I always cringe when I see a press release that “regulators” have a solution! FHA has yet another new proposal that sounds great on the surface, but as typical misses some very important items that will cost taxpayers millions or considerably more as government accounting is a bit of a mystery. What is in the new proposal by FHA and will this resolve delinquent loans or merely pass the buck to taxpayers?

Why is the FHA getting involved in monumental changes to the mortgage market?

Rising interest rates are putting up new roadblocks for people struggling to pay their mortgages. Housing officials are working on a fix. The officials are trying to address a problem that is unique to this economy. The Federal Reserve is lifting interest rates and vowing to keep them elevated to combat inflation, last year pushing mortgage rates to their highest level in more than two decades. At the same time, the economy is showing signs of strain, and more Americans are running into financial trouble.

Historically, homeowner distress has risen when the U.S. is heading into a recession and the Fed is cutting interest rates to stimulate the economy. Struggling borrowers can then take advantage of falling rates to reduce their monthly mortgage payments. In this cycle as inflation continues its torrid pace rates will remain higher for much longer even if the economy softens.

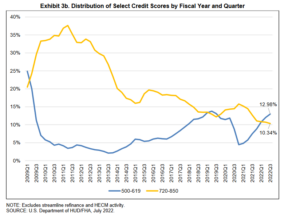

Also note, at the same time FHA is making this new proposal credit scores continue to drop further increasing the risk of defaults as noted in the chart above.

What is in the new FHA proposal?

The Federal Housing Administration proposed a plan on Wednesday for mortgage borrowers who are behind on payments to get back on track by temporarily reducing their monthly bills. As part of it, borrowers would avoid giving up their super-low mortgage rates.

The FHA would essentially pay part of the homeowner’s monthly bill, using its insurance fund, then structure the repayment as a second loan due after the first is paid off, officials said. It would be available to people who otherwise wouldn’t benefit from a traditional modification that involves giving up their low rate for a higher one.

This proposal essentially would create a negative amortizing loan meaning that the principle could continue growing via a second mortgage. Here is an example:

If a homeowner has an $800 monthly principal and interest payment, the supplement from FHA might cover $200 so the homeowner only pays $600. The mortgage company would pay the $200 to the investor that owns the loan and then get reimbursed by FHA. This 200 is essentially the principle part of the mortgage that would be added as a second mortgage behind the first mortgage. The homeowner would then theoretically make up the payments at the end of the loan term.

Three glaring problems with the proposal:

I’m always amazed at the proposals coming out of the government. There are three amateur mistakes that will cost taxpayers a lot.

- Negative amortization: The proposal as I interpret it would basically be negative amortizing and homeowners would be underwater immediately. Remember for most FHA loans, borrowers put down 10% or less as a downpayment. With principle being added each month due to the “modification” borrowers are underwater owing more on their house than it is worth.

- Probability of default still elevated: The root cause of the issue where the borrower could not make the full payment has not been addressed so the risk of default has not been reduced. Unfortunately the opposite has occurred as the number one indicator of default is equity. As many borrowers now owe more than the house is worth, the risk of defaults climbs substantially.

- Second Mortgage: FHA, like many other types of mortgages, are packaged and sold on the secondary market to investors. Under this proposal the first mortgage is preserved which means when there is a default the government is out of luck in the second position. In a foreclosure the second mortgage is wiped out (unless they repurchase the first which wouldn’t make sense as the house is worth less than the two mortgages combined). So, the government and in turn taxpayers are on the hook for huge losses

Summary:

I understand in theory what the new FHA rule is trying to do, but this solution will cost taxpayers considerable money and not resolve the issue of defaults. The proposal makes three amateur mistakes by making the loan negative amortizing, increasing default risk, and placing a second mortgage on the property. Unfortunately, this new proposal will make matters considerably worse and do very little for struggling homeowners while passing on huge costs to taxpayers.

Additional Reading/Resources

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, homeowners