Investor Peter Boockvar, the chief investment officer at Bleakley Advisory Group, is sounding the alarm on a housing price bubble brought on by the Federal Reserve’s Covid pandemic policies which have stimulated so much demand that the supply side can’t keep up. What will trigger the next housing cycle? Who will be most hurt?

How is the Federal Reserve creating a “housing bubble”?

Boockvar, who went on inflation watch in mid-2020, has been critical of Fed policy through the pandemic. By maintaining unprecedented quantitative easing measures through the economic recovery, he notes the central bank created a spike in housing demand that has been overwhelming supply. The result is skyrocketing prices.

“The problem is it stimulated so much demand that the supply side couldn’t keep up — whether it was builders who couldn’t get materials or couldn’t find labor or couldn’t find enough lots,” said Boockvar, a CNBC contributor.

The federal reserve has continued to pledge aggressively low rates which in turn has made housing even more expensive. This trend looks to continue which creates considerably more risk of a bubble.

Another worrying sign; a large spike in rents

A federal reserve study done in 2004 confirmed a high correlation between rental rates and prices. (Here is more information on the report) Denver is a case study in rents. Median rents were $1,460 for a one-bedroom apartment in metro Denver and $1,780 for a two-bedroom unit last month, per the report.

After Colorado Springs, Castle Rock had the biggest gain in apartment rents since the start of the pandemic at 21.6%, followed by Parker at 20.5%, Thornton at 19.9%, Lone Tree at 19.1%, Littleton at 17.7% and Broomfield at 16.6%.

Furthermore, the second-quarter report, sponsored by the Colorado Division of Housing, surveyed local apartment owners and landlords whose properties totaled nearly 23,000 units in the Colorado Springs area. It showed the average monthly rent jumped to $1,429.58 in the second quarter in the Colorado Springs area, up $95.89 over the first quarter when rents averaged $1,333.69. Since the start of the year, rents have climbed by $163.66 and are $183.11 higher than in the second quarter of 2020.

To put those rent hikes into perspective, the average weekly wage for workers in metro Denver rose 4.3% annually in the first quarter of the year, according to the U.S. Bureau of Labor Statistics. The same trends are playing out throughout the country as rental rates spike in most major cities.

Essentially the study found that in rapidly appreciating markets, like we are seeing throughout Colorado, it takes some time for rents to catch up to values. Why do rents take time to increase? Many leases are at least a year which insulates the existing tenant from large increases. As the leases renew the increases begin to occur. This whole process could take years to filter through the rental market depending on the lease renewals and turnover of tenants.

We are just seeing the beginning of this trend as prices of real estate really started to take off about 18 months ago. The Federal reserve study confirms that there is an intrinsic relationship between rent growth and price growth of real estate. As rents make large jumps, prices will “correct”. This means that prices will best case stay constant, worst-case fall. Furthermore, the study found that prices were unlikely to continue the rapid appreciation as rents at some point cannot rise enough to justify the values. Long and short, the two scenarios are prices will stabilize or fall.

What will slow real estate prices down?

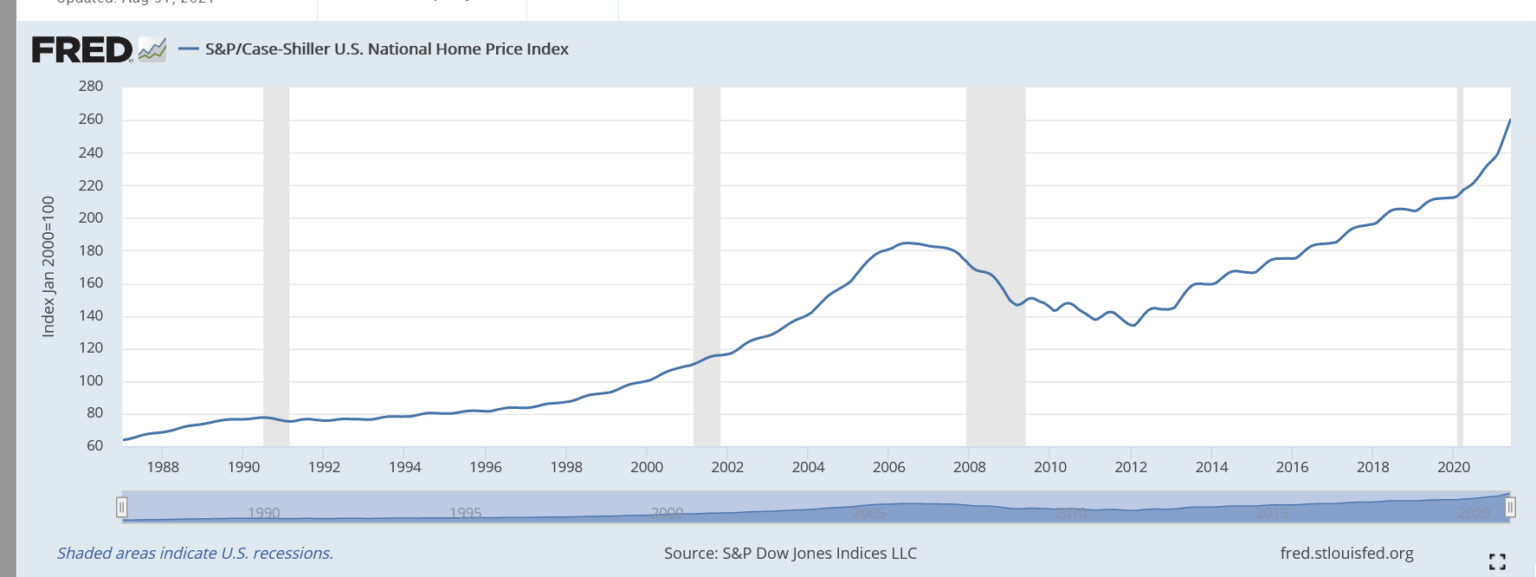

- Prices: Prices have risen substantially reaching their highest levels ever throughout the country (see the case schiller graph above). This is creating sticker shock for buyers as prices rise quickly and many are beginning to sit on the sidelines. The last two months pending homes sales have declined mainly due to the high prices.

- Higher interest rates: There is no direction for rates to go other than up. Actual inflation and inflation expectations are proving much more “sticky” than the federal reserve is suggesting. This will lead to higher rates to tame inflation. As rates go up payments on real estate and any other purchases bought with credit will increase substantially

- Wages not keeping up with appreciation: As we are seeing in Denver, wages rose about 4% last year, yet real estate appreciated closer to 16% in many markets. This mismatch between wages and housing costs cannot continue as the money must come from somewhere.

- Return to more normal work and school patterns: With each wave of the pandemic we have become as a country much more adept dealing with the economic fall out with considerably less shutdowns. These trends will continue, and businesses and their employees will adapt with much more normal work and school patterns. As these patterns normalize people will fall back into old habits of going back into the office a good portion of the time.

Will real estate prices fall?

As the federal reserve continues to put its foot on the gas and Congress contemplates 3 trillion dollars in additional spending risks are beginning to run high that there will be another correction. The easy monetary policy combined with continues government spending will continue to spur demand while supply will struggle to recover to meet the new demand due to labor shortages, material constraints, etc…

The real estate market is at an inflection point. Currently in the market I do not see a huge probability of a correction, but the direction of easy monetary policy and continued government spending increases the correction probability considerably in the future.

Who will be hurt the most?

Unfortunately, the people that will be hurt the most are the ones buying now (or recently) with low down payment loans. When there is a correction, it would likely be in the range of 5-15% which is mild compared to 2008. Unfortunately, if someone just bought a property with 5% down (or nothing down) they are immediately underwater. We saw in the last housing crisis that equity was the number one determination of default. As equity decreased or was eliminated or negative the strategic defaults also increased.

Summary

The federal reserve and congress are playing a dangerous game. The current policies are juicing demand while supply is unable to catch up. This is leading to drastic price increases not only on real estate but other items. As loose money supply and spending continues the risk for a correction will only grow louder as the federal reserve will likely have to act more aggressively on rates to control the huge price jumps.

The million-dollar question is what the correction looks like. Fortunately, this correction should be mild as billions of dollars has been raised by wall street firms that are ready to buy on any dip. This should put a floor under real estate prices and mitigate the downside potential. Unfortunately, with any cycle there will be winners and losers. The property owners with the least amount of equity will suffer the most. When a correction transpires is uncertain, but with the easy monetary policy and government spending the correction might be closer than anyone thinks.

Additional Reading/Resources

- https://www.reuters.com/business/finance/us-pending-home-sales-decline-july-2021-08-30/

- https://www.cnbc.com/2021/08/27/housing-price-bubble-will-wipe-out-wealth-peter-boockvar-warns.html?__source=sharebar|email&par=sharebar

- https://coloradohardmoney.com/rent-jumps-22-in-colorado-will-real-estate-values-correct-the-federal-reserve-thinks-so/

- https://fred.stlouisfed.org/series/CSUSHPINSA

We are still Lending as we fund in Cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).