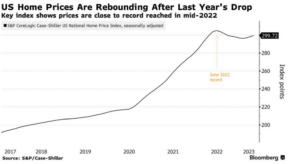

Like most, I have been surprised at the recent upward movement in prices. Did we just experience the shortest housing cycle ever? Are housing prices going to continue their recent upward swing? Why are housing prices now moving higher after a very shallow decline even in the face of higher interest rates?

What was in the recent data on housing prices?

The recent data on housing prices is quite impressive. The median home sale price in the four weeks ending July 16 was $382,500, up 2% from a year earlier, according to Redfin. Prices rose more sharply in some cities, including a 12% increase in Milwaukee, a 10% rise in Miami and a 9.5% bump in Cincinnati.

“The U.S. housing market continued to strengthen in April 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “Home prices peaked in June 2022, declined until January 2023, and then began to recover. The National Composite rose by 1.3% in April (repeating March’s performance), and now stands only 2.4% below its June 2022 peak. Our 10- and 20-CityComposites both gained 1.7% in April.

“The ongoing recovery in home prices is broadly based. Before seasonal adjustments, prices rose in all 20 cities in April (as they had also done in March). Seasonally adjusted data showed rising prices in 19 cities in April (versus 14 in March).

“The drag from higher rates on housing kind of seems to have come and gone,” said Veronica Clark, an economist for Citigroup.

Why are housing prices now heading higher

The media keeps drastically oversimplifying the causes of rising home prices as inventory shortages. The simple answer is inventory, but this answer glosses over the real drivers. There are three primary drivers of higher house prices:

- Golden Handcuffs of lower rates: the historic low rates that were locked in during the pandemic is drastically reducing supply. A good example is a recent retiree. Historically they would sell their larger house, downsize to a smaller house therefore freeing up inventory and cash. This is not occurring as the ultra-low rates are forcing would be sellers to stay put. Even if a house was priced less than their existing house, with higher rates, the payments would likely be higher. Furthermore for young professionals looking to move up even if there is a job paying more money, to sell a house for a move would be tough financially as the higher rates likely would outpace income gains.

- Mismatch of supply and demand: If we look at the recent building, very little is at the starter/entry level. As the cost of building has continued rising due to land costs, labor increases, material shortages, and new efficiency legislation it is nearly impossible to build at the entry level This has further constrained inventory at the areas with the most demand.

- Continued strong employment: With record employment, there is very little if any distress in the market. Incomes continue rising further pushing up demand while inventory is restrained.

Why do housing prices matter for inflation?

Shelter costs, which account for roughly 40% of the core CPI basket, are an important part of that battle.

The Bureau of Labor Statistics, which calculates the CPI, mainly measures shelter through the cost of rent, including what renters pay each month and an estimate of what a homeowner would be paying if they rented out a similar place (rent equivalent). Rising home values push up rents over time, as landlords factor in what they could receive if they sold the property.

Since rents are typically updated about once a year, changes in home prices and rents trickle into the official inflation metrics with a lag. The home price declines seen last year, combined with a cooling in rental costs, are now contributing to a drop in shelter inflation and overall price gains.

But a resurgence in home prices will likely lead to increased rent prices and in turn more inflationary pressures.

Dallas Fed President Lorie Logan said earlier this month at a conference in New York. “While housing inflation will likely continue to soften in the near term as a result of progress on rents last year, a rebound in housing would pose an upside risk to inflation down the road.”

Where will interest rates head from here?

With housing prices remaining strong it is going to be very difficult if not impossible for the federal reserve to get inflation down to their 2% target. The federal reserve will either have to be patient for a few years with higher interest rates and/or move interest rates up higher. The current consensus is that the federal reserve’s strategy is to let rates remain higher well into 2024 to quell inflation which may not work.

Summary

Although this “housing cycle” was I believe the shortest on record, inflation is far from over which will ultimately lead to another cycle that will be considerably more painful. The Federal reserve has once again waived the white flag that inflation is coming down and a soft landing is imminent, and the market has bought into this theory.

If you look at any past economic cycle, when rates rose substantially housing prices declined. This trend initially happened but has since reversed course even considering doubled interest rates. Rising house prices should be a huge concern for the federal reserve as rising house prices are a warning for future inflation.

As housing prices continue to trend higher rents will also go higher. Furthermore, higher prices bring higher costs to property owners from higher taxes, higher insurance due to rebuilding costs, higher maintenance costs, etc… all these items will continue flowing through to higher rents and in turn make is considerably more difficult to hit the Federal reserve inflation targets.

The federal reserve will have a difficult decision to make. Either they can let inflation run hotter than their 2% target and create more issues down the road or they will be forced to raise interest rates even higher than they are saying and the market is anticipating to finally slow the labor market down and ultimately housing.

Neither option the federal reserve has will lead to the predicted soft landing. Unfortunately, the longer the federal reserve waits to address the underlying issues of inflation the more difficult the economic consequences will be and the harder the landing down the road. Although we just experienced the shortest real estate cycle in recent memory, don’t worry there is another one in the offing as inflation has yet to be fully addressed.

Additional Reading/Resources

- https://www.bloomberg.com/news/articles/2023-07-24/housing-market-rebound-poses-challenge-for-fed-s-inflation-fight?srnd=premium

- https://www.spglobal.com/spdji/en/index-announcements/article/sp-corelogic-case-shiller-index-continued-gains-in-april/

- https://www.bankrate.com/real-estate/housing-prices-falling-across-country/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags:

Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender