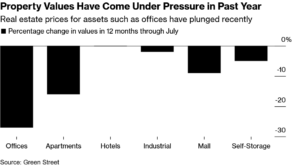

I continue to hear discussions about the huge plunge in office values while little attention has been given to other commercial property sectors like apartments. Apartment buildings, long considered a real-estate haven, are emerging as the next major trouble spot in the beleaguered commercial-property world. What is causing the sudden change in fortunes? Will this trend quickly reverse like we saw in past property cycles?

Why are apartments dropping so quickly in value?

It is counterintuitive that rents are still rising and yet we are now seeing defaults in the multifamily sector. Investors bid up the prices of multifamily buildings for years, attracted by steadily rising rents and the prospect of outsize returns. Many took on too much debt, expecting they could raise rents fast enough to pay it down. The sudden surge in debt costs last year now threatens to wipe out many multifamily owners across the country. Apartment-building values fell 14% for the year ended in June after rising 25% the previous year, according to data company CoStar. That drop is roughly the same as the fall in office values.

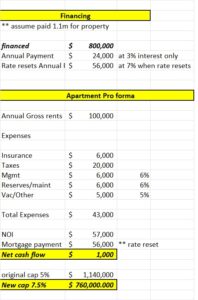

An example of the change in Apartment values

It is always easiest to illustrate a big change with numbers. Below is a proforma of an apartment complex that I had looked at for lending. Here are the key assumptions:

- Borrower paid 1.1m for property and financed 800k

- At time of purchase cap rate 5%

- Initial rate was 3% interest only (remember most commercial loans are only locked for 3-5 years)

- Rate resets to 7.5% interest only

- Cap rate increases based on treasury increases to 7%

As you can see from the analysis below, with stagnating rent growth and the huge jump in interest rates, the proper barely breaks even from a cash flow perspective. Furthermore, with the new cap rate on the property the value has declined to a little less than the loan amount.

The example below clearly shows why there are huge defaults in apartments and considerably more on the way.

Apartments are much more interest rate sensitive than other commercial properties

Apartments were trading on ultra-low cap rates in the 2-5% range which makes them very sensitive to any big changes in interest rates. As treasuries rise, so do cap rates which will lead to huge value destruction. The change in cap rates along with higher interest rates is a death knell for many properties.

Soft landing narrative will destroy commercial real estate values

The Federal reserve and our politicians continue touting the soft landing narrative. While a soft landing could be good for some, commercial real estate values will fall dramatically under this scenario. To achieve a soft landing this means that unemployment will not spike and there will not be a huge pullback in spending. Without these events, the only way for inflation to continue to reduce is with high rates for longer periods. As interest rates remain high, cash flow will continue to be impaired for most commercial properties including apartments as rates are forced to reset at a much higher interest rate.

Just seeing the beginning of the stress in Apartments

Outstanding multifamily mortgages more than doubled over the past decade to about $2 trillion, according to the Mortgage Bankers Association. That is nearly twice the amount of office debt, according to Trepp. The data provider adds that $980.7 billion in multifamily debt is set to come due between 2023 and 2027. We have yet to see the full effects of the huge jumps in interest rates yet. As rates stay high into 24 and beyond apartments are facing a huge reckoning.

Banks/lenders have a big problem

Many apartment loans are held by small/regional banks. If we continue with the scenario above banks have a huge problem as the collateral is worth less than their loan. Furthermore even if the value was higher the cash flow off the property makes it basically not financeable with any other lenders.

At the end of the day many banks will be holding the bag as property owners walk from properties as there are no other available options. This issue is further compounded by higher interest rates for longer which means lenders will be hard pressed to sit on the asset for many years until resolution. Many lenders will be taking large losses on their apartment portfolios due to rising rates.

Summary

In past cycles after interest rates rose, there would be a decline in employment and ultimately a recession. This would allow the federal reserve to quickly lower rates to help counter the recession. This cycle will not be the same as there will not be a trigger event to quickly lower rates. Without lower rates many apartment deals that were made in the last 7 years or so no longer make sense due to higher cap rates, higher expenses, and higher mortgage rates.

Although the market continues to focus on office properties, apartments are going to be a huge loss leader for borrowers and ultimately lenders. The losses will be compounded as rates are forced to stay higher for longer to try to achieve a soft landing. On a positive note, once the dust settles there should be some sales on multifamily properties to the tune of 20-30% off today’s prices.

Additional Reading/Resources

- https://www.wsj.com/articles/a-real-estate-haven-turns-perilous-with-roughly-1-trillion-coming-due-74d20528?mod=hp_lead_pos2

- https://www.bloomberg.com/news/articles/2023-08-07/property-loans-are-so-unappealing-that-banks-want-to-dump-them?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender