What do the increased conforming loan limits mean for real estate?

The federal government (aka you the taxpayer) now backs mortgages up to 1.15m. The maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac has jumped sharply over the last several years, a reflection of the rapid appreciation in home prices nationally. How will this impact the real estate market? Who pays for these changes? Hint: you will!

How do Mortgages work?

Before going into the change from Fannie Mae, it is important to understand how the mortgage market works. The United States mortgage market is unique. For the vast majority of mortgages, Banks, brokers, or other lenders originate loans and immediately sell the note to either Fannie Mae or Freddie Mac. The two government sponsored entities (GSEs) buy mortgages, package them via securities, and sell these securities to various investors. At the same time Fannie/Freddie and ultimately taxpayers guarantee these mortgage pools which enables very low pricing as the government holds the majority of risk in the security. This system has enabled the US to have rock bottom rates and offer a 30 year mortgage product.

What are in the new changes for Fannie/Freddie?

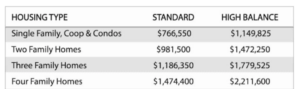

The Federal Housing Finance Agency (FHFA) today announced the conforming loan limit values (CLLs) for mortgages Fannie Mae and Freddie Mac (the Enterprises) will acquire in 2024. In most of the United States, the 2024 CLL value for one-unit properties will be $766,550.

Furthermore, median home values generally increased in high-cost areas in 2023, which increased their CLL values. The new ceiling loan limit for one-unit properties will be $1,149,825, which is 150 percent of $766,550.

The Difference between Jumbo loans and conforming loans

In essence, with the huge jump in conforming loan limits, Fannie Mae/taxpayers are clearing getting into the jumbo real estate market which is radically different than the original intent of the government sponsored entitities.

Jumbo loans are considerably riskier due to their size. For example, the possible loss on a 1m dollar property is considerably higher than a 100k loan. Furthermore, when there is a default, the marketing time on a million dollar house is considerably greater as the available pool of buyers is lower. As a result, banks have implemented four strategies to mitigate this risk

- Higher rates: Currently rates on jumbo loans are ½ to ¾% higher than a 30 year mortgage, I suspect the same will happen on many of the condos that Fannie/Freddie will no longer insure.

- Stricter underwriting standards: With no government backing, banks/lenders will increase underwriting to decrease their risk. This will include higher credit score requirements, increased income, lower loan to value and decreased debt requirements.

- More Adjustable Products (ARM): Lenders are stuck with the future interest rate risk. As a result you see more ARM products like a 5/1 or 7/1 where a mortgage is fixed for 5 years and then adjusts. This is how the jumbo market currently functions with 30 year fixed mortgages not as prevalent

- Lower Loan to Value ratios: Instead of down payments as low as 3%, many jumbo mortgages require 25-30% down to reduce the lenders exposure

Fannie/Freddie subsidizing expensive houses

The Federal governments is taking a much larger slice of the housing market by having huge jumps in the mortgages they buy. With the increased limits the government will make it considerably easier to buy very expensive homes. For example, someone could now purchase a 1.2m home in a high cost area with as little as 3% down. The expected jump in loan limits raises questions about the appropriate role of the government in housing and whether taxpayers should effectively backstop sky-high housing prices, when Fannie and Freddie’s market share is already rising.

In essence the increased loan limits are not focused on supporting buyers in Indiana or Georgia but in expensive coastal markets.

Taxpayers on the hook big time

The companies’ market share during the pandemic jumped to nearly 60% of all new mortgages, up from about 42% in 2019, according to the Urban Institute, a Washington think tank that conducts research on economic and social policy. With these changes, the percentage of loans guaranteed by taxpayers will likely increase to 75% or greater.

2008 wasn’t that long ago when there were huge losses in real estate. Unfortunately, the losses in 2008 were not an anomaly, there have been many cycles in the last 50 years with real estate losses. With taxpayers on the hook for losses on an even greater amount of mortgages, the losses will be amplified in the next cycle.

Summary

The original objective of Fannie/Freddie was to make mortgages available to low- and moderate-income borrowers. Remember Fannie/Freddie does not provide loans but backs or guarantees them in the secondary mortgage market. This leads to the question, is a million-dollar house for “low or moderate income”? It seems that there is considerable scope creep from the original intent of Fannie/Freddie.

I think most, including myself, would say a 1.2 million-dollar home is not for a low-income borrower. Raising loan limits so high is effectively trying to find a solution for a problem that doesn’t exist; there is a robust jumbo market that has effectively factored in risks for higher priced loans. By expanding loan sizes to high priced homes, taxpayers are going to be on the hook for enormous losses when real estate hits another cycle. The downside risks for taxpayers are much greater than any benefit from such a huge expansion in loan limits. We will all pay the price through higher taxes to subsidize expensive houses in expensive cities.

Additional reading/resources

- https://www.fhfa.gov//Media/PublicAffairs/Pages/FHFA-Announces-Conforming-Loan-Limit-Values-for-2024.aspx

- https://www.bloomberg.com/news/articles/2023-11-28/us-to-back-million-dollar-mortgages-in-san-diego-breckenridge?srnd=premium

- https://www.mpamag.com/us/specialty/wholesale/uwm-raises-conventional-loan-cap-ahead-of-fhfa-announcement/419945

- https://www.wsj.com/articles/fannie-mae-freddie-mac-to-back-home-loans-of-nearly-1-million-as-prices-soar-11637071380?st=k94odj1gsyh8w4j&reflink=share_mobilewebshare

- https://www.investopedia.com/articles/investing/091814/fannie-mae-what-it-does-and-how-it-operates.asp

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender