Soft Landing base case, impact on real estate

Every realtor newsletter I have received predicts an increase in sales and a great real estate market is 2024 due to lower mortgage rates. Will this come to fruition? Will we have a “soft landing” in 2024 and which will lead to a great real estate market. Is a soft or hard landing better for real estate? Does it really matter which “landing” it is? Is real estate already in a “hard” landing?

What is a soft landing?

There is no official definition of a soft landing. The National Bureau of Economic Research (NBER), often considered by economists as the quasi-official arbiter of dating recessions, does not define hard or soft landings. Many economists consider a mild recession with a small increase in the unemployment rate as soft – what Fed Chair Jay Powell once described as a “softish” landing.

In essence, the federal reserve, under a soft landing scenario, is able to slow the economy without triggering any major bad outcomes like an asset price reset like the 2008 recession, or a huge stock market correction, or a collapse of any major industries.

The soft landing scenario is played out in the recent federal reserve meeting where rates where held steady with projections of one more rate hike and then rates fairly consistent through next year (https://s.wsj.net/public/resources/documents/projectionsl20230920.pdf )

Will the economy actually achieve a soft landing?

Although the market is factoring in an almost certain “soft landing”. The reality is drastically different. Achieving a soft landing is extremely unlikely. Since World War II, economists say, the U.S. has achieved only one durable soft landing, in 1995. “We steered the economy very expertly, but in addition, we were lucky. Nothing bad happened,” said Alan Blinder, an economist who was Fed vice chair from 1994-96. The probability of a soft landing is very small compared to the more likely outcome of some sort of a recession.

In today’s environment a soft landing will also be difficult as the theory of higher rates for longer will ultimately unintentionally break something else in the economy that will trigger a harder landing. Real estate is a prime example that could easily break under the higher interest rates. We are already seeing this play out in commercial real estate.

Real estate already experiencing a hard landing

Regardless of what metric you look at, real estate is already experiencing a hard landing. Closings volumes are down, interest rates are up, and if you ask anyone in real estate, it looks pretty bleak. The one positive is on the residential side prices are holding up in most markets.

According to a recent Well’s Fargo report: “Existing home sales inched down as resales continue to be constrained by low inventory and rising borrowing costs. The 4.04 million-unit sales pace is the slowest since January and the second slowest pace since October 2010, when the housing market was still in recovery from the housing market crash.

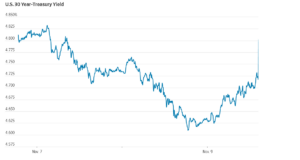

The long slide in existing home sales, which have fallen 17 of the past 19 months, and are now down 15.3% over the year continue. Elevated mortgage rates continue to be a prohibitive force and thus will weigh on demand for the foreseeable future. The outlook for a persistently high financing cost environment was affirmed by the FOMC’s September meeting yesterday in which it communicated a higher for longer interest rate outlook with minimal cuts projected for 2024.”

On the flip side commercial prices are in a free fall in office, with multifamily and large big box retail up next for price resets. We are seeing huge amounts of distressed debt starting to surface in the office sector. Although we haven’t seen a large-scale commercial reset yet, there are rumblings of further stress in other sectors, especially multifamily.

Predicted Fed cuts unlikely to materially change real estate in 2024

Although the industry is predicting a swift turn around in 2024, I’m skeptical of any big swings in real estate as volumes look to remain anemic. Even with the federal reserve announced cuts, it looks to keep interest rates north of 6%. By historical standards, 6% is about normal, but it is still almost double what it was a year or so ago. With rates remaining high, affordability continues to be problem.

Furthermore the lock in effect will continue as millions locked in ultra low rates that they will be unwilling to give up. Without a shock in the economy there is unlikely to be any impetus for people to move which will lead to similar low volumes as we saw in 2023.

Summary

Although the federal reserve continues priding itself on a soft landing the economy, it does not mean that every industry will achieve this goal. Regardless of the soft landing for the economy, real estate is already deep into a hard landing with volumes historically low, rates remaining high, and price resets beginning in commercial real estate.

Unfortunately the real estate hard landing is only set to continue through 2024 as rates remain high and there is little impetus for existing home owners to move. This will lead to anemic sales volumes in 2024 that will likely be similar to 2023. On a positive note, on the residential side I don’t see a free fall in prices as supply continues to remain constrained.

Furthermore, I don’t see any impetus for a quick rebound in real estate until we see a much larger drop in rates which doesn’t look like it is in 2024.

Additional Reading/Resources:

- https://s.wsj.net/public/resources/documents/projectionsl20230920.pdf

- https://www.wsj.com/economy/central-banking/federal-reserve-powell-interest-rates-ba600bf0

- https://www.reuters.com/markets/us/us-existing-home-sales-drop-prices-up-year-earlier-2023-08-22/

- https://www.wellsfargo.com/cib/insights/economics/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender