ATTOM’s just released January 2022 U.S. Foreclosure Market Report shows there were a total of 23,204 U.S. properties with foreclosure filings reported in January 2022. That figure is up 29 percent from December 2021 and 139 percent from January 2021. Will we see a return to pre pandemic levels of foreclosures? When?

What was in the data on the increase in foreclosure filings?

According to ATTOM’s latest foreclosure activity analysis, lenders repossessed 4,784 U.S. properties through completed foreclosures (REOs) in January 2022. The report notes that number is up 57 percent from December 2021 and 235 percent from January 2021 – the 7th consecutive month with an annual increase in completed foreclosures and the highest level since the beginning of the COVID-19 pandemic.

The report also notes that states with at least 100 or more REOs that saw the greatest monthly increase in January 2022 included: Michigan (up 622 percent); Georgia (up 163 percent); Texas (up 98 percent); Tennessee (up 50 percent); and Alabama (up 44 percent).

Despite increased foreclosure activity last quarter, foreclosures are still far below historic numbers, according to Rick Sharga, executive vice president at RealtyTrac, an ATTOM company.

“September foreclosure actions were almost 70% lower than they were prior to the COVID-19 pandemic in September of 2019, and third quarter foreclosure activity was 60% lower than the same quarter that year,” he said in a press release. “Even with similar increases in foreclosures over the next few months, we’ll end the year significantly below what we’d see in a normal housing market.”

When will we see an increase in foreclosure filings?

Although, foreclosure filings have increased, they are still well below pandemic levels. What will cause foreclosure filings to increase further. Below are 4 factors that will increase filings

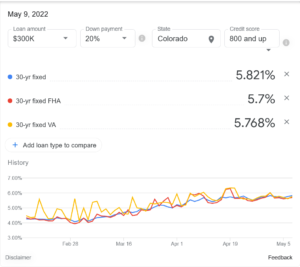

- Rise in interest rates above 6%: as interest rates rise above 6%, demand for new houses and in turn appreciation will slow. This could also lead to a 10-15% decline in prices once the economy corrects. Fannie Mae, the largest buyer of mortgage loans is predicting a recession in 2023. As prices slow/fall more houses will enter foreclosure as equity positions are eroded especially for new purchases with little equity.

- Correction in the stock market: A large decline in the stock market will lead to a decline in the “wealth effect” where people feel less wealthy and therefore purchase less items. This negative sentiment could flow into housing leading to slowing sales

- Continue migration back into the urban cores: There was a huge push into far out suburban/exurban areas that over the long haul will be risky as city life returns with businesses, entertainment, etc… this will cause a large decline in values in these areas

- Large jump in inflation: As the federal reserve raises interest rates, inflation should respond. Unfortunately, inflation has now become entrenched and might not respond quickly which would force the federal reserve into further tightening that would ultimately trigger an economic correction.

Will foreclosure filings reach pre pandemic levels?

I think foreclosures will fall back into prior patterns and reach pre-pandemic levels as stimulus wears off, the economy slows, and in turn real estate slows. We should see an indication of the depth of the foreclosures to come later in 2022 or early 2023 as we get a better view of the four items above.

Will foreclosure levels rise to similar highs as the last recession?

There is one major change between 2008 and now, Wall street. Since the last recession wall street has gotten in on the single family home market similar to what occurred years ago in the apartment market.

As prices of residential properties begin to fall/correct, there are huge funds waiting to buy investment single family homes. They would buy these homes in bulk from banks, the federal government, etc… which will ensure that prices do not fall precipitously as there will be substantial demand for these defaulted properties. The shear amount of available institutional capital waiting to invest in single family rental homes will put a “floor under prices” and ensure that this real estate cycle is not nearly as deep as 2008.

Summary

Just like the stock market, real estate is set for a bumpy ride over the next year or two. Foreclosure filings will continue to rise as moratoriums expire and the huge monetary stimulus is removed. Fortunately, this real estate market will not be a repeat of 2008 as there is substantial institutional/wall street money waiting to buy any small dip in real estate. This should put a floor under prices and lessen the downside risk in this cycle.

Additional Reading/Resources:

Foreclosure activity on the rise, yet still far below historic norms – Atlanta Agent Magazine

Highest Concentrations of Completed Foreclosures in Early 2022 | ATTOM (attomdata.com)

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender