“A reckoning is due. Home prices and rents can’t separate as significantly as they have from their long-term fundamental trends without major issues arising in the marketplace,” said Ken Johnson, an economist at Florida Atlantic University, in an analysis. “Few markets, if any, will escape unscathed.” Will real estate values plummet as the study predicts? How accurate is the model with their predictions?

What did the model say regarding cities that are drastically overvalued?

Home values tend to cycle between periods of overvaluation and undervaluation, but eventually, move back toward long-term trends. During the housing bubble in the early ’00s, overvaluation approached 20% in metro Denver. From 2008 to 2016, home values in metro Denver ran at a discount to the trend. Smaller premiums came back in 2016, but those started to tighten again in 2019 and 2020.

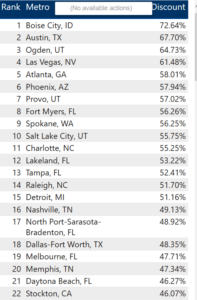

The model sees the same trends with cities throughout the country. The top 10 markets are overvalued between 56-72%.

How accurate is the model in predicting huge declines in real estate prices throughout the country?

Whenever I see bold predictions like prices will drop almost 60% in Atlanta, I always get a little suspect and dig deeper to understand the details of the model. Unfortunately this model was oversimplified and missed some big trends that have influenced individual markets. The model basically extrapolates price predictions based on zillows house value index based on a historical correlation with rents. Unfortunately there are some flaws in this reasoning. Here are four notable flaws.

- Easy monetary policy: Easy monetary policy skewed the payments on more expensive houses. Low rates are the primary reason that house prices jumped as high as they did. For example with a 2.5% mortgage rate, the payment 2k a month. If we take the same house of 500k now with a 6% rate the payment is 3k/month. Millions locked in ultra low rates less than 3% which means their payments are well below current market rates. Even though they might have paid above market, with the locked in lower rate they are essentially at the same place as if they were buying a substantially less expensive house today. The same could be said with a rental property, if a property owner locked in a 3% rate, the needed rent to cover the payment and make a profit is substantially less than if I had a 5% rate on the same house.

- Rents always lag prices by 6-12 months. This model is showing a huge divergence in rents to prices. As prices have shot up so quickly, rents have not had time to catch up. You will see double digit increases in rents over the next 12 months that will drastically alter the data.

- Relocation of jobs to areas like Denver, Atlanta, Austin: The model fails to account for historical changes that have occurred due to Covid. There have been an influx of employers out of places like New York or San Diego to Denver, Austin, Atlanta, etc… This huge movement of employers and subsequently employees has changed the dynamics in the respective market. Take the Denver metro, there have been hundreds of announcements from big companies like Amazon, Google, Microsoft, etc… increasing their presence in Denver/Boulder. All of these relocations need housing which has furthered price increases and in turn rents. The historical trend might not hold true as the salaries of many of the relocators is substantially above historical norms.

- Relies on Zillow house price index: The basis for prices relies on Zillow house price index. Unfortunately this is not the most reliable source. If this metric were accurate Zillow wouldn’t have lost money. The Home price index relies on predicted median values which is different than actual sales. I have seen Zestimates skew primarily to the high side by 10-20%. Furthermore, Zillow announced a change in the zestimate in 2019 to supposedly make the zestimate more accurate in fast moving markets. Unfortunately beyond the statistical jargon, the real reason is that their number one clients are realtors and realtors will not continue to advertise if the zestimate on a house they are listing is less than the listing price. Pull up any house listed on Zillow, on almost every house I have looked at, the zestimate and the listing price are the same. How ironic?

Long and short, the model oversimplified the intricacies of the real estate market and relied on bad information going into the model.

Will prices actually fall the amount each market is overvalued?

According to the study, prices will fall back to their long range trend. Unfortunately I do not see this as realistic. I think we are due to a cooling off, but I don’t see Atlanta dropping 60% or Denver 40%. Here are three reasons

- Depends on market, areas like Denver, Atlanta, Austin will fare better than others due to the huge quantities of new arrivals in these markets due to employer relocations.

- Millions locked in lower rates and will not move crimping supply. On my house I locked in 2.75%, with higher house prices and rates double what mine is, I don’t foresee moving for a long time.

- Rental rates already moving up even as prices cool: We are just now starting to see prices start to level off. At the same time rental rates have shown no signs of abating. This shows that rents will make huge jumps over the next year to catch up with the large gains in appreciation.

- Lack of excess inventory: In markets like Denver and Austin, there is negligible inventory available this will ultimately keep inventory from exploding which will help prevent a precipitous drop.

Some markets have better market fundamentals than others

Real estate is local and location is the primary driver of value. Austin, TX will perform drastically different than places like Boise, ID. For example numerous high tech companies have relocated to Austin including Tesla which is now requiring all managers to be in the office 40 hours a week. All of these high paid employees will need somewhere to live.

On the flip side, places like Boise do not have the job growth to support the number of people that have relocated there and local wages can’t keep up with house prices. As the economy normalizes, cities like Boise will be considerably riskier than Austin, Denver, or Atlanta.

How much will prices fall in “solid” markets like Denver, Atlanta, Austin, etc…?

In good markets with solid employment growth there will be 15-20% decline. Good markets have ample employment to support the prices of the houses. For example an engineer in Boulder making 300k a year can buy a million dollar house. Remember last year alone prices increased in places like Denver was almost 30%. Good markets will give back some of this gain.

How much will prices fall in severely inflated markets like Boise, ID?

Boise and some of the other markets noted in the study are bubble waiting to pop. There will likely be 40% + declines in these markets as local wages are unable to support the house prices and in turn rents cannot rise high enough to justify the prices.

Summary

The sky is not falling, Denver is not going to fall almost 40% next year and Austin is not falling 70%. This model reminds me of one of my first job out of college at a fortune 10 company. I was a finance whiz and had a great idea on optimizing a supply chain that could save millions of dollars. I went and presented to the VP. He looked at the model for several minutes, then to my astonishment replied “This sucks!”; there is nothing like some honest feedback. I was new to the industry and my model did not fully account for the intricacies of the market. Instead of millions, the real savings was in the thousands :< This is eerily similar to the model above.

The crux of the problem with the professors model is that it uses faulty data on values which inflates the disparity of rents vs. values and it furthermore doesn’t account for the ability for rent to grow. As rents grow the disparity between values and rents shrinks. Some markets like Denver and Atlanta will be able to achieve rent growth, while others like Boise do not have the local wages to raise rents substantially further.

Unfortunately the model above is oversimplified to be of much use. Austin is not going to decline 70% as rents will ultimately catch up with prices. Furthermore the relocation of high paying employers to the area has altered the market. On the flip side, places like Boise are much riskier as local wages are unable to keep up with rising prices and therefore rents will not be able to increase enough to close the gap. Therefore, Boise will decline at least twice as much as places like Austin, Denver, or Atlanta.

As suspected when bold claims are made, we must all be highly suspect of the data as in the case above. The general theory of rents vs values is useful, but this model is oversimplified to be of much use to make decisions with. The real estate market is no doubt in for a reset, but there are no indications of 60% declines overall in places like Atlanta or Denver or Austin as the market has fundamentally changed with employment and they have the ability to raise rents.

Additional reading/resources

- https://www.zillow.com/research/zhvi-methodology-2019-highlights-26221/

- https://business.fau.edu/executive-education/housing-market-ranking/methodology/index.php

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender