According to everything I’ve read, the economy is humming along. Economic growth is good, the labor market is healthy, and a soft landing is all but inevitable. At the same time lenders are acting polar opposite of what we should expect. Why are lenders all the sudden tightening up on auto lending? What does this mean for real estate and the economy as a whole? What red flag did the fed highlight in auto lending data that could have major ramifications for real estate and the economy?

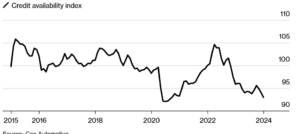

It is now 23% harder to get an auto loan than the historical 15 year average.

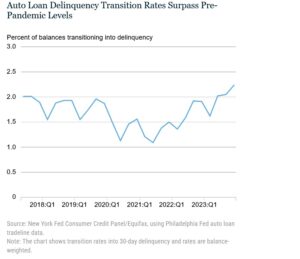

Access to auto credit is the lowest since August 2020, with the approval rate for loans down 1.6 percentage points year-over-year, according to Cox Automotive. At the same time, the percentage of US auto loans 90 days or more delinquent rose above pre-pandemic levels to 2.66% in the fourth quarter of 2023, according to data from the New York Federal Reserve. That compares to 2.37% at the beginning of 2020 and a 15-year average of 2.16%.

Why are Auto lenders pulling back when the economy is expanding?

Even though supposedly the economy is gumdrops and roses, auto delinquencies have now soared. Lenders are getting nervous and pulling back to try to reduce their future exposure. This is exactly the opposite response to what we should be seeing in an expanding economy.

“What people are struggling with is the level of inflation causing them to have to juggle expenses and try to stay current on their loans,” said Jonathan Smoke, chief economist for Cox Automotive. “It’s produced some very alarming statistics that indicate risk has grown in an environment in which lenders have become more risk adverse.”

From the federal reserve:

“Concentrating on auto loans, delinquency transition rates have pushed past pre-pandemic levels, and the worsening appears to be broad-based. Loans opened during 2022 and 2023 are, so far, performing worse than loans opened in earlier years.”

Big red flag in the auto delinquency data.

As shown above, the federal reserve has found conclusive evidence that loans originated during 2022 and 2023 are considerably more likely to default. The authors assumption is that “perhaps because buyers during these years faced higher car prices and may have been pressed to borrow more, and at higher interest rates.”

Unfortunately, just noting that prices were higher is not the reason for higher delinquencies. Something else profound happened in the last 3 years. During this time credit scores have been artificially inflated due to lack of student loan payments along with huge stimulus that have allowed borrowers to pay down their outstanding balances while the government provided “free money”.

What the federal reserve data really shows is that the economy is transitioning into old habits and the free money is going to lead to some bad outcomes like we are seeing with the huge jumps in auto delinquencies.

Car prices will start dropping

We are already seeing it in the used car market, but I suspect this will begin carrying over to the new car market as well over the next year as prices adjust due to increased delinquency. Furthermore, tighter lending will decrease demand as less will qualify for more expensive vehicles. This should put a further crimp into the economic expansion over the next year or so.

What does the auto market have to do with real estate?

Real estate is not immune to the forces impacting the auto industry. As auto defaults increase credit scores will no doubt take a hit which leads to fewer qualified buyers. On top of the increased defaults, interest rates are remaining high which will lead to a further pullback in demand.

Autos also raise an interesting question regarding inflated credit scores during the pandemic buying spree. I suspect that there were many borrowers that took out loans due to higher credit scores that are falling back into old habits. There likely will be a corresponding increase in foreclosures in the coming year or so. The good news is that anyone who bought early enough in the pandemic has reaped huge appreciation which should limit the downside somewhat in housing.

Considerable under currents in the economy

Autos highlight what I am seeing in the economy with considerable under currents that are acting opposite of what is expected in an expanding economy. The huge rise in auto delinquencies should serve as a warning that there is considerable downside risk in the economy regardless of the “soft landing” narrative. Furthermore, autos should also be watched as a possible leading indicator for real estate and problems that could be brewing beneath the surface.

I’m a big believer in discounting words vs. actions. It is clear that lenders are taking action by considerably tightening underwriting standards on autos which should be a cautionary tale for the economy.

Additional Reading/Resources:

- https://www.bloomberg.com/news/articles/2024-02-29/why-is-it-so-hard-to-get-a-car-loan-right-now-banks-tighten-standards?srnd=homepage-americas

- https://libertystreeteconomics.newyorkfed.org/2024/02/auto-loan-delinquency-revs-up-as-car-prices-stress-budgets/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender