The National Association of Realtors came out with their 2019 forecast saying: “the economy is “good.” And noted that we have low unemployment, record high job openings, historically low jobless claims, job additions for eight straight years and wages beginning to increase. This type of activity in the economy should support the housing market, even as interest rates rise, said Yun.” He went on to predict that home sales would stabilize, and price growth would continue. Unfortunately, one number is painting a radically different picture and one chart from the University of Michigan is showing a radically different outcome.

The surveys have long stressed the important influence of consumer spending and saving decisions in determining the course of the national economy. The Surveys of Consumers are conducted by the Survey Research Center at the University of Michigan founded in 1946

The Index of Consumer Expectations focuses on three areas: how consumers view prospects for their own financial situation, how they view prospects for the general economy over the near term, and their view of prospects for the economy over the long term. The Expectations Index represents only a small part of the entire survey data that is collected on a regular basis.

Each monthly survey contains approximately 50 core questions, each of which tracks a different aspect of consumer attitudes and expectations. The samples for the Surveys of Consumers are statistically designed to be representative of all American households, excluding those in Alaska and Hawaii. Each month, a minimum of 500 interviews are conducted by telephone from the Ann Arbor facility

What was the recent consumer sentiment reading?

Consumer sentiment just fell to a two year low in a recent report. The University of Michigan said its consumer sentiment index fell 7.7 percent to a reading of 90.7 this month, the lowest reading since October 2016 and the steepest drop since September 2015. Economists had forecast a reading of a 97.0.

Why is this metric so important?

Consumer sentiment measures not only how consumers feel today but their perceptions on the future.

Purchases of homes, vehicles, and household durables, as well as the incurrence of debt and acquisition of financial assets, are important economic decisions for individual families, but in the aggregate, the timing of these decisions influences the course of the entire economy.

These large and infrequent spending and saving decisions are often associated with planning and deliberation on the part of consumers, rather than with impulse or habit. Moreover, these decisions are not based solely on consumers’ current economic situation, but also depend on their expectations about household income, employment, prices, and interest rates. (University of Michigan)

Chris Rupkey, chief economist at MUFG in New York put it succinctly “This report on consumer sentiment is the first concrete evidence that the economy is going to fall and fall hard “.

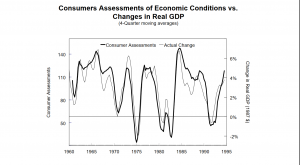

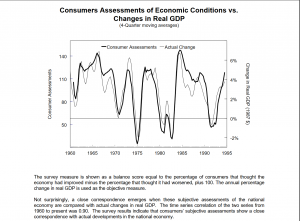

Looking at this chart (below) from the University of Michigan, Consumers are very accurate at predicting larger macros changes to the economy. This chart shows a direct correlation that as consumers hiccup so does the greater economy.

What causes consumer sentiment to change?

Consumer sentiment is kind of like the common cold, you have some theories as to how you got the cold but not really sure exactly, was it the airplane ride, or one of your kids, or your spouse???? Nobody really knows what caused the cold, but you definitely know when you get the cold as you feel it instantly. It seems like consumer sentiment got the cold! Was it the stock market, international woes, dysfunction in Washington or a myriad of other factors?

Consumer sentiment is the primary metric to watch in real estate

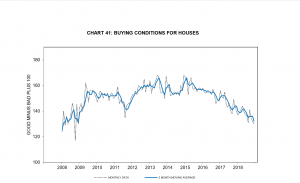

Consumer sentiment is a “soft number” based on people’s perception of how they feel about the financial situation today and into the future. How people feel is the primary driver of whether they make large financial commitments like a house purchase. If consumers are nervous, they are unlikely going to make the plunge on the large purchase. All the other economic indicators seem to play into how consumers perceive the economy. Look at the chart below, consumer sentiment for homebuying has been trending downward along with purchases.

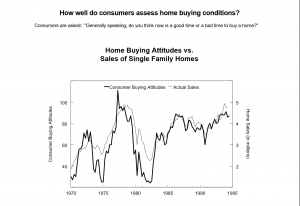

I was a bit skeptical that consumers were accurate in predicting sales, this chart below should put the skepticism to rest. The chart below shows consumers perception of homebuying conditions has a direct correlation to actual sales. Guess what happened in December, home sales dropped 6.4% to their lowest level since 2015. Consumer sentiment once again hit the mark and accurately predicted a slowdown.

The recent drop in consumer sentiment could be a blip or a much larger indicator of the economy. The shear size of the drop, almost 8 percent, points to an erosion in how consumers “feel” about the future. This will no doubt lead to a drop in real estate purchase activity as we are already seeing this in many markets.

This leads to the next question, how deep is the “cold” that consumer sentiment caught? Unfortunately, nobody really knows how severe this “cold” is. Is this the case where you drink some orange juice and are fine the next day and consumer sentiment will quickly rebound or is this a bit deeper like a case of strep throat or pneumonia? The deepness of the cold will provide a roadmap for real estate in 2019.

If you look at the trend line for the graph above (chart 41), the prediction for real estate doesn’t look good. Based on historical trends two things will occur, either the market will continue to trend down, or it will best case level off. Neither answer would be great for real estate. We’ll have to wait for future numbers to see how “sick” the consumer actually is and which way the market goes.

Additional Reading/Resources

- http://www.sca.isr.umich.edu/

- https://data.sca.isr.umich.edu/fetchdoc.php?docid=24774

- https://www.reuters.com/article/us-usa-economy/u-s-consumer-sentiment-at-two-year-low-manufacturing-rebounds-idUSKCN1PC1NT

- https://www.wsj.com/articles/u-s-existing-home-sales-posted-steep-fall-in-december-11548169461

I need your help!

Don’t worry, I’m not asking you to wire money to your long lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)