In almost every real estate advertisement I receive, there is a common theme that prospective buyers should not focus on the rate as they will be able to refinance relatively soon at a much lower rate. How true is this theory? Are rates going to drop quickly like in past cycles? What can airlines tell us about future mortgage rates?

Why focus on airlines?

Anyone who has been to the airport knows that travel demand is off the hook. Bookings are up and it seems like nobody works anymore as they are all at the airport. Furthermore travel/leisure encompasses around 10% of annual family budgets and is up 4.7% from last year. With travel being a large spending category, it can serve as a proxy for the economy and future inflation and in turn real estate.

What happened with recent airline expenses?

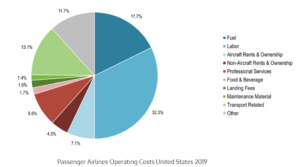

Labor encompasses approximately 33% of airlines expenses; this is the largest single category. Recently there have been huge raises for airline employees. United Airlines and the union representing its pilots said Saturday they reached agreement on a contract that will raise pilot pay by up to 40% over four years. The union valued the agreement at about $10 billion.

I did a quick calculation to see how this would flow through to ticket prices and ultimately the economy:

| 40% increase in labor costs | % change | ||

| Ticket price | 500 | 566 | 13% |

| Labor costs | 165 | 231 | 40% |

| Other costs | 335 | 335 | 0% |

Long and short, the huge jumps in employee compensation will flow through the economy in the form of higher spending by the employees and higher costs to travelers or lower profits to the airlines/shareholders.

Labor increases are not unique to airlines:

UPS just reached a new labor agreement which raises starting pay from 16.2 to 21/hour a 30% increase and grants existing workers 7.5/hour increase over the life of the contract. These expenses will also flow through with higher shipping costs for just about everything and shows how entrenched the large increases in pay have become throughout the economy.

What do airlines and UPS have to do with the economy?

Although the market rejoiced the last labor market report, when you dig beneath the surface, labor costs continue to rise which is going to make the federal reserve’s job increasingly difficult.

The federal reserve target for inflation is 2%, if wages are increasing by 7-10%/ year getting inflation to 2% is going to be considerably more difficult.

Rates will need to stay higher for longer.

Wage increases will hold inflation higher for longer than the market is anticipating. This means interest rates in turn will stay higher for longer. We are already seeing this as originally the market was penciling in cuts later this year, now predictions are that rates will stay high well through 2024.

Mortgage rates will stay higher than anticipated. As of this writing they were around 7.5% and expected to stay well north of 6.5% for the foreseeable future.

Marry the house/ date the rate

The assumption in this analysis to Marry the house and date the rate meaning that the house is a long term commitment, but you will be able to quickly refinance into a much lower rate is not holding true.

Based on fundamental changes in productivity, compensation, etc… rates are likely to stay considerably higher than anticipated and likely will never return to the 2.5-4% range for 5-10 years. We will see interest rates in the 5.5-8% range the next 7-10 years or so. I know this is a huge range, but the trend is what is important in that rates will be substantially higher than they were pre pandemic.

Summary

Unfortunately the marketing mantra to marry the house and date the rate is proving to be false. As a result of much higher labor compensation by Airlines, UPS, and countless others inflation will remain stubbornly above the federal reserve’s 2% target.

With inflation continuing to be stickier than the market anticipates treasuries and in turn mortgage rates will remain considerably higher for longer. I anticipate mortgage rates to stay north of 6.5% for the next two or three years which will give borrowers limited ability to refinance to save substantial money.

Furthermore I don’t foresee rates dropping to pandemic lows for quite a while if ever as this was a once in a lifetime event that caused the federal reserve to buy mortgages at the same time they pushed down long term rates.

Look for real estate volumes to stay low for some time as there is little incentive for people to move that have a low rate which should help stabilize prices even considering higher rates. The real question is will buyers ultimately be happy marrying both the house and the initial interest rate?

Additional Reading/Resources:

- https://transportgeography.org/contents/chapter5/air-transport/airline-operating-costs/

- https://apnews.com/article/united-airlines-pilots-pay-raise-d1cf2dcd38d0d267bf8cfd8c652c6750

- https://www.ustravel.org/research/monthly-travel-data-report

- https://www.wsj.com/articles/ups-teamsters-reach-agreement-on-new-contract-a134c910?mod=article_inline

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender