If you haven’t gotten a haircut in a while, you are in for a surprise. Haircut prices like many other services in the economy are experiencing large increases. What does the increase in haircut prices mean for the economy and in turn real estate? Why are haircuts such an important indicator? What are haircuts telling us about future interest rates? How will the price of your haircut impact the federal reserve?

Why are Haircuts an important indicator for the economy and in turn real estate?

Haircuts show more is at play when it comes to underlying inflation trends. Between 2010 and 2012, when the U.S. was recovering from recession, unemployment was high and inflation consistently registered below the Federal Reserve’s 2% objective. Haircut prices barely budged then, rising only as the last expansion wore on, unemployment fell and labor became more scarce. Yet the hike in prices wasn’t nearly as sharp as what customers are seeing today.

One reason haircuts hint at bigger economic issues is that rent and labor, two of the main costs for barber shops and salons, are two of the bigger price forces in the broader economy. Payroll makes up about 50% of an average salon’s budget and rent or lease payments make up 20%, according to Nina Daily, executive director of the Professional Beauty Association, an industry trade group.

“Most of this inflation is now built into the system in a way that is going to take time and effort to get rid of,” says Stephen Cecchetti, a Brandeis University international finance professor who tracked inflation as a young man for the White House when prices were soaring during the 1970s.

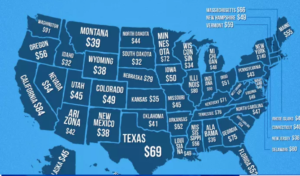

Haircuts are a useful indicator, he says. He recalls a former colleague during his time at the Switzerland-based Bank for International Settlements who made a habit of getting his hair trimmed whenever traveling abroad. The cuts shed light on the relative costs of services in different countries. Visiting barber shops, Mr. Cecchetti says, “was like an economics field trip.”

What does the increase in haircut prices mean for inflation?

The largest driver of the consumer price index and in turn inflation is rent/rent equivalents. As rent increases due to higher commercial and residential real estate prices, inflation will continue. Remember rent is a lagging indicator as it could take many months (or even years on commercial property) to flow through. With rent making up 20% of a barber’s budget, increases in rent will flow through to the consumer with higher prices as we are seeing today.

Labor makes up 50% of the cost of a haircut. With labor shortages/mismatches labor costs are skyrocketing. Many of the initial wage increases started in the lower skilled service professions, but as wages are raised for someone for example taking orders at McDonalds this will compress wages and ultimately lead to gains further up. For example if an order taker is now making 18 an hour, now a barber will need to raise wages to 25 an hour (or some other number) to retain employees.

Rent and inflation are “sticky” indicators of inflation. Neither immediately adjusts due to the economy and in the case of wages, even in a recession, we don’t necessarily see declines in wages, we see more layoffs and existing workers keep their salaries. This is a huge problem for the federal reserve as haircuts further emphasize how entrenched inflation has become

How will haircut prices influence interest rates?

Haircut prices are another indicator that the federal reserve has painted itself into a box. The federal reserve waited way too long to raise rates as they were more concerned about full employment which has led to the overheating in the economy and in turn inflation running at 400% of their target.

With rent and labor prices becoming more entrenched the federal reserve will have to continue to raise rates higher to “temper demand” and reduce labor costs by increasing the unemployment rate. Unfortunately as we are seeing with the stickiness in labor and rent flowing through haircut prices, the federal reserve will have to hike rates even higher and longer than originally planned.

We saw a hint of what the federal reserve is up to with a large jump in rates of .75% at their last meeting, there likely will be further large increases on the horizon. This will in turn push mortgage rates even higher as the 10 year treasury rises. Rates as I am writing this are a bit above 6%, the huge increases by the federal reserve will likely push mortgage rates above 7% next year.

Will real estate prices continue to increase like the cost of haircuts?

Don’t count on it. Hair cut prices likely will continue to increase, but real estate should remain flat or likely decline due to the huge jump in interest rates. A 6% rate is double what it was less than a year ago which has further crimped the buying power of purchasers. Look for demand to continue to decline as rates increase which will ultimately lead to a softening of real estate prices.

Summary

Soaring haircut prices are a warning to the real estate market. As inflation becomes entrenched in labor and rent costs the federal reserve will have to continue to act forcefully to bring inflation back down to its target of 2%. With inflation running 400% above their target, haircut prices show that the federal reserve has a long road ahead of large rate increases. These large rate increases will in turn raise mortgage rates, soften demand, and ultimately lead to lower prices of real estate. The only unanswered question is how high the federal reserve will have to raise rates to accomplish their goal of low inflation and ultimately how high mortgage rates will go.

Additional Reading/Resources:

- https://www.bloomberg.com/opinion/articles/2022-06-22/the-us-economy-is-headed-for-a-hard-landing?srnd=premium

- https://www.wsj.com/articles/inflation-haircut-rising-prices-salon-11655837423?st=9pogq1lv28779u7&reflink=share_mobilewebshare

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender