by Glen | May 27, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information

Wow, what a year. In December the market was anticipating as many as 4 rate cuts this year. At the same time the federal reserve was doing a victory dance on pulling of a soft landing. Fast forward and inflation is still hot and there is now a question of if...

by Glen | May 6, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Denver Hard Money, General real estate financing information, Georgia hard money

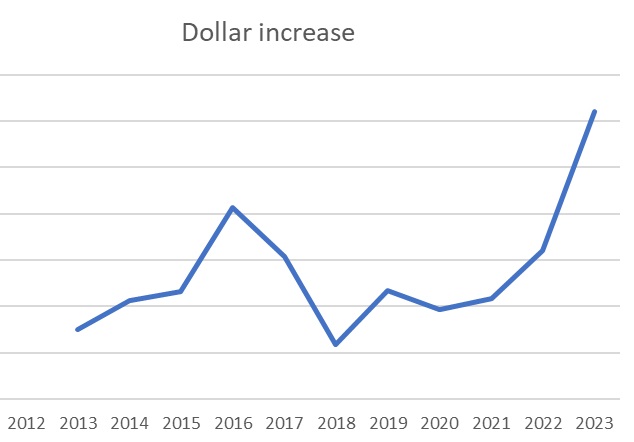

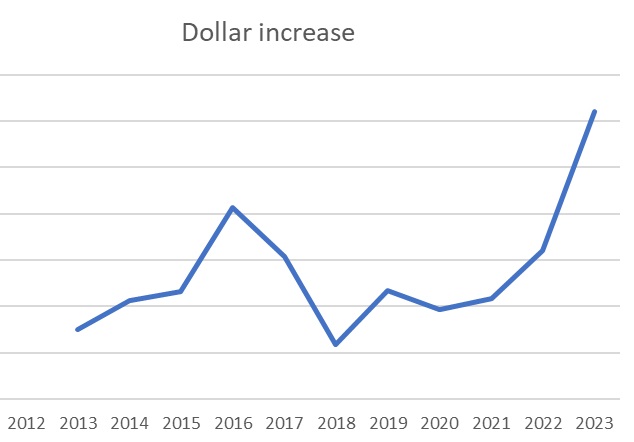

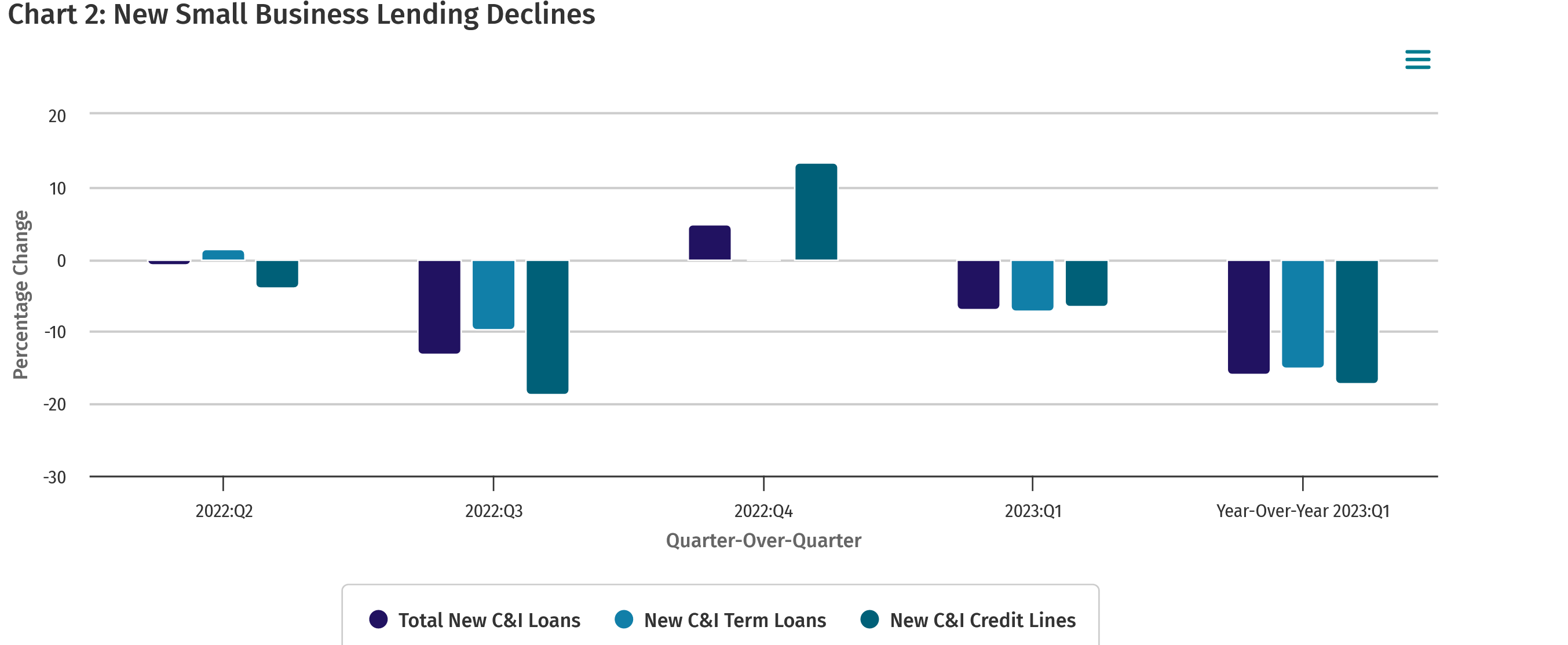

It is interesting that the market continues to focus on interest rates and employment as the barometer for the economy while totally ignoring one metric. As a lender I just did an analysis on our portfolio and one metric jumped off (chart above is my portfolio). In...

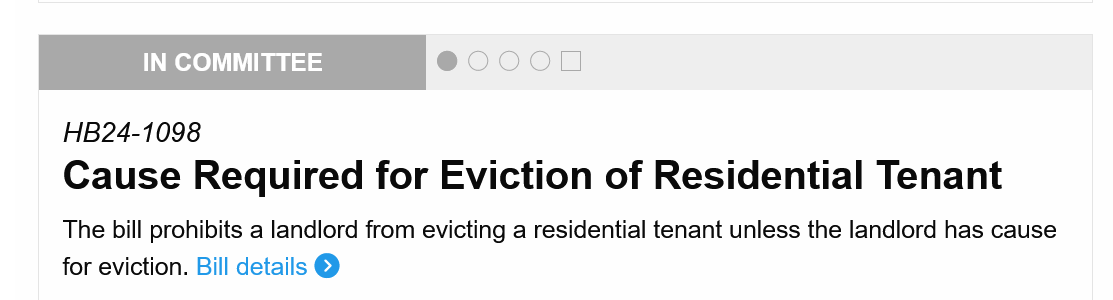

by Glen | Apr 29, 2024 | 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, How will Biden tax plan impact real estate?, national rental regulations

States have traditionally set rental regulations including zoning, evictions, etc… but that is all set to change with the president’s new proposal. The federal government will now be assuming many of the powers that were granted to the states. The biggest change is...

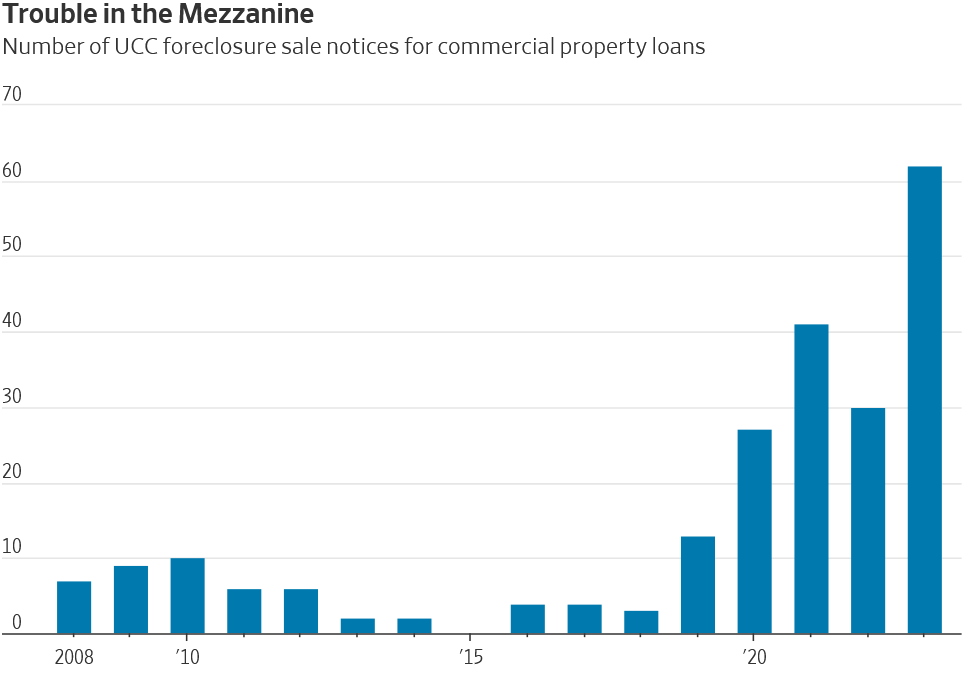

by Glen | Mar 25, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta real estate trends, Bank failures, Bankruptcy, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending in the news, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Georgia hard money, Hard Money Lending

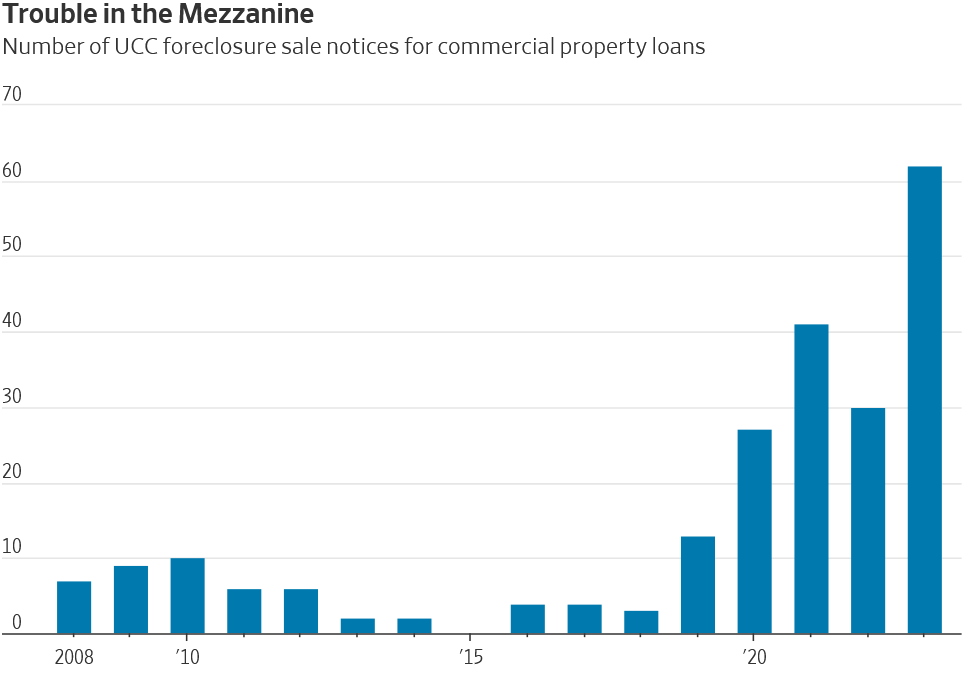

Foreclosures are surging in a risky corner of commercial real-estate finance, offering one of the most profound signs yet that turmoil in the commercial property market is just beginning. Lenders this year have issued a record number of foreclosure notices for...

by Glen | Feb 26, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Housing Price Trends / Information

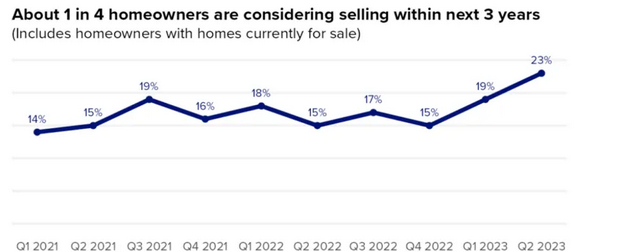

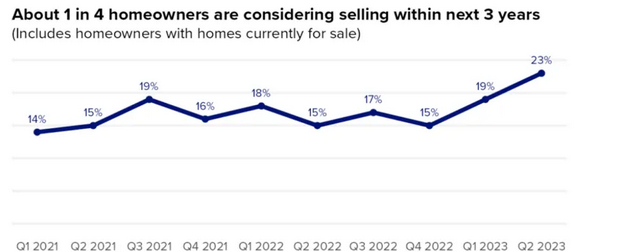

There is a theory that locked in low mortgage rates will force owners to stay in their houses. This has led to a huge shortage of inventory throughout the country. Why is the “lock in effect” starting to wind down? What does this mean for real estate prices over...

by Glen | Jan 22, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money loans, Housing Price Trends / Information

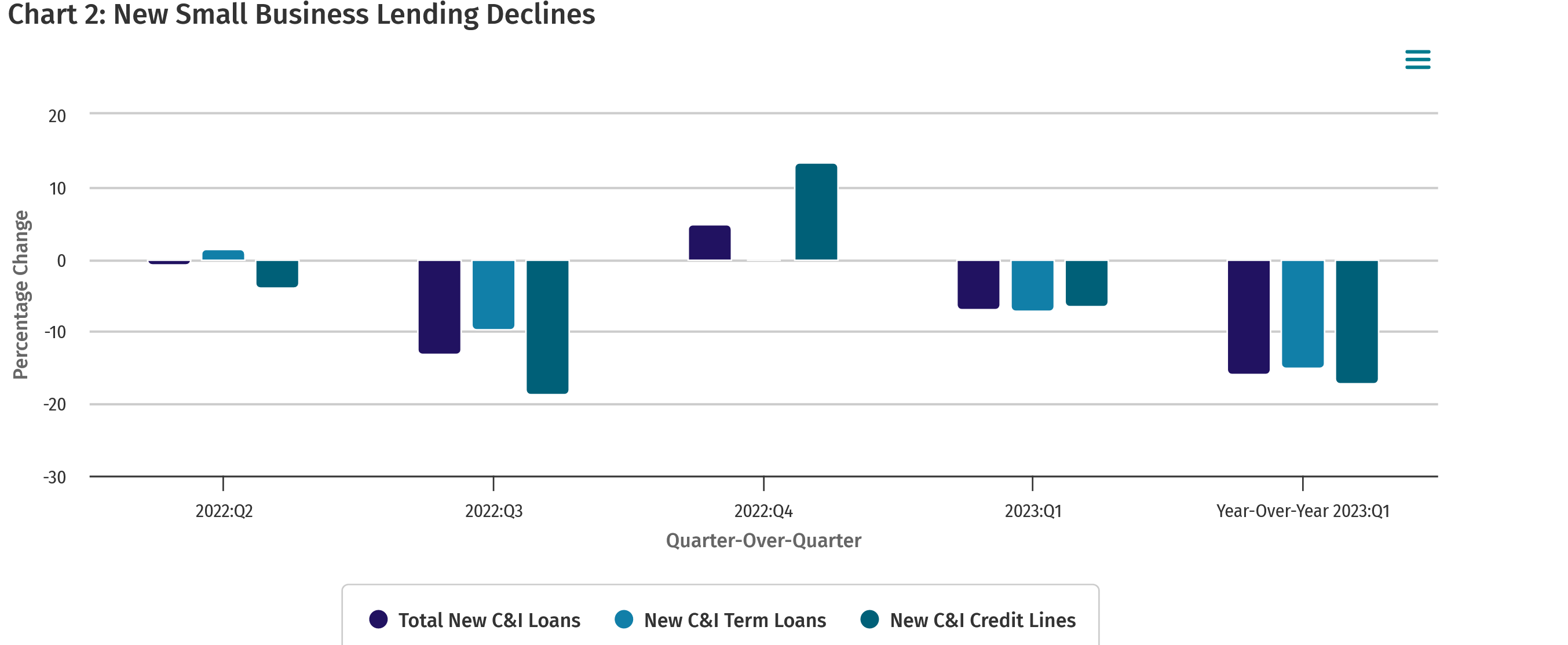

It is interesting that the market continues to focus on interest rates and employment as the barometer for the economy while totally ignoring one metric. As a lender I just did a year end analysis on our portfolio and one metric jumped off the page increasing...