The federal reserve did an analysis of what has led to the surge in housing prices and has a conclusive answer; the driver of high prices is not that we don’t have enough houses as the media has been claiming. What is the real culprit behind soaring prices? Is there really a supply issue? What does this mean for future prices in the next real estate cycle?

Why is the answer to supply vs. demand so important to the housing market?

The answer is important because it has implications for monetary policy and the Federal Reserve’s attempts to rein in inflation. If prices are going up because demand is too high, then raising interest rates could have some use in bringing them back down as tighter policy drives up unemployment and people would have less money to buy things. But if prices are going up primarily because supply is too tight, then raising interest rates won’t be that impactful. After all, higher interest rates don’t create more cars, computer chips, or cows.

What was in the federal reserve analysis of housing demand and supply

Here is an abstract from the Federal reserve analysis of supply vs. demand

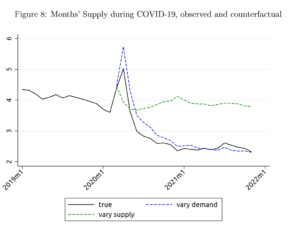

We use a housing search model and data on individual home listings to decompose fluctuations in home sales and price growth into supply or demand factors. Simulations of the estimated model show that housing demand drives short-run fluctuations in home sales and prices, while variation in supply plays only a limited role. We consider two implications of these results. First, we show that reduction of supply was a minor factor relative to increased demand in the tightening of housing markets during COVID-19. New for-sale listings would have had to expand 30 percent to keep the rate of price growth at prepandemic levels given the pandemic-era surge in demand. Second, we estimate that housing demand is very sensitive to changes in mortgage rates, even more so than comparable estimates for home sales. This suggests that policies that affect housing demand through mortgage rates can influence housing market dynamics.

The fed study shows that supply is not the culprit of higher prices as there is no way supply could have ever surged to compensate for the huge increase in demand. According to the study for supply and demand to balance, new construction would have had to increase 300%. We see the same thing playing out in the auto market where there is no way that supply could ever increase enough to cover the newfound demand.

The importance of knowing demand is the culprit shows that the federal reserve can get better control of prices by reducing demand through higher interest rates which will better balance the housing, auto markets, etc…

Is the federal reserve study accurate?

Yes. I have said since the beginning of this cycle that there is no shortage of houses, there is a mismatch with demand. As interest rates have soared, the number of sales has declined while inventory has continued to increase. If the market were driven by supply, the ample demand in the market would easily absorb any new supply that is occurring, but that is not happening. Here is a chart of Denver in June showing a 74% increase in inventory. This plays out exactly as the study predicted that price surges were due to demand. As costs increase via higher mortgage rates, sales have fallen.

What does this mean in the real world of real estate?

“We estimate that a one percentage point increase in the mortgage rate lowers housing demand by 10.4 percent,” the authors write. “This is a larger demand sensitivity to rates than evidence using purely observable housing market variables suggests.” If I extrapolate this ratio, with interest rates rising basically a little over 3%, that means that demand should fall by around 30%.

With demand falling 30%, this means that prices will lose some air. There is no way that prices will continue increasing and/or remain sky high with a thirty percent reduction in buyers.

Summary

The federal reserve study is the first I have seen that has conclusively determined that interest rates are the largest determinate of demand in our current cycle. Although I’ve thought this for a while, I’ve never seen an actual analysis that proved this theory. Furthermore, to quantify the decrease in demand is critical to future price predictions. As rates increase, demand decreases, and in turn prices will ultimately fall. How much prices fall will be determined by how high the federal reserve must raise rates in order to get control of inflation.

From the market lows, mortgage rates have increased approximately 3 percent which leads to a 30% drop in demand. This will swing the market back quickly from a sellers to a buyers’ market with prices best case stagnant and most likely decreases in prices. The wild card is where we go from here. As inflation becomes more ingrained, real estate rates likely will go up around 1% more, which would lead to a 40% drop in demand from the pandemic highs.

The question this paper didn’t answer is what the tipping point is where decreased demand causes a huge drop in prices. What do you think the tipping point is? A 30%, 40%, or higher reduction in demand? In this upcoming cycle we will have a front row seat to find out this answer.

Additional Reading/Resources:

- https://www.federalreserve.gov/econres/feds/volatility-in-home-sales-and-prices-supply-or-demand.htm

- https://www.bloomberg.com/news/articles/2022-07-07/new-fed-paper-finds-surging-home-prices-driven-by-demand-not-supply

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender