Nike is a bellwether for the retail industry and general economy generating over 40 billion in annual revenue making it one of the largest athletic retailers in the world. Since 2006 revenue has consistently increased every year. In June, Nike announced that sales fell 38% in the latest quarter. What does this mean for the general economy and real estate?

Why focus on Nike?

Nike is a very well-run company. Nike’s sales falling this quickly in one quarter is unprecedented as they are one of the best run companies in the country. They are very agile, have a great balance sheet with ample cash and low debt, have a large online presence, and some of the highest brand awareness in the world. If sales are this bad for Nike, it makes you wonder, how bad they are for other companies that aren’t as nimble and well run.

Nike is a good bellwether for the general economy. For example, most people own a pair or two of tennis shoes, shorts, t shirts, etc… With most people not going into the office, I would assume they are working in shorts, t shirts, tennis shoes, etc.. that are comfortable. Furthermore, Nike’s products are at a reasonable price point (I’m not talking about high end shoes, but in general). The vast majority of Americans can afford their products. Even during the last recession Nike’s sales did not go down much which makes the sales miss even more ominous.

Blip or start of a trend?

In one sense this is a blip to have this large of a fall in retail sales in one quarter is unprecedented and unlikely to be repeated. On the other hand, this drop in retail store sales is indicative of a bigger change coming down the pipe as companies adapt to the new paradigm. For example, Microsoft just announced it was closing all of its retail stores (72) to focus solely on online sales. Brick and Mortar retail is in for a rough ride that is just getting started. The downfall of brick and mortar will have profound repercussions not just on real estate, but also on the labor market and economy in general.

Accelerated transition to online

The pandemic pushed forward the transition from physical stores to e-commerce by years for every major retailer and many small businesses. This was a transition out of necessity to keep the lights on while physical stores were closed and even today many are operating at substantially reduced capacity. Unfortunately, the swift transformation to online is happening quickly for many companies but millions of workers will get lost in the move. There will be four major changes from this quick transition.

- More efficient: E-commerce is exponentially more efficient than a typical retail store (not including stores like Lowes with heavy, awkward, and inexpensive products like plants, lumber, concrete, etc…) as it cuts out considerable overhead from showrooms, storage costs, utilities and maintenance on the properties, labor costs, taxes, etc..

- Less jobs: Unfortunately, the efficiency from e-commerce comes with a substantial cost, lost jobs. In the last 15 years e-commerce has gained 178k jobs, yet department stores have lost 448k jobs This doesn’t account for the ancillary jobs lost from cleaning, maintenance, other businesses that rely on the traffic from the anchor tenant, etc…

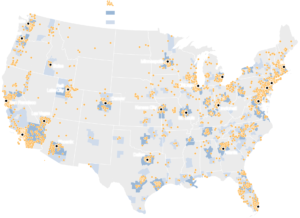

- Concentration of jobs in “tech hubs” with larger cities: As you can see from the picture, jobs are migrating to the top 20 cities and away from many of the smaller cities where unemployment rates are higher.

- Mismatch between locations and unemployment: Economists assume that markets are “efficient” but this couldn’t be any farther from the truth in the post pandemic area. Many of the areas with large available labor are not where the new jobs are being created. The people needed for the new jobs are in different locations. Unfortunately, people are not packages that can easily be moved.

Impact on real estate

Even though the pandemic will have large impacts on inner cities, the metro areas surrounding the top tier cities in general will excel. For example, there may be less demand in downtown Denver, but Westminster just north of Denver will boom with the Amazon distribution warehouse. You will see this play out in cities throughout the United States as ecommerce and distribution hubs continue to focus on the same places for labor talent, location, etc… The above picture is telling of where real estate will remain healthy compared to other places as the jobs are “clustering” around major cities

Summary:

Although the wheels for the change to e-commerce were set in motion long before the pandemic, the pandemic sped up the transition by many years. There is a misnomer that the new paradigm from work from home will spread the “riches” throughout the country. Unfortunately, this couldn’t be farther from the truth. Sure, there will be some smaller cities that gain knowledge workers, but the macro trends show a continued migration to the top 20 metro areas which will continue to outperform the nation.

Resources/Additional Reading

- https://www.nytimes.com/interactive/2017/07/06/business/ecommerce-retail-jobs.html

- https://www.9news.com/article/news/nation-world/microsoft-permanently-closing-all-its-retail-stores/507-5014510c-56a7-4e5a-82d4-d2ba07d93320

- https://www.macrotrends.net/stocks/charts/NKE/nike/revenue

- https://www.marketwatch.com/story/nike-fourth-quarter-sales-drop-nearly-40-2020-06-25

- https://www.businessoffashion.com/articles/news-analysis/nikes-sales-expected-to-drop-3-5-billion

- https://www.forbes.com/sites/shelleykohan/2020/06/25/nike-sales-drop-38-but-leadership-is-not-concerned/#617dd1da2a37

- http://investors.nikeinc.com/investors/news-events-and-reports/?toggle=earnings

We are still Lending as we fund in Cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).