It has been quite the year for the stock market. As I am writing this blog, the market has already plunged 10% to kick off the year. Morgan Stanley just warned that stocks are more overvalued than the tech bubble. How will this impact real estate? What happened when the tech bubble burst? Is the 2007 housing bust a better metric for real estate than the tech bubble?

Why is the stock market falling?

It seems like overnight the stock market went from a darling to a dud as investors started running for the exits. The sentiment really began to shift as inflation numbers continued to run higher throughout last year and are forecasted to stay high throughout 2022. This has forced the federal reserve to radically change its tune and wake up to the idea that interest rates will need to rise and rise faster than the market anticipated.

The accommodative monetary and fiscal policies of the US government have “flooded” the market with liquidity over the last several years. Much of this liquidity flowed into the stock market with many speculative investments. For example, there was a craze for certain stocks, like gamestop, that had no fundamental reasoning. Last year the average return was 29% compared to the long term average of 7%. In a nutshell the market got ahead of itself and the recent rises in rates are prodding investors to give a higher “risk premium” to once high flying companies.

This recent sell off especially in the Nasdaq which is heavily tech weighted is bringing back memories of the tech bubble in the early 2000’s. Morgan Stanley came out with a client note that stocks are now more overvalued than during the tech bubble. Bloomberg came out with a similar article: “Unrelenting plunges in the Nasdaq ring a dot com bust alarm bell”.

How does today compare to the tech bubble?

The Fed mistakenly created too much money in the fall of 1999 in order to fend off the expected deflationary impact of the Y2K bug—effectively pouring gasoline on a smoldering fire in the stock markets—and banks and brokerage houses used some of the excess liquidity to fund the share price bubble. In the fourth quarter of 1999, the Fed expanded the money supply at an annual rate of 22% (9.6% after seasonal adjustment). In comparison, the rate of growth of the money supply in the fourth quarter of 2000 was 9.2% (–2.8% after seasonal adjustment).

The setup is eerily similar today as the federal reserve has continued a loose monetary policy a bit longer than they should of and now they are behind the curve as inflation is running substantially higher.

Fed Chairman Alan Greenspan, seeing the flood of money into risky start-ups, pricked the dot-com balloon with monetary tightening in the spring of 2000. This tightening ultimately was the impetus for the dot com bust.

If 2022 is like the tech bubble, what does this mean for the economy?

With many major industry participants making a correlation between the tech bubble and now, what does this mean for real estate prices. 538, a statistical analysis company owned by Walt Disney/ABC, did an interesting look back at the tech bubble and the correlation to real estate prices. Here are some of their key findings:

In 2000, the dotcom bubble destroyed 6.2 trillion in wealth, 7 years later the housing bubble destroyed 6 trillion in wealth but the outcomes for the economy were drastically different. The housing bubble led to the worst recession since the great depression. Why the difference in outcomes when both caused approximately the same loss in household wealth?

What explains these different outcomes? In the forthcoming book, “House of Debt,” we argue that it was the distribution of losses that made the housing crash so much more severe than the dot-com crash. The sharp decline in home prices starting in 2007 concentrated losses on people with the least capacity to bear them, disproportionately affecting poor homeowners who then stopped spending. What about the tech crash? In 2001, stocks were held almost exclusively by the rich. The tech crash concentrated losses on the rich, but the rich had almost no debt and didn’t need to cut back their spending.

What happened to real estate prices during/after the dot com bust?

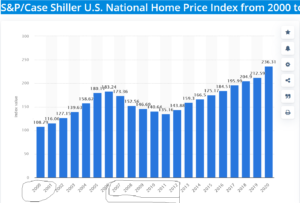

As we can see from the chart above prices of real estate continued an upward trajectory even during the mild recession that occurred because of the dot com bubble bursting. Housing prices didn’t decline until the 2007/08 housing market bust.

Will real estate perform like the dotcom bust with prices continuing to increase?

History is a good guide for the future, but there are always some twists. As you look at the chart, housing is racking up some unprecedented gains since the housing bubble burst in 2014 which makes it a bit riskier than the dotcom bust. Here are a few differences to keep in mind.

- Inflation is the impetus for rate hikes in 2022 not a bubble that needed popping in 2000

- Housing appreciation is at historically high levels relative to any historic metric

Will we repeat the 2007 housing bust?

I don’t think we will repeat 2007. The housing bust was led by a subprime bonanza with considerable spec building and way to much free money to borrowers that could not afford the payments. Underwriting is considerably tighter today along with low inventory which should help us avoid the meltdown like we say in 2007. On the flip side, there are some correlations, there is considerable buying of non-primary residences for rentals. Furthermore, in my personal call volume, I’ve seen a noticeable uptick in investors trying to fix and flip that have little to no experience. Both of these items occurred before the 2007 housing bust

Neither 2000 nor 2007 will fully explain our current 2022 market correction.

Unfortunately the answer will not be clear cut that we will follow either the housing bust of 2007 or the dot com recession of 2000. This correction will land somewhere in between as inflation and the feds reaction to it are the drivers or this next cycle.

As inflation continues to run hot, the fed will be forced to raise rates even higher than the market anticipates in order to slow demand and bring inflation back down. Unfortunately, the fed has wasted time fighting inflation and is late to the party. The correction in the stock market is foreshadowing a much steeper rate climb to tame inflation.

As interest climb, housing will continue to become more expensive. Add the additional payments due to higher rates on top of lofty house prices, affordability is now a huge issue for prospective buyers. As rates continue to rise, this will force house prices to moderate/decline slightly.

Based on the information I have today, in this next cycle (whenever it technically begins), I predict that prices will fall around 10-15% on average through most markets. Although this seems like a big number, remember places like Denver were up over 20% just last year so to give back half of that is not outlandish.

Summary:

Since 200 and 2007 are not perfect roadmaps, real estate will likely follow a hybrid of the two. With the stock market anticipating a bumpy economic road ahead, the housing market will have some impacts as well. Interest rates will rise faster than in 2000 which will lead to a minor housing correction that will give back the gains over the last year or so. I hate to be the bearer of bad news, but we are past the peak in real estate in the current cycle with the best case a flatter market, likely scenario a small decline in the range of 10-15%.

Additional resources/reading:

See below for a list of articles/information I referenced when writing this blog, there are some great resources.

- Morgan Stanley Warns Stocks Are More Overvalued Than Tech Bubble (businessinsider.com)

- Why the Housing Bubble Tanked the Economy And the Tech Bubble Didn’t | FiveThirtyEight

- https://www.bloombergquint.com/markets/unrelenting-plunges-in-the-nasdaq-ring-a-dot-com-bust-alarm-bell

- Nasdaq’s unrelenting declines ring a dot-com bust alarm bell | Fortune

- No one seems worried about a housing bubble. Just like last time the bubble burst – CNN

- S. Case Shiller National Home Price Index 2020 | Statista

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).