The economy is in for a bit of a ride! The federal reserve in their last meeting changed their tone signaling two more rate increases this year as opposed to one bringing the total rate increase to four. Why is this change in tone important? What does this have to do with real estate? What does upside down (inversion) mean and what is the impact on the economy?

Is the economy doing “very well” as Jerome Powell, the Federal Reserve Chairman said in the policy announcement. Do the economic indicators back up Powell’s assertion? Before talking about how the economy is doing, it is important to understand that not all inflation is equal. There is an improper assumption that just because there is inflation the economy is doing well.

Drivers of inflation:

Unfortunately, not all inflation is created equal. Merely having inflation does not mean the economy is doing well. It is important to note, there are two very distinct types of inflation. Good inflation and bad inflation. Good inflation signifies growth in the economy (increased GDP) while bad inflation is triggered by outside factors that are not growing the economy but merely making goods more expensive. Bad inflation can ultimately lead to “stagflation” which is a stagnating economy with increasing prices. This is what Japan has experienced for the last 20 years or so with little to no economic growth while prices increase.

Good inflation:

Positive economic activity will translate into rising prices. For example, as people become more productive profitability increases and there is more disposable income in the economy to increase wages, buy new plants/equipment, invest in development of new products, etc… There are three indicators of positive inflation: growth in productivity, wage growth, and ultimately increases in GDP/ economic growth. All three are closely intertwined.

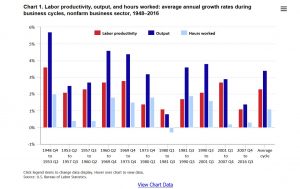

- Growth in productivity: The more a worker can produce per hour has barely changed. Productivity is important because more good/services are produced with limited incremental costs. This increases profitability. In Q1 of 18 productivity growth was .7% vs .9% in relative terms, the US productivity has been the second lowest since 1948 (source bus.gov) and is is less than one-third the long-term rate of productivity growth of 2.3 percent posted from 1947 to 2007. Productivity growth is the driver of economic growth. Without productivity growth economic growth will lag.

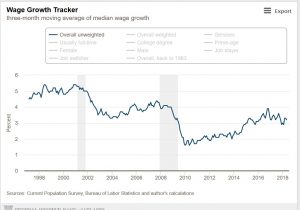

- Wage growth is the increase in real wages. During this recovery wage growth has been tepid and was 2.3% in the last year. In the last cycle 2000 to 2008 wage growth averaged over 4% (source federal reserve bank)

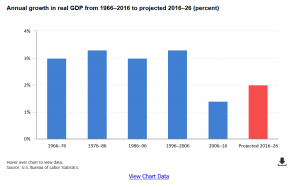

- Economic growth/change in gross domestic product: As productivity increases economic growth also increases in Q1 economic growth was 2.2%, not stellar by any metric. The average over prior cycles was north of 3%. (source Bureau of labor statistics)

As you can see above, good inflation is not the driver of our current economy with lackluster productivity and wage growth and ultimately very slow economic growth/GDP Growth. This leads us to the culprit in our current economic cycle, bad inflation.

Bad inflation

Bad inflation occurs when goods and services are increasing in costs due to external factors and not driven by increased economic activity.

- Housing/Real Estate: Both residential and commercial costs have increased. Housing is one of the primary drivers of inflation. One big driver of cost increases is materials. In November, tariffs of 20.83% were imposed on lumber imported from Canada. According to the National Association of Home Builders these costs have largely been passed along to consumers, and you’ve seen new home prices touch new highs,” Terrazas said. It added $6,000 to $10,000 to the cost of a median-priced home. (source MarketWatch). Furthermore, new tariffs proposed on aluminum and steel will hit commercial construction costs much harder. Even if you do not own a home or commercial property, the increased building costs are driving increased rents that businesses and renters will pay. This increase in costs has led to no economic gain.

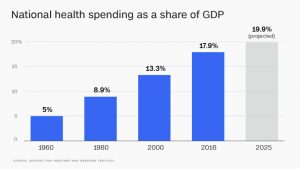

- Healthcare: Healthcare costs continue to rise rapidly. “The ballooning costs of health care act as a hungry tapeworm on the American economy,” Buffett said. National health spending — which includes spending by federal and state governments, the private sector and individuals — has risen from just 5% as a share of the economy in 1960 to 17.9% in 2016, according to the most recent data from the Centers for Medicare and Medicaid Services. It’s projected to rise to 19.9% by 2025. Healthcare costs are a large driver of inflation. This is money that cannot be spent on other items that drive the economy.

The two most recent drivers of “bad inflation” have been healthcare and housing costs which are not leading to economic productivity, wage growth, or GDP growth. This creates a precarious situation for the federal reserve as they raise rates to try and control the bad inflation.

Ready to go upside down? Yield curve could invert due to bad inflation.

What does an inversion mean? If you plot short and long-term rates on a graph in a growing economic cycle, as short term rates increase, long term rates should also increase. Long term rates are a gauge of long term economic prospects and as they increase they signify that the market anticipates future growth. If the short-term rates and long term rates invert (meaning short term rates are more expensive than long term rates) the market is warning that long term growth prospects are not good. The yield curve has accurately predicted that last seven recessions. Currently the yield curve is flat with predictions of an inversion by late summer (Bloomberg published an article titled: Thanks to the fed an inverted yield curve is imminent). This is a clear sign that the market is not buying the long term economic growth prospects of the US economy and a warning that short term rates should not be rising as fast as they are.

What about real estate?

Real estate, like the general economy, is very cyclical. Consumer sentiment is a large driver of real estate. The 10-year treasury and possible yield inversion is an indicator that a slowdown is on the horizon. This will translate into a decline in consumer confidence and ultimately a slowdown in real estate.

The “hawkish” view from the fed about inflation fighting and lack of differentiation between good and bad inflation is an ominous sign for the economy. Federal Reserve Chairman Jerome Powell said “The main takeaway is the economy is doing very well.” Maybe the federal reserve needs to stop focusing on “fake news” and look at the data produced by the various branches within the government that paint a very different picture (featured above). Numbers don’t lie! There is lackluster growth in productivity, wages, and GDP; the economy is clearly not doing well as well as stated (nor is it predicted to get much better based on GDP predictions). By the fed taking aggressive action on “bad inflation” they will no doubt drive the yield curve to invert and push the economy into the next economic downturn.

Sources/Additional Reading

- https://www.forbes.com/sites/jjkinahan/2018/06/13/fed-language-accompanying-expected-rate-hike-is-more-hawkish/#184344ac47c8

- https://www.frbatlanta.org/chcs/wage-growth-tracker.aspx?panel=1

- https://www.cnbc.com/2018/05/03/us-productivity-q1-2018.html

- https://www.bls.gov/opub/btn/volume-6/below-trend-the-us-productivity-slowdown-since-the-great-recession.htm

- https://www.bea.gov/newsreleases/national/gdp/gdp_glance.htm

- https://www.bls.gov/careeroutlook/2017/data-on-display/economic-growth.htm

- https://www.bls.gov/careeroutlook/2017/data-on-display/economic-growth.htm

- https://www.marketwatch.com/story/what-home-buyers-and-renters-need-to-know-about-trumps-steel-tariffs-2018-03-05

- http://money.cnn.com/2018/01/30/news/economy/health-care-costs-eating-the-economy/index.html

- https://www.reuters.com/article/us-usa-economy/rising-rents-healthcare-costs-boost-underlying-u-s-inflation-idUSKBN1F11QD

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).