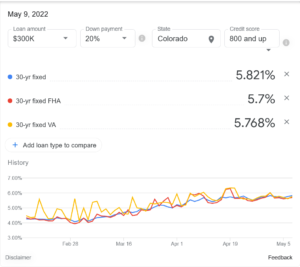

Where mortgage rates are heading seems to be the biggest question on everyone’s mind in real estate. As of this writing rates were around 5.821% which is substantially higher than any economists had predicted even a few months ago. What is causing the jump in mortgage rates? Where do mortgage rates go from here? How will high rates impact home prices?

How are mortgage rates “set”?

Remember the federal reserve does not “set” mortgage rates. First, it is important to note that the federal reserve does not directly control mortgage rates. The fed controls the “federal funds rate”. The federal funds rate is the rate at which banks and credit unions lend reserve balances to other banks and credit unions overnight. In a nutshell this is the rate banks get on the money they are holding in cash/reserves. Here is a more detailed explanation from Wikipedia .

So how are mortgage rates set? Unfortunately, mortgage rates are not “set”. There is no government or private party that can set rates per se. Mortgage rates are based on the 10-year treasury yield. So how does this work?

Before discussing rates, it is important to understand how bond yields work. The most important piece of this equation is the relationship between a bond price and its return. For treasuries, it is critical to note that a bond price and its yield move in inverse. What this means is that a higher bond price results in a lower yield and vice versa where a higher yield results in a lower bond price. For simplification purposes, I will not get into the full details of why bonds function the way that they do. Rest assured that it works this way and will always work this way.

With this key piece of information, we can now understand why mortgages do not move in direct correlation with the federal funds rate. This is now very apparent as the federal reserve has raised rate .75%, yet the 10-year treasury has gone well above 3%.

What is driving the current jump in mortgage rates?

Long and short, the “market” is not believing the federal reserve that inflation will fall anytime soon even with the recent inflation numbers coming in lower than last month (8.3% vs 8.5%). When you look at the recent CPI numbers, inflation is becoming more entrenched in wages, services, and rent which will be very difficult for the fed to bring down quickly without some huge increases in rates. Inflation is no longer being pinned on supply chain issues as it is considerably more widespread in the last CPI report and therefore will be drastically harder to reduce than what was originally thought by the federal reserve.

- Inflation expectations: Market expectations for inflation rates have reached their highest levels in a decade, driven by a large fiscal package, ultralow rates from the federal reserve, and pent up reopening demand. Consumers are expecting inflation to continue which then becomes a self-fulfilling prophecy as they “expect” higher prices and in turn accept them. This ultimately leads to higher future inflation.

- Actual inflation: It is no longer just a theory that inflation is not “transitory”. Inflation has been sticking around with huge jumps in labor costs, rent, food, gas, etc… Basically everything has increased in price. As of this writing, inflation was running at 8.3%, well over 400% higher than the federal reserve target. Unfortunately inflation is not going away on its own and has continued far longer than expected and will remain high due to “sticky” factors like rent and wages.

- Fear the fed is not telling the whole story and inflation is actually worse. The market is no longer buying that the federal reserve has a handle on inflation and expects that they will have to make large increases in interest rates to get inflation back under control. These future expectations that the federal reserve will have to hike faster and higher than anticipated is leading to higher future rates in the 10 year treasury market which in turn is driving up mortgage rates.

What are my predictions for mortgage rates?

As of the writing of this article, rates are around 5.8%. I don’t think the market is fully pricing in the increases the federal reserve will have to make to bring down inflation which means that rates will go up substantially higher. I see rates cresting 6% for a 30 year mortgage later this year and rising to 6.5%-7% by sometime next year. Rates could go higher than 7% in this cycle depending on how aggressive the fed needs to be to contain inflation.

After the recent CPI report, former Federal Reserve Bank of New York President Bill Dudley said

“I think it’s 4 to 5 (percent) or higher (federal funds rate),” Dudley said in an interview with Bloomberg Surveillance on Wednesday on how high the Fed should raise interest rates to cool price pressures. “I was 3 to 4 (percent) maybe six months ago. Now I’m 4 to 5 and it wouldn’t shock me if I’m 5 to 6 a few months from now,” said Dudley, who is a Bloomberg Opinion columnist and senior adviser to Bloomberg Economics.

If Dudley is correct, then mortgage rates would soar past 6% and be closer to 7 to 7.5%. I don’t think this is out of the question based on the last inflation reading that showed persistent broad based inflation which will force the federal reserve to hike even faster than they are today.

How will higher mortgage rates impact real estate prices?

As rates rise, there will be two primary impacts on residential real estate. Sales will slow and refinances will come to a screeching halt.

- Sales slow: as rates rise, real estate becomes relatively more expensive as payments increase. The increase in rates has already increased payments around 30%, if rate rise to 6%, then mortgage payments will increase 50% off the lows seen last year. This is on top of soaring prices. For example the average home in the US appreciated 20% last year, so on top of the 50% from higher rates, the real impact is a 70% increase in costs for buyers. Look for the residential market to slow down substantially very quickly as rates continue to rise.

- Refinancing basically stops: As mortgage rates rise, the number of homeowners that will benefit from a refinance will drastically drop. Refinancing activity has already declined 60% in the last month or so as rates have risen. Look for the refi spicket to basically turn off as rates trend higher.

What do higher mortgage rates mean for commercial real estate?

Commercial real estate is valued primarily through the income approach. As rates rise capitalization rates also rise. Recall that cap rates work in inverse like bonds so lower rates equal higher values. For example, a property might trade on a 3 cap, with the rise in treasury yields maybe it trades on a 4 cap as a higher return. Here is a quick example assuming that income stays constant:

| Net Operating income | Cap rate | Value |

| $ 50,000.00 | 3% | $ 1,666,666.67 |

| $ 50,000.00 | 4% | $ 1,250,000.00 |

| Change | $ 416,666.67 |

A 1% rise in cap rate will lead to over a 25% drop in value; think of an office building that has a loss of income and an increase in the cap rate; the value of that property has plummeted.

Summary:

The current real estate market was built on ultra low interest rates that led to abnormally high appreciation. Furthermore, values have become detached to underlying fundamentals like income. This has been exacerbated with the recent rise in rates along with soaring appreciation.

With rates rising faster than anticipated, reality is sinking in quickly for real estate. With rates set to crest 6% the residential market will hit the brakes. Commercial properties will not be left out as rising cap rates impact values. We are in for some “interesting” times in real estate as higher rates take the air out of the market. Fortunately, today, I don’t see a 2008 repeat, but the longer that appreciation outpaces income/affordability the increasing odds of a hard landing in real estate.

Additional reading/Resources:

- https://www.wsj.com/articles/the-mortgage-refi-boom-is-running-out-11652206979?mod=hp_lead_pos3

- https://www.bloomberg.com/news/articles/2022-05-11/dudley-says-fed-should-hike-to-5-or-higher-to-curb-inflation?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender