As US superstar top 20 real estate investment cities thrive, the weaker ones get left behind. In many ways the country has seemingly recovered from a 2007-2009 recession that was the worst downturn since the 1930s. But a Reuters analysis of federal data shows just how unevenly the spoils of growth have been divided. Some cities have thrived while others continue to languish. What is causing the huge change in fortunes among cities? Why is this so important for real estate?

What does the data say?

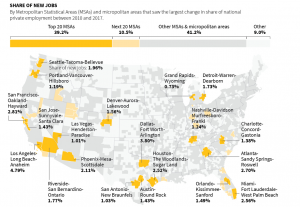

In a ranking of 378 metropolitan areas by how their share of national employment changed from 2010 to 2017, 40% of the new jobs generated during that time went to the top 20 places, along with a similar share of the additional wages. Those cities represent only about a quarter of the country’s population and are concentrated in the fast-growing southern and coastal states. None were in the northeast, and only two were in the “rust belt” interior – Grand Rapids, Michigan, and a rebounding Detroit.

The drop from there is steep. The next set of 20 cities captured about 10% of the jobs created from 2010 through 2017, close to their roughly 7.5% share of the population. At the bottom, 251 cities, many spread across the heartland and in the industrial northeast, lost job share.

In the top 20 are cities like Denver, Atlanta, Nashville, Seattle, Portland (see map above)

What 3 traits do the superstar cities have in common?

Atlanta Federal Reserve Bank president Raphael Bostic stated ““Every city has its unique narrative as to why it got to where it got,” Bostic said. “I don’t think there is a general formula that if you hit each point at a certain level you guarantee an outcome.” Although there is no magic formula to recreate the success of the top 20 cities, they each have three common denominators

- Well educated workforce: the top 20 cities have a higher concentration of well educated knowledge workers

- Concentration of companies in a particular industry: Companies, like people seem to gravitate to certain cities. For example in Denver there is a large outdoor industry with the North Face and countless other outdoor oriented companies. Atlanta on the other hand has become world renowned for its cutting edge medical. The top 20 cities each have many industries that are

- Younger workforce attracted to the area: The same top 20 cities are also a magnet for younger well-educated workers. Bloomberg did an analysis of the top destinations for millennials, each of these cities is also on the top 20 list from Reuters.

As the Atlanta Fed Chairman observed, it is difficult to come up with a way to recreate the success of the top twenty cities but the top 20 cities should continue to thrive as the three items above continue the feedback cycle attracting more companies and more young well educated workers.

What does this mean for real estate?

The implications on real estate are profound. As people, companies, and ultimately money continue to flow to the top twenty cities, these areas will be the leaders in real estate. This is especially important today. We are currently at an interesting point in the market. Many have mentioned that we are at or very near a peak in this real estate cycle. Buying now is considerably riskier than earlier in the cycle so it is critical that you are investing in places that can weather the impending storm.

Summary

In the last real estate cycle, we saw for the most part that the top twenty cities declined less and came back quicker and stronger than other areas. This was due to a strong employment base and well educated in demand workers. Don’t get me wrong, some cities in the top 20 will do considerably better than others in the next downturn, but overall the top 20 cities should outperform other areas when the market cycles again. These same top twenty cities will continue to thrive into the future and are long term good real estate investments.

Resources/Additional reading

- https://www.wsj.com/articles/where-you-should-move-to-make-the-most-money-americas-superstar-cities-11544850010

- https://www.bloomberg.com/news/articles/2019-07-19/millennials-moving-west-portland-seattle

- https://www.reuters.com/article/us-usa-economy-nashville-insight/as-superstar-cities-thrive-poorer-ones-get-left-behind-idUSKCN1UE13B

- https://www.nytimes.com/2018/11/07/upshot/in-superstar-cities-the-rich-get-richer-and-they-get-amazon.html

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).