We are in a new paradigm for real estate. With talks of a recession getting louder, what does this mean for real estate. In 2008/9 real estate was radically different than today. Companies like VRBO and Airbnb were not even around. How will the next recession be different for real estate? How will nightly rental properties perform? What will happen if a recession comes to fruition?

What happens to the hospitality sector during a recession?

The negative impacts of economic recession on lodging firms have been

well documented. During the 1990-1991 recession, the hotel room occupancy in

the U.S. fell well below the breakeven point and eventually led to bankruptcy

filings of many hotel firms (Romeo, 1997). The 2001 recession that lasted for

eight months placed hardships on many of well-known U.S. lodging properties

including Wyndham International and Park Place Entertainment Corporation

(Hotel & Motel Management, 2001). The most recent recession that began in

December 2007 has affected many hospitality firms. According to Sharkey (2008),

even the upscale four- and five-star properties have suffered due to declining

corporate travel and rising cancellations. According to a recent report by Smith

Travel Research, both occupancy and room rates fell about 10% from the

previous year and many hotels no longer generate operating profits (Haughey,

2009). Property & Portfolio Research expects 13% drop in overall occupancy and

a 23% lower revenue per available room in 2010 (Haughey, 2009).

During the last recession approximately 10 percent of hotels opened in the last 5 years closed

What is the risk that is “hiding” in plain sight that nobody seems to be talking about?

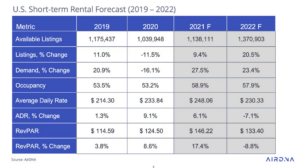

Short term vacation rentals like Vrbo, Airbnb, etc…. These short-term rentals are growing rapidly. Here are a few statistics about Airbnb. Also look at the chart below from Airbnb (source WSJ)

- There are 9 million hosts on Airbnb worldwide in 2022.

- 14,000 new hosts are joining the platform each month in 2022.

- There are over 7 million listings on Airbnb worldwide in 2022.

There are 100,000 cities with active Airbnb listings in 2022

Why rent short term vs. long term?

Basic economics! A short-term rental can gross three to 4 times the amount of a long-term rental property. Many property owners in resort communities have discovered the new economics of short term rentals and have jumped on the bandwagon as you can see above.

Why short-term rentals are riskier?

Short-term rentals are much more prone to economic shock from cycles than longer term rentals. If we look at the last recession (and prior recessions) the first thing cut back by consumers is vacations. We see that people will vacation locally as opposed to venturing to faraway places. Local visitors spend substantially less than destination spenders.

Also note the initial Covid shot was not an indication of what is to come as the government doled out billions of aid which ensured borrowers could make payments even without rentals. This scenario will not repeat in the upcoming cycle.

Short term rentals more prone to shock.

Short-term vacation rentals/nightly rentals are much more exposed to changing consumer spending. For example, if you have a long-term tenant, it is unlikely they will move out immediately from a recession. They still need a place to live. Vacation rentals are a different animal. As soon as there is a substantial recession, they will not book that vacation (or cancel their existing vacation). It is an easy and quick decision to save disposable income. Occupancy rates will fall in destination markets and this will quickly translate into loss of revenue to short term rentals.

Most short term rentals bought with leverage.

Here is an interesting statistic by Homeaway: “ Fifty-nine percent of subscribers get at least 75 percent of their mortgage covered by the rental stream.” For almost 60% of people that utilize short term rentals 75% of their mortgage is paid for by the rental income. What happens when the party stops? The last recession can give us some clues.

One of the largest sectors of nightly rentals are condos.

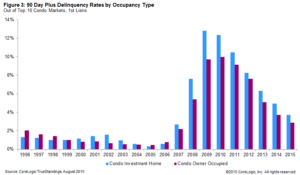

Condos are easy to rent and easy to maintain. But there is a downside. After the recent housing market crash, condominiums got a bad rap for having higher mortgage default rates, foreclosure rates and total losses. This is an interesting chart by Corelogic, which shows substantially higher default rates on “investment” vs. owner occupied (blue designates investment properties). This same correlation is likely true for any investment property vs an owner-occupied property. At the peak over 15% of all investment condos defaulted. Will the same happen in the current crisis?

Not only are people renting condos, but primary residences.

The Wall Street Journal wrote an article about how people can buy more house as a result of the additional income from renting rooms in their property. For example, someone might have bought a 250k house, but instead paid 50k more so that they could rent out the additional space for a profit. This seems like a logical assessment from a homebuyer, why wouldn’t a homeowner do this? It is human nature to focus on the positives, as opposed to the negatives. What happens as the market changes and that room is no longer renting out?

Do you really think that property owners saved their earnings!

This is highly unlikely. Look at the graph below from the federal reserve. The average American saves less than 2.5% of their income annually; this includes income from short term rentals. How will the mortgage get paid?

Why this crisis will be worse.

With 60% of owners on HomeAway saying that around 75% of their mortgage is covered by short term rentals, what happens when the short-term rentals slow? Where are the additional funds coming from? With most short-term rentals bought with leverage, the mortgage, taxes, maintenance, HOA fees, etc… continue whether you are renting the unit or not.

Two items could derail the short-term rental market.

First, a recession is the obvious risk. As disposable income decreases due to a recession, they will spend less on vacations including lodging. The second risk is regulation. Many cities are banning nightly rentals, substantially restricting them, and/or increasing the taxes. For example, numerous cities in Colorado have prohibited rentals in certain zones, others have increased taxes up to 21%, and some have capped the total number of nightly rentals allowed which will drastically change the economics of short term renting (Here are 6 recently passed laws on nightly rentals in Colorado). The two risks above could be catastrophic for many short-term rental owners.

The extent of the impending problem is deeper than we think.

The explosive growth in nightly rentals has led to an exposure to millions of property owners from a possible recession.

- Best case on Foreclosures: let’s assume 10% are foreclosed on similar to the hospitality industry. There are approximately 2.6 million nightly rentals in the US this would lead to 260k foreclosures, although this is not a big number it could be concentrated in various markets

- Worst case: With a 23% drop in income the impact could be substantially worse. As mentioned above 60% of nightly rental owners get 75% of their mortgage from rentals, if this number drops precipitously the defaults could be drastically worse to the tune of 500k, note that on 2022 foreclosures were averaging about 30k a month so this would be a substantial increase

Summary

We are in a new paradigm. Nightly rentals were just coming onto the scene after the last crisis. Now almost 3 million nightly rentals have propagated throughout the country. We know what happened to the hospitality sector after the last recession with 10% going out of business and substantially more restructuring. Furthermore, there was a 23% drop in revenue during the last recession.

With 60% of nightly rental owners paying 75% of their mortgage with their rental income, the risk to the hospitality sector is substantially higher in the next recession. This leads to the question, are nightly rentals like the subprime crisis that was lurking right under our nose?

Additional Reading/Resources

- https://www.attomdata.com/news/market-trends/foreclosures/attom-q1-2022-u-s-foreclosure-market-report/

- https://www.irishtimes.com/news/hotel-profits-down-25-in-2008-1.843698

- https://ipropertymanagement.com/research/airbnb-statistics

- https://www.alltherooms.com/analytics/airbnb-ipo-going-public-revenues-business-model-statistics/

- https://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1206&context=jhfm

- http://www.cpr.org/news/story/short-term-vacation-rentals-colorado-invention-are-under-gun-denver

- http://www.latimes.com/local/california/la-me-adv-mammoth-curtails-nightly-rentals-20151018-story.html

- https://www.denverpost.com/2015/02/20/mountain-towns-learn-to-love-and-regulate-short-term-rentals/

- https://www.stratosjets.com/blog/airbnb-statistics/

- http://www.corelogic.com/blog/authors/kristine-yao/2015/10/serious-delinquency-rate-of-condo-loans-drops-to-29-percent-in-top-10-markets.aspx

- https://www.washingtonian.com/2016/02/18/you-can-find-renters-to-pay-off-your-vacation-house-airbnb-vrbo-homeaway/

- https://www.wsj.com/articles/homeowners-tap-income-in-their-homesby-renting-out-space-1411333004

- https://fred.stlouisfed.org/series/PSAVERT

- https://coloradohardmoney.com/co-short-term-rental-elections-20-tax-rates-approved-what-are-the-results-and-what-does-this-mean-to-you-and-colorado-ski-real-estate/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender