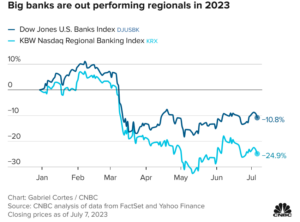

Major banks are facing one of the biggest regulatory overhauls since the financial crisis of 2008, setting up a major clash over the amount of capital that they have to set aside to weather downturns. At the same time regional banks are already struggling with increased capital requirements. What does this mean for the future of banks and in turn their real estate lending? Why will 50%+ likely disappear over the next 10 years?

What are the new capital requirements for banks?

There are three major changes to Capital requirements that will radically change how banks operate

- 2% increase in Capital requirements for banks over 100 billion

- Calculate unrealized losses in their capital requirement. For example, if bonds decrease in value due to higher interest rates, this will further increase banks capital requirements

- Charges more capital for positions that are less liquid, so for example if the asset is not readily saleable a discount would be taken, and more capital would need to be held.

Even though the fed is saying that capital requirements will only increase by 2%, unrealized losses and increased capital for certain positions will drastically increase the capital requirements well above 2%. Unfortunately each bank is unique so it is hard to fully estimate how much more other than guessing that it is likely double the 2% number.

50% of banks will disappear

What is coming will likely be the most significant shift in the American banking landscape since the 2008 financial crisis. Many of the country’s 4,672 lenders will be forced into the arms of stronger banks over the next few years, either by market forces or regulators, according to a dozen executives, advisors and investment bankers who spoke with CNBC.

“You’re going to have a massive wave of M&A among smaller banks because they need to get bigger,” said the co-president of a top six U.S. bank who declined to be identified speaking candidly about industry consolidation. “We’re the only country in the world that has this many banks.”

“There’s going to be a lot more costs coming down the pipe that’s going to depress returns and pressure earnings,” said Chris Wolfe, a Fitch banking analyst who previously worked at the Federal Reserve Bank of New York.

“Higher fixed costs require greater scale, whether you’re in steel manufacturing or banking,” he said. “The incentives for banks to get bigger have just gone up materially.”

Half of the country’s banks will likely be swallowed by competitors in the next decade, said Wolfe.

Substantially reduced lending and increase costs.

Lending will be substantially reduced for two primary reasons:

- Increased capital means less money to lend as more will need to be held in liquid assets. Furthermore, with less money to lend banks will charge more for the money they are lending.

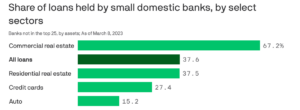

- Less smaller/midsize banks will reduce funding to many borrowers. Remember small and midsized banks, defined as domestically chartered banks not among the 25 largest, currently hold 67.2% of all outstanding commercial real estate loans, and 6% of loans overall.

Real estate lending substantially impacted

Small/Midsize banks are the economic engine for small/midsize companies. Whether is it a line of credit, real estate loan, business loan, etc…. Many midsize companies rely on smaller regional/local banks for their business relationships. With 50% less banks, many small businesses will be forced into the big banks that will not provide the same lending as their prior banks.

Commercial: With small/midsize banks accounting for 70% of all commercial loans, as the number of banks is substantially reduced there will be less real estate deals funded. This will hit smaller/midsize/ rural markets especially hard as the larger banks will not focus on these areas nor have the expertise.

Residential jumbo/helocs: Many of the small/midsize banks provide jumbo and home equity lines of credit. With the number of banks substantially reduced the jumbo and Heloc markets will be more difficult for borrowers to get funded.

What should the federal reserve do instead

Increased capital is not the best solution as the unintended consequences of less lending will hurt an economy already entering into a transition phase to slower growth. The federal reserve should take a measured approach and actually use the existing tools to weed out poorly run banks. In the case of SVB bank, this should have been flagged immediately due to the rapid growth in the size of the bank. It was not possible to grow at the speed they did without taking huge risks. It seems like the Federal reserve is just adding more bureaucracy for banks as opposed to actually doing the audits properly that would have already caught the issues. But, one of their proposals for a uniform accounting of assets so that each bank is not using a separate method of accounting is a well needed idea. If they couple the change in accounting with their current tools it could help prevent another crisis while at the same time not eliminating half of the small/midsize banks due to increased regulation and capital requirements.

Summary:

As with anything in economics, it is a zero-sum game that has far reaching impacts. The federal reserve rules for higher capital and mark to market on securities will have huge impacts to small/midsize banks.

Although changes need to be made to ensure a “safer” banking sector, the new rules will cause substantial harm to the drivers of real estate and small businesses by eliminating about half of all banks.

With less banks willing to lend, pricing power of the remaining players will be greatly increased. On both residential Jumbo/Helocs and commercial loans look for prices to rise. Rest assured these will be passed on to borrowers in the form of higher rates and fees. Furthermore many loans will not be funded at any price drastically reducing capital in the market.

There are much better solutions to the current banking crisis than a huge increase in regulations and capital requirements that would lead to the elimination of almost half of small/midsize banks. Small/Midsize banks are an enormous economic driver and as they are eliminated so too will the economic benefits.

Additional Reading/Resources

- https://www.wsj.com/articles/feds-barr-says-nations-biggest-banks-need-more-capital-abf3bee8?mod=hp_lead_pos6

- https://www.bloomberg.com/news/articles/2023-07-10/banks-face-higher-capital-requirements-in-plan-from-fed-s-barr

- https://www.cnbc.com/2023/07/10/american-banks-face-more-pain-huge-shift.html

- https://www.axios.com/2023/03/21/small-bank-struggles-could-hit-the-real-estate-market-hard

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender