As of the writing of this article, President’s Biden’s plan is to forgive 10k in student loan per each borrower and further extend the payment pause until year end. How will this forgiveness impact real estate prices, mortgage rates, and prospective purchasers? What are democratic economists saying on the forgiveness plan?

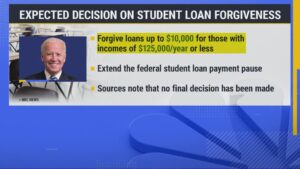

What was in Biden’s student loan forgiveness plan?

- 10k forgiveness per each borrower

- Up to 20k for Pell Grant recipients

- Income caps of 125k for single or 250k married couples filing jointly

- Delay in student loan payments until December 31

- Cap repayments at 5% of income for undergraduate loans

How many people will student loan forgiveness impact?

According to the May 2021 census data around 12.9% of the population has student loans with an average balance of around 60k. This equates to about 43.4 million people. With the threshold at 125k (250 for couples), the overwhelming majority with student debt will get a 10k reduction.

How will loan forgiveness impact prospective borrowers?

If you are a borrower with student debt, the elimination of 10k in debt could help the debt to income ratio, but I don’t think 10k is going to move the needle one way or the other. I don’t foresee the forgiveness of 10k in debt will all of the sudden open up a new pool of buyers. Furthermore, any help from forgiveness has been zeroed out by the swift rise in mortgage rates that have almost doubled payments in the last 6 months.

How will student loan forgiveness impact mortgage rates?

The cost of forgiveness according to the budget office is around 230 billion, but the basic math gives a different number. Assume 43.4 million borrowers, each one gets 10k, with income cuttoffs of 250k for married couples basically all the borrowers would get relief which adds up to 434 billion. According to a Washington Post article 97% of all borrowers fall below those thresholds.

- Inflation/consumer spending: Regardless of your political position on student loans, I hope everyone agrees that we have an inflation problem. Putting an addition 434 billion of liquidity into the economy will further increase the spending power of millions of borrowers that will ultimately put even more upward pressure on inflation. As inflation continues, the federal reserve will need to continue its aggressive rate tightening which will lead to higher mortgage rates. Furthermore former Democratic Treasury Secretary Larry Summers has cautioned that it would fuel price growth and said the “worst idea” would be to extend a pause on payments. Furthermore, the Committee for a Responsible Federal Budget, a D.C.-based think tank that opposes loan forgiveness, has found that wiping out $10,000 of debt per borrower would increase core inflation by 0.2 percentage points and wipe out most of the deficit reduction achieved in the first decade of the Inflation Reduction Act, according to Marc Goldwein, the organization’s senior vice president and senior policy director. The federal reserve will have to work harder to decrease reduction by increasing rates.

- National Deficit: Waiving 10k for each borrower who has student loans will add about 2% to the national deficit. At the same time the deficit increases, higher rates will make servicing the deficit even more expensive. Remember to increase the deficit, the treasury must sell treasury bonds. As the number of treasury bonds for sale increases, the price falls (yields and prices work in inverse). As bond prices fall, this in turn will increase the rates on 10 year treasuries and ultimately mortgage rates. Most interest rates are pegged to treasuries from car loans, credit card payments, lines of credit, etc…. all of these items will go up substantially as the deficit increases and treasury yields soar. However you slice and dice the student loan forgiveness, treasury rates will increase and in turn mortgage rates have only one direction to go, up.

What impact will student loan forgiveness have on real estate prices?

As mortgage rates continue to increase, the number of prospective buyers decrease as mortgage payments also increase. The further increase in rates will slow future appreciation and at some point, could drive depreciation in some markets as salaries cannot keep pace with rising rates. Furthermore, any benefit to borrowers with a lower debt to income ratio from the forgiveness is greatly overwhelmed by increases in mortgage rates.

Summary

However you look at loan forgiveness, there will be costs borne by everyone. Unfortunately, there is no money tree to pay for this. For real estate, additional deficit spending and increased consumer spending will make interest rates increase on both treasuries and in turn mortgage rates and every other consumer rate from credit cards to car loans. This in turn will make mortgage payments increase and house prices continue to decrease. Forgiving loans is a new social experiment that will not work out as planned as inflation roars and rates climb, we will all bear the costs.

Additional Reading/Resources:

- https://www.brookings.edu/policy2020/votervital/who-owes-all-that-student-debt-and-whod-benefit-if-it-were-forgiven/

- https://www.bloomberg.com/news/articles/2022-08-23/biden-plans-wednesday-student-loan-debt-relief-announcement?srnd=premium

- https://www.nerdwallet.com/article/loans/student-loans/student-loan-debt

- https://www.washingtonpost.com/us-policy/2022/05/27/biden-student-debt-borrower/

- https://www.wsj.com/articles/white-house-planning-student-loan-announcement-wednesday-11661269442?mod=hp_lead_pos13

- https://www.bloomberg.com/news/articles/2022-08-24/biden-set-to-freeze-student-loan-repayments-for-four-more-months?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender