper on inflation?

The core personal consumption expenditures price index, the Fed’s preferred measurement of inflation, rose 0.6% in January and 4.7% from the prior year, coming in well above economists’ expectations. On the heels of this very hot reading a new white paper was published by the federal reserve bank.

There were four primary findings in the Federal reserve whitepaper:

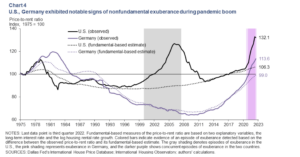

- It is a bit ironic that the federal reserve released a new research paper on a day when inflation data showed an unexpected spike, the authors found that over 16 episodes of “disinflation” engineered by central banks in the United States, Germany, Canada and the United Kingdom, “we find no instance in which a significant central bank-induced disinflation occurred without a recession.”

- A higher initial inflation rate is associated with a lower sacrifice ratio. Essentially swift and relatively painless disinflations of the past were due to early and sharp policy interest rate increases. In today’s case this would plausibly lead to a mild recession

- Easing monetary policy before the disinflation is complete, or easing by too much, is costly. The central bank must finish what they started in order to get inflation back to their target. Furthermore, it is a bad idea to change the inflation target.

- Federal funds rates will likely need to peak around 6.5% in mid 2023

It is also interesting that the paper highlighted that the federal reserve messed up by not raising rates sooner and more aggressively.

The federal open market committee (FOMC) continues saying a soft landing is the baseline

At the same time the paper came out, multiple current members of the federal open market committee put out statements countering the paper and explaining why this time is radically different than any other instance in history. Currently the markets seem to be accepting this theory as yields are not pricing in a recession and neither is the stock market. Unfortunately this will end very badly

Which scenario will ultimately prevail?

I am going to put my money on the authors of the white paper with a 100% probability of a recession. Although Covid was unique, at the end of the day gravity prevails and we will fall back into old/similar patterns. As the current inflation numbers show, the federal reserve will have to raise rates again and hold for considerably longer.

Remember the federal reserve also stated for years that inflation was transitory and now they are calling for a swift fall inflation. Unfortunately, the numbers do not work. Inflation is remaining considerably stickier with wages staying high, spending off the charts, and no sign of distress in the economy.

The white paper made another interesting prediction that inflation does not meet the federal reserve target of 2% until 2025. This is radically different than what the market is pricing in and will ultimately lead to a shock that will cause a recession.

What does this mean for real estate prices and volumes?

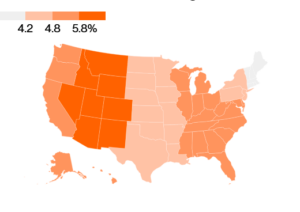

- Interest rates will be higher than currently priced in: if it takes until 2025 to get inflation under control this means that interest rates will have to remain higher for longer. This should put mortgage rates close to 6.25 to 7.5% for the next two years.

- Short term volumes will be lower due to golden handcuffs: In the short term as the economy outperforms expectations look for inventory to be held back as people will keep their low rates. This will be a short-term phenomenon as life happens and ultimately inventory will increase

- Correction delayed much more than priced in: The correction in the economy will happen, but not happen as quickly as many anticipated. The most likely scenario is the end of 23 or early 24.

- Correction could be deeper than anticipated: if a recession happens later this year, the federal reserve will not be able to come to the rescue of the economy with lower rates as inflation would just come back stronger like in the 70s which will lead to much deeper pain than the market thinks.

Summary

Do not buy the message that we will be able to achieve a soft landing with no pain for the economy. It is like saying that you can lose weight by eating ice cream and sitting on the sofa. If there is no pain, there is no gain. This theory has held true in every single historical case of disinflation. As the white paper noted, there has always been economic pain to correct the imbalances that led to the high inflation.

The same will hold true in this cycle and will ultimately lead to price corrections in real estate along with a substantial drop in volumes. Prices are not sustainable with the current rates. Furthermore, higher rates will ultimately slow the economy leading to higher unemployment that will reduce demand.

Although the impending economic storm is at least 6 months or more out, history has shown with 100% certainty that it will happen and there will be pain for the economy and a correction in pricing of assets from Real estate, stocks, bonds, and everything in between. The recent bank failures were just a small warning for what it to come. Don’t forget the reminder from Mark Twain, “history doesn’t repeat, but rhymes”.

Additional reading/resources

https://www.cnbc.com/2023/02/24/the-fed-cant-tame-inflation-without-more-hikes-paper-says.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).