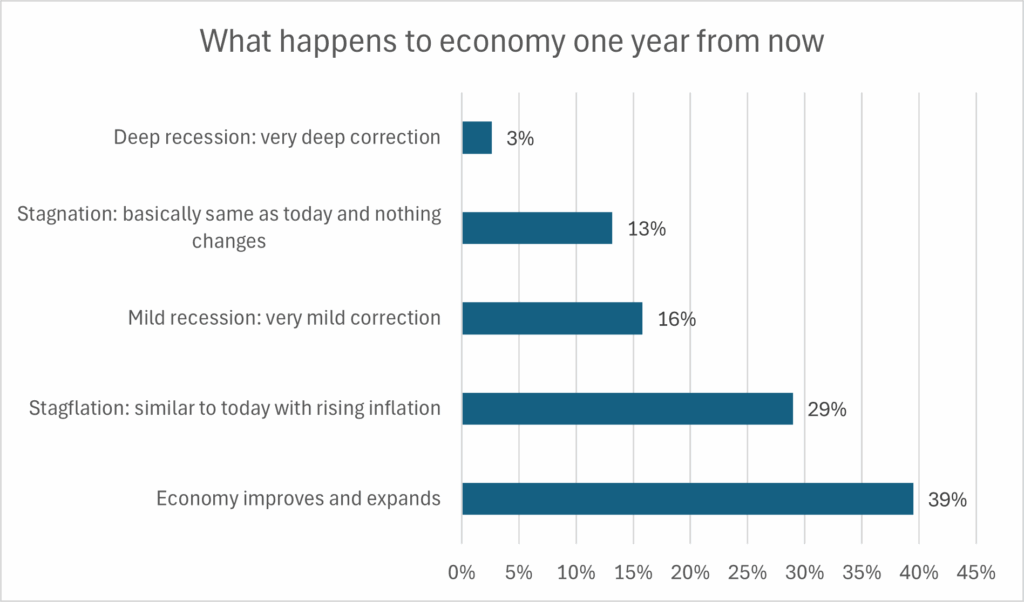

Last week in my blog, Heavy trucks signal a recession, I asked all of you what happens to the economy one year from now? I was floored by the response. The real estate pros have spoken and as you can see from the chart above, the majority (39%) think the economy is going to improve/expand from here. How accurate are these predictions? What was the rationale behind the improving economy.

What did real estate pros say about the economy one year from now?

I was pretty surprised at the responses. My predictions is that the economy expands and a deep recession would be about equal (less than 5%). I was totally wrong, based on the survey the majority thought that the economy would expand. It is important to take this will a little grain of salt as 45% thought that the economy would stay the same or enter a stagflationary environment. My gut is that one of these two scenarios will play out and I’m not as optimistic on an expansive economy, but I definitely could be wrong especially based on the rationale given in the comments below.

Key insights into what will happen to the economy in one year

Here are some of the key comments that were mentioned when answering the survey on the economy:

- Inflation and interest rates are improving and Trump policies should start to turn economy

- Efficiency revolution and infrastructure/factory investments.

- The mortgage rates will get lowered when Powell leaves and the housing market will become vibrant again.

- The massive capital investment—both public and private sector—is immense. The continued reduction of regulations and the lighter touch on taxes federally are driving consumers and small businesses. Healthcare is a major contributor to inflation and economic dysfunction however.

- I think the economy hits a period of rising inflation at the same time the economy stagnates a bit. The stock market is overvalued and once that stops we will see the economy basically stand still

- Consumer confidence is declining. Small businesses sales are flat. CRE office loan defaults are increasing. AI hype is driving equity values. Fed shutdown is continuing. SFR sales decline accelerating.

Key takeaways on where the economy goes from here

Thank you everyone for your participation and insights in my survey. The insight in the comments from readers was amazing and as you can see there are very different/polarizing thoughts on the economy. My key takeaway from this survey is that we don’t really know what is going to happen, but my best guess is that we are basically stuck. On the flip side, as many readers highlighted in the comments we are seeing a revolution in technology that could drastically alter the economy with higher efficiency leading to an upside surprise. Long and short we will have to wait and see how this all shakes out. Thanks again and stay tuned for upcoming surveys

Additional Reading/Resources:

- https://www.fairviewlending.com/trucks-signal-a-recession-my-data-says-opposite/

- https://www.fairviewlending.com/fed-drops-rates-why-did-mortgage-rates-barely-budge/

- https://www.fairviewlending.com/phantom-debt-soars-what-does-this-mean-for-real-estate-2/

- https://www.fairviewlending.com/never-buy-a-residential-condo/

- https://www.fairviewlending.com/the-war-on-landlords/

- https://www.fairviewlending.com/house-prices-hit-another-record-should-you-even-care/

- https://www.fairviewlending.com/root-cause-of-real-estate-price-declines/

- https://www.fairviewlending.com/will-real-estate-fall-to-2020-values/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender