The Tony Blair institute recently did a study in the UK regarding remote work and ultimately the impact on employment numbers. What did the UK study predict regarding employment? How will this impact the US labor force? What will be the impact on real estate be? Who will be the winners and losers in US real estate?

The “mass experiment” with remote working means that companies concerned about costs could decide to keep just core staff needed for in-person collaboration and decision making leading to huge job losses in certain areas. 18% of all jobs could be impacted by this trend.

How the remote work debate unfolds will have profound implications for real estate. For example, does a finance person need to be in pricey market like Denver or can they live in Detroit or anywhere in the world with connectivity and be paid accordingly?

What was in the data?

One in five jobs based in the U.K. could be outsourced to other countries in the wake of the coronavirus pandemic, threatening the loss of well-paid white-collar employment.

That is according to the Tony Blair Institute for Global Change, which warned that 5.9 million “anywhere” workers — from graphic designers to software programmers — are at risk, many of them in London and southeast England.

Today, almost one in five workers have an Anywhere Job whether as graphic designers, accountants, or software programmers.

In the past, it was typically blue-collar jobs in the manufacturing sector that were outsourced or offshored and skilled routine service jobs that became automated. Professional white-collar jobs had been sheltered from the pressures of globalization, however, until the mass experiment with remote work during the pandemic changed this.

Having put in place the digital infrastructure to make remote working possible, businesses, especially larger ones, are likely to persist with it even after the pandemic in order to reduce overheads, boost productivity and recruit talent from a wider geography. As a result, they may opt to employ only the core staff required for in-person collaboration and decision-making while outsourcing and offshoring those who are not. This could then make UK-based Anywhere Jobs vulnerable to being outsourced to on-demand, digital piecework platforms1 or being shifted abroad, just as routine manufacturing roles have been automated or offshored since the 1970s.2

Here is the full report: Tony Blair Institute Report

Paradigm shift in the US

I’m not as doomsday as the report above, but it is plausible to have a huge loss of jobs as companies migrate remote positions to lower cost markets within the United States and abroad. Below is how I think the remote work will shake out for the majority of companies.

- Most will go back to the office: I see most businesses back in the office in some form

- Majority will adopt a hybrid setup: Most companies will be office based with some work from home days

- Some will go to remote only: There will be some firms that go 100% remote, these are the firms where outsourcing to lower cost markets will likely occur

- Many jobs will get outsourced: Although I don’t think 18% will get outsourced as the study above highlights, there will be a considerable number of remote jobs that can be done elsewhere for substantially lower labor and overhead costs.

Profound impacts on real estate

- Less large corporate campuses: the trend of huge office campuses where the entire company gathers will be a relic of the past.

- Shift to smaller remote/regional offices: We saw this trend before the pandemic, but it has now been supercharged. Remote/regional offices will be the new norm

- Shift to less costly areas: 2nd tier cities will be the new superstar cities: The coastal migration to less costly smaller markets will continue over the next several years

- Shift from Urban to suburban: You will see this shift to more suburban/ smaller markets continue both on the office side and residential side as employees demand more space.

Summary

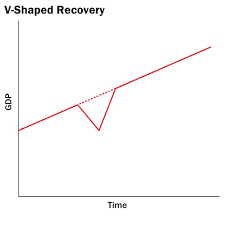

The remote work paradigm will go through a number of iterations over the next several years where companies will see what works for their business. How office work looks now might not be the same 3 years from now. Although it will take years for everything to normalize, we are already seeing profound implications on real estate with more to come.

Additional Reading/Resources

- Tony Blair Institute Report

- https://www.bloomberg.com/news/articles/2021-06-15/home-working-boom-risks-loss-of-6-million-u-k-professional-jobs

We are still Lending as we fund in Cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).