Is there a new subprime crisis lurking?

10 years ago nightly rentals were a novel concept, fast forward to 2024 and the number of nightly rentals have surged 40%. What does this huge increase in nightly rentals mean for real estate values? Has the market gotten ahead of itself? What happens when consumer spending falls? Will real estate values in once “hot” nightly rental markets fall?

What happens to the hospitality sector when consumer spending falls?

Although the talk of a recession has receded, there is broad consensus that the consumer can not continue spending at the current rate. Sometime over 2024, there will be a substantial pull back in consumer spending and travel will no doubt be impacted. What has happened historically in the hospitality industry when there is a decline in consumer spending?

The negative impacts of economic recession on lodging firms have been

well documented. During the 1990-1991 recession, the hotel room occupancy in

the U.S. fell well below the breakeven point and eventually led to bankruptcy

filings of many hotel firms (Romeo, 1997). The 2001 recession that lasted for

eight months placed hardships on many of well-known U.S. lodging properties

including Wyndham International and Park Place Entertainment Corporation

(Hotel & Motel Management, 2001). The most recent recession that began in

December 2007 has affected many hospitality firms. According to Sharkey (2008),

even the upscale four- and five-star properties have suffered due to declining

corporate travel and rising cancellations. According to a recent report by Smith

Travel Research, both occupancy and room rates fell about 10% from the

previous year and many hotels no longer generate operating profits (Haughey,

2009). Property & Portfolio Research expects 13% drop in overall occupancy and

a 23% lower revenue per available room in 2010 (Haughey, 2009).

During the last recession approximately 10 percent of hotels opened in the last 5 years closed

What is the risk that is “hiding” in plain sight that nobody seems to be talking about?

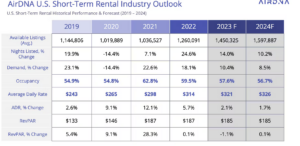

Short term vacation rentals like Vrbo, Airbnb, etc…. are a new risk that we have never seen in prior downturns. Furthermore the number of short-term rentals continue growing rapidly. Here are a few statistics about Airbnb. Also look at the chart above

- There are 9 million hosts on Airbnb worldwide in 2022.

- 14,000 new hosts are joining the platform each month in 2022.

- There are over 7 million listings on Airbnb worldwide in 2022.

- There are 100,000 cities with active Airbnb listings in 2022

- From 2019 to 2024, the number of nightly rentals are expected to increase by 40%

- From 2023 to 2024 the number of nightly rentals are expected to increase by 14%

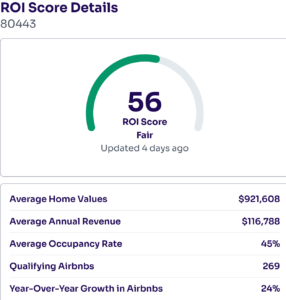

Breckenridge/Summit County a cautionary tale for nightly rentals

Breckenridge (owned by Vail resorts) is the heart of Summit County with three major resorts including Keystone and Copper mountain. I did a quick analysis on Summit County and it shows a huge increase in nightly rentals, up 24% according to recent data. Demand can not come even close to keeping up with the increase in supply. This is resulting in lower utilization rates along with lower average nightly rates. Ultimately nightly rentals in Summit County will become increasingly less profitable.

“In the last couple of years you do see an over saturation in some markets and one needs to do more research because there is so much variance in the market,” said Paul Kromidas, founder and CEO of Summer, a short-term rental operator based in New York. “People want to commodify these assets; they want to try to fit it into a box. There are opportunities in this market, but it now needs to more thought and you cannot wake up and decide to do it.”

Why do owners rent short term vs. long term?

Basic economics! A short-term rental can gross three to 4 times the amount of a long-term rental property. Many property owners in resort communities have discovered the new economics of short term rentals and have jumped on the bandwagon as you can see above.

Why are short term rentals riskier than long term rentals?

Short-term rentals are much more prone to economic shock from cycles than longer term rentals. If we look at the last recession (and prior recessions) the first thing cut back by consumers is vacations. We see that people will vacation locally as opposed to venturing to faraway places. Local visitors spend substantially less than destination spenders.

Short term rentals more prone to shock.

Short-term vacation rentals/nightly rentals are much more exposed to changing consumer spending. For example, if you have a long-term tenant, it is unlikely they will move out immediately from a recession. They still need a place to live. Vacation rentals are a different animal. As soon as there is a substantial recession, they will not book that vacation (or cancel their existing vacation). It is an easy and quick decision to save disposable income. Occupancy rates will fall in destination markets and this will quickly translate into loss of revenue to short term rentals.

Most short term rentals bought with leverage.

Here is an interesting statistic by Homeaway: “ Fifty-nine percent of subscribers get at least 75 percent of their mortgage covered by the rental stream.” For almost 60% of people that utilize short term rentals 75% of their mortgage is paid for by the rental income. What happens when the party stops? The last recession can give us some clues.

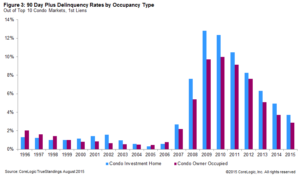

One of the largest sectors of nightly rentals are condos.

Condos are easy to rent and easy to maintain. But there is a downside. After the recent housing market crash, condominiums got a bad rap for having higher mortgage default rates, foreclosure rates and total losses. This is an interesting chart by Corelogic, which shows substantially higher default rates on “investment” vs. owner occupied (blue designates investment properties). This same correlation is likely true for any investment property vs an owner-occupied property. At the peak over 15% of all investment condos defaulted. Will the same happen in the current crisi?

Not only are people renting condos, but primary residences.

The Wall Street Journal wrote an article about how people can buy more house as a result of the additional income from renting rooms in their property. For example, someone might have bought a 250k house, but instead paid 50k more so that they could rent out the additional space for a profit. This seems like a logical assessment from a homebuyer, why wouldn’t a homeowner do this? It is human nature to focus on the positives, as opposed to the negatives. What happens as the market changes and that room is no longer renting out?

Do you really think that property owners saved their earnings!

This is highly unlikely. Look at the graph below from the federal reserve. The average American saves less than 2.5% of their income annually; this includes income from short term rentals. How will the mortgage get paid?

Why will this real estate cycle be worse for short term rentals?

With 60% of owners on HomeAway saying that around 75% of their mortgage is covered by short term rentals, what happens when the short-term rentals slow? Where are the additional funds coming from? With most short-term rentals bought with leverage, the mortgage, taxes, maintenance, HOA fees, etc… continue whether you are renting the unit or not.

Two items could derail the short-term rental market.

First, a pullback in consumer spending coupled with increased supply is the obvious risk. As disposable income decreases and debt service remains high, they will spend less on vacations including lodging. At the same time the supply of nightly rentals continues to increase further amplifying the supply/demand mismatch.

The second risk is regulation. Many cities are banning nightly rentals, substantially restricting them, and/or increasing the taxes. For example, the state of Colorado has proposed taxing nightly rentals throughout the state as commercial properties. This increases the taxes by around 400% and changes the economics of renting. The two risks above could be catastrophic for many short-term rental owners.

The extent of the impending problem is deeper than we think. The explosive growth in nightly rentals has led to an exposure to millions of property owners from a possible recession.

- Best case on Foreclosures: let’s assume 10% are foreclosed on similar to the hospitality industry. There are approximately 2.6 million nightly rentals in the US this would lead to 260k foreclosures, although this is not a big number it could be concentrated in various markets

- Worst case: With a 23% drop in income the impact could be substantially worse. As mentioned above 60% of nightly rental owners get 75% of their mortgage from rentals, if this number drops precipitously the defaults could be drastically worse to the tune of 500k, note that on 2022 foreclosures were averaging about 30k a month so this would be a substantial increase

Summary

We are in a new paradigm. Nightly rentals were just coming onto the scene after the last crisis. Now almost 3 million nightly rentals have propagated throughout the country. We know what happened to the hospitality sector after the last recession with 10% going out of business and substantially more restructuring. Furthermore, there was a 23% drop in revenue during the last recession.

Regardless of whether there is a recession or not, we are no doubt on the cusp of a huge change in the economy. Consumers have exhausted their pandemic savings while continuing their spending habits with debt. 2024 will be a reckoning for consumer spending and in turn nightly rentals.

With 60% of nightly rental owners paying 75% of their mortgage with their rental income, the risk to the hospitality sector is substantially higher. Furthermore as demand wanes due to consumer pullback supply continues at all time highs which will further exasperate the supply/demand mismatch. This leads to the question, are nightly rentals like the subprime crisis that was lurking right under our nose?

- https://www.airdna.co/blog/2023-us-mid-year-short-term-rental-outlook-report

- https://skift.com/2023/07/21/short-term-rental-saturation-leads-to-a-correction-and-lots-of-home-sales/

- https://coloradohardmoney.com/live-like-a-local-pay-hotel-property-taxes-on-nightly-rentals/

- https://www.wbir.com/article/news/local/sevier-county-airbnb-rentals-taxed-as-commerical-properties/51-8f75c52b-d070-467d-90db-6bd2825b2d6b

- https://www.attomdata.com/news/market-trends/foreclosures/attom-q1-2022-u-s-foreclosure-market-report/

- https://www.irishtimes.com/news/hotel-profits-down-25-in-2008-1.843698

- https://ipropertymanagement.com/research/airbnb-statistics

- https://www.alltherooms.com/analytics/airbnb-ipo-going-public-revenues-business-model-statistics/

- https://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1206&context=jhfm

- http://www.cpr.org/news/story/short-term-vacation-rentals-colorado-invention-are-under-gun-denver

- http://www.latimes.com/local/california/la-me-adv-mammoth-curtails-nightly-rentals-20151018-story.html

- https://www.denverpost.com/2015/02/20/mountain-towns-learn-to-love-and-regulate-short-term-rentals/

- https://www.stratosjets.com/blog/airbnb-statistics/

- http://www.corelogic.com/blog/authors/kristine-yao/2015/10/serious-delinquency-rate-of-condo-loans-drops-to-29-percent-in-top-10-markets.aspx

- https://www.washingtonian.com/2016/02/18/you-can-find-renters-to-pay-off-your-vacation-house-airbnb-vrbo-homeaway/

- https://www.wsj.com/articles/homeowners-tap-income-in-their-homesby-renting-out-space-1411333004

- https://fred.stlouisfed.org/series/PSAVERT

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender