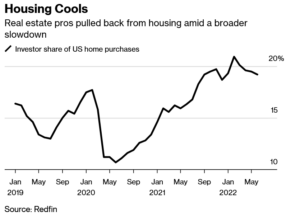

Wow, what a difference a few months makes. Earlier in the summer, basically any property with 4 walls had multiple offers and prices were on a tear. Fast Forward a few months and Blackstone, one of the largest buyers of residential rental homes, is pausing purchases. Why are they suddenly “cold” on the real estate market. Is this an indicator of a larger reset or just a small “bump” in the real estate market?

Blackstone and other ibuyers halt home purchases

Home Partners of America, the single-family landlord owned by Blackstone Inc., will stop buying homes in 38 US cities, becoming the latest institutional investor to back away from an overheated housing market.

The company, acquired by Blackstone in June 2021 for $6 billion, told customers that as of Sept. 1, it is pausing applications and property submissions in Boise, Idaho; Fresno, California; Memphis, Tennessee, and 25 other areas. It will go on hiatus in 10 additional cities on Oct. 1.

Home Partners isn’t the first large investor to back away from the US housing market, which reached a frenzied state during the first half of the year. Invitation Homes Inc., American Homes 4 Rent, and KKR & Co.’s My Community Homes are among landlords that have slowed purchases during a period of high home prices and rising financing costs.

Why are Blackstone and others halting/slowing purchases?

- Returns have fallen: As rates have basically doubled, returns have fallen substantially, when buyers could borrower in the 2-3% range, it was incredibly easy to make a healthy return. Now with rates double or triple, the numbers might not pencil out

- Market has gotten too high: Prices have gone up by double digits year over year, Blackstone and others recognize this growth is not sustainable and we are somewhere near a peak so it is a good time to slow down or completely halt buying at these price points as the only way from here is down.

- Wait for future opportunities at lower prices: There is a prevailing feeling in the market that prices will be heading down substantially as the economy resets and interest rates continue to rise. This will allow considerably more buying opportunities at much lower prices.

Are Blackstone’s actions portending a larger shift in the market?

I am a big believer in following the money. Blackstone is led by some extremely bright people that have incredible insight on the market. If they are getting nervous on the market and acting on it by halting purchases then it would be wise to follow suit. The market is drastically under pricing the down side real estate risk. Much of the run up in prices over the last several years was speculation fueled by rock bottom interest rates. As rates continue to rise higher and investor confidence wanes, there will be a much bigger reset in the real estate market.

Summary

It is crazy that a few months ago, the media was pounding the idea that we have the largest inventory shortage ever. Unfortunately this could not be farther from the truth. We never had an inventory problem, merely a demand spike from investors borrowing at rock bottom rates. This trend is rapidly unwinding. Blackstone and others through their actions are a warning for the real estate market that there is considerable turmoil ahead. Do not take the actions of Blackstone and others lightly as they have considerable knowledge and insight into the markets that the average investor does not. Unfortunately Blackstone is just a prelude of what is to come in the real estate market with falling values becoming prevalent.

Additional Reading/Resources

- https://www.bloomberg.com/news/articles/2022-08-12/housing-slowdown-chills-investors-who-supercharged-us-market

- https://www.bloomberg.com/news/articles/2022-08-25/blackstone-single-family-landlord-to-halt-purchases-in-38-cities

- https://www.bloomberg.com/news/articles/2022-08-30/home-price-growth-slowed-in-june-as-us-housing-market-turned

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).