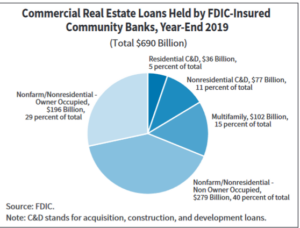

As the banking crisis unfolds, the media continues to focus on depositors and shareholders. Although both are important, there is an even bigger issue that is not being discussed. According to the FDIC, community banks made 67% of all commercial real estate loans in smaller metropolitan areas along with 28% in larger markets. With community banks and small/regional banks on the fences what does this mean for commercial real estate? How about residential real estate?

What was in the data in the FDIC community banking report:

Community banks have been active CRE lenders across all sizes of markets and are particularly prominent in smaller communities. According to Call Report data, community banks headquartered in rural areas and small metropolitan areas in 2019 held 67 percent of CRE loans held by all banks headquartered in those smaller geographic areas. In larger metropolitan areas, the share of CRE loans held by community banks is lower, but still material: 28 percent of total CRE loans of all banks headquartered in these areas.

Community banks are also key players in the SBA-guaranteed 7(a) loan program, which guarantees

loans originated up to $5 million.15 Between 2011 and 2019, community banks saw their share of SBA 7(a) loan originations increase from $5.7 billion to $9.0 billion. Of the loans originated by banks in that program in 2019, community banks originated approximately 46 percent.

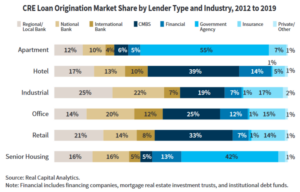

Smaller banks have huge exposure to commercial real estate

With the huge exposure to commercial real estate, smaller community banks/mid-size banks are likely in a more precarious position than the market is anticipating. Last cycle was a residential values bust, this cycle will be commercial real estate. With low rates over the last 10 years investors gorged on commercial real estate pushing cap rates down. Fast forward and rents are declining or at best holding steady on many property types while at the same time cap rates are rising. This leads to lower volumes and small banks are on the hook for billions in commercial real estate loans without the capital cushions of larger banks which could lead to disaster for many smaller/midsize institutions. As smaller banks come under increased regulatory scrutiny they will have to write down the asset value which will require them to raise more equity. It is a terrible time to be forced to come to market for an equity raise which will lead to further failures.

Construction and residential also impacted

Smaller banks are the engine for developers and builders. With less liquidity available developers and builders will be in a tight spot. Look for a profound shift over the next several months with a sharp pullback in Construction and Development loans (C&D).

What do the bank collapses mean for real estate values?

Even if the banking crisis stopped on a dime today, the damage has been done. Lenders are pulling back sharply on loans that don’t fit traditional Fannie/Freddie conventional guidelines. If the loan is not picture perfect, it will be difficult if not impossible to find financing. Smaller lenders are the lifeblood for “relationship” lending, but the recent fallout from the bank failures will pretty much eliminate relationship lending going forward. Either the boxes will be checked or they will not which will leave many borrowers without financing.

With credit being restricted, there will be downward pressure on real estate values. Commercial will feel the pinch the quickest and hardest, but even residential values will come under pressure.

Will the bank collapses lead to a recession?

The recent bank collapses will not directly lead to a recession, but the impending credit tightening will ultimately tip the economy into a downturn later this year.

Summary

When big events like the recent banking crisis happens, it is important to dig beneath the surface to understand in the long run how this will impact not just depositors, but the broader economy. The recent failures will result in a huge pullback in available credit especially on the commercial side. Small banks hold 67%+ of all commercial loans in small/midsize markets. As credit tightens these borrowers will not be able to refinance their existing debt and new borrowers will have increased challenges of getting credit. Furthermore in large markets, small banks make up almost a third of all commercial real estate loans so no market will be immune.

There will be a long term contagion effect from tightening credit that will ultimately ripple through the economy leading to lower values on commercial and residential properties. Furthermore, the tightening credit will lead to more defaults and ultimately contribute to a recession later this year.

Additional Reading/Resources:

- https://www.wsj.com/articles/smaller-banks-critical-role-in-economy-means-distress-raises-recession-risks-ba31e6a8?mod=mhp

- https://www.msci.com/documents/10199/08f87379-0d69-442a-b26d-46f749bb459b

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender