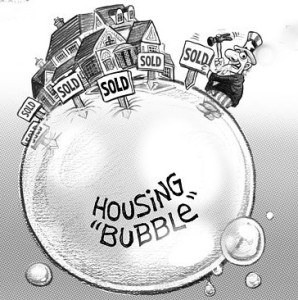

As I look around the real estate market, you cannot help but notice the craziness. On my personal house in Colorado, my value is up around 50% in two years. These same trends are unfolding throughout the country, with appreciation hitting records. Is the real estate market hitting a bubble? Will there be a crash on the other side? What should you do now?

Is there a real estate bubble?

There is considerable “excitement” in the market that makes me extremely nervous. There is no justification for the huge price increases throughout the country. From a logic standpoint there was a flight out of large cities into smaller metro markets. One would expect the smaller markets to appreciate due to the increased demand from new transplants, while at the same time larger markets would decline as population left those areas.

What I would expect is not happening. In markets like Denver, the median home price is up 25% year over year. At the same time, markets like San Francisco are also up 9%. This begs the question why is real estate throughout the country up double digits in most places? This is much more than the covid migration.

Rock bottom interest rates are the driver of the appreciation. With rates at or below 3% your buying power is considerably greater. Unfortunately, the low interest rates will soon be a distant memory as government spending continues to increase which will “juice” the economy more and the tight supply chains that are causing prices to increase.

I am not prepared to say that we have a bubble as this implies that the market will “pop”. Fortunately, I do not think we will have a huge fall like we did in 2008, but we are at the peak in values. We could be looking at a 10-20% downward reset in values. In 08 we saw values drop by 30% plus in many markets, but I do not foresee that happening today as inventory is much more constrained and underwriting by most lenders much more robust.

What should you do now?

If you ever had a desire to sell, now is the best time we have seen in the last 15-20 years in many locations. On the purchase side we are near/ at a peak with values getting ludicrous in many markets. Now would be the time to be patient if you do not have to buy. A more rational market is not far off.

Summary

Although I do not see a bubble right now, there is considerable risk of one forming over the next year. The current appreciation is unsustainable as incomes are not keeping pace with the appreciation. If interest rates continue to stay at historic lows and the craziness of the market continues, we could be setting ourselves up for a much larger fall. The federal reserve published a report noting that “Asset prices may be vulnerable to significant declines should risk appetite fall,” it would be wise to head this advice. I would love to hear your take on the bubble prospects in the comments below.

Additional reading/ resources

- https://coloradohardmoney.com/is-denver-real-estate-overvalued-is-there-a-crash-coming/

- https://www.bayareamarketreports.com/trend/san-francisco-home-prices-market-trends-news

- https://www.cnbc.com/2021/05/06/fed-warns-of-possible-significant-declines-in-stocks-as-valuations-climb.html

We are still Lending as we fund in Cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).