Both the stock and bond markets are partying like its 99 again. Fannie Mae, the largest buyer of US mortgages, is not buying into the theory that a soft landing is the base case for the economy. What is Fannie Mae predicting for inflation and in turn interest rates? Will the supply issues cushion real estate price declines? Why is Fannie Mae predicting a different outcome than the rest of the market?

Fannie Mae has unique insight into the market.

I always read Fannie Mae’s economic commentary. As the largest buyer of mortgages, they have a unique market prospective as they can see forward looking data on purchases, refinances, lates, etc… This gives them a unique perspective to predict the future of residential real estate and in turn the economy.

What is Fannie Mae predicting on inflation and the economy?

The stock market is fully pricing in a soft landing as their base case scenario after the last inflation reading. Fannie Mae isn’t fully buying this prediction:

While the latest data on inflation has provided reason for optimism, less favorable base effects are likely to slow further progress in reducing annual inflation to the preferred 2-percent target, according to the July 2023 commentary from the Fannie Mae (FNMA/OTCQB) Economic and Strategic Research (ESR) Group. Given the low rate of productivity gains, wage growth appears to remain too high for inflation to near its target rate anytime soon, and so the ESR Group is forecasting another rate hike later this month and even tighter monetary policy through the end of the year.

What is Fannie Mae predicting on interest rates?

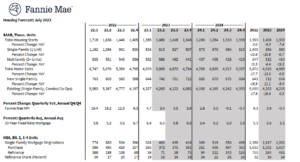

With inflation continuing to exceed the federal reserve targets, interest rates look to remain above expectations as well through the next 18 months. Fannie Mae is predicting rates to be around 7 percent for the remainder of the year and falling to around 6 percent next year.

Doug Duncan, Senior Vice President and Chief Economist, Fannie Mae. “The decline in headline inflation is encouraging, but year-over-year measures will work against further progress in the second half of 2023. Thus, we expect the Federal Reserve will stick to ‘higher-for-longer’ policy after one or two more quarter-point increases, until they conclude that the core inflation rate is sustainably at their 2-percent target. Putting aside any temporary volatility, we expect mortgage rates to stay higher as well. While spreads have come in a bit recently, they remain well above longer-term levels and that means rates for consumers will likely stay elevated.”

High mortgage rates are an indicator that the federal reserve will keep monetary policy tight through 2024 and they are not predicting a quick reversal with substantial rate cuts in the next 18 months.

Housing will provide a cushion for the economy.

Currently there continues to be an inventory shortage in most markets. Building has not kept pace with demand for several years. Furthermore, ultra-low locked in interest rates are keeping most sellers on the sidelines. These two factors are keeping housing prices high as there is no excess inventory from continued building and very little movement in existing housing stock.

“As we noted in our April 2022 forecast, whether there is a mild recession (our base case) or a soft landing, the supply issues in housing will provide a downside cushion for economic activity. That is playing out quite close to forecast on existing homes, but new construction has been even more supportive than we expected.”

The lack of inventory should provide a cushion for the upcoming downturn as housing prices should not collapse like in 2008.

Summary

Although the stock markets are partying like is it 99, Fannie Mae is not buying the optimism as their base case is a mild recession early next year. The root cause of the upcoming recession will ultimately be tighter monetary policy through higher rates that will ultimately flow through the economy. Mortgage rates will stay much higher for considerably longer than the market is currently predicting, which will ultimately lead to more downside risk to prices.

Fortunately, inventory continues to remain constrained which will limit how far prices will fall and ultimately prevent a 2008 rerun. Although the lack of inventory will put a floor under real estate prices, we are not totally out of the woods yet. I’m already starting to see an increase in lates/defaults that will eventually lead to foreclosures and a downward adjustment in prices. Fortunately, I don’t see a 2008 rerun in the cards as the adjustments look to be in the 10-20% range as opposed to almost 50% in some markets in the last cycle.

Additional Reading/Resources

- https://www.fanniemae.com/newsroom/fannie-mae-news/inflation-slowing-fully-quelling-it-will-be-tough

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender