Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the Congressional Budget Office study. Furthermore, nearly 40 percent of Americans say they would not be able to cover a $400 emergency expense easily. What does this mean for mortgage payments? Why is the middle class getting hit hardest in this cycle? What does this mean for real estate prices?

Last recession focused on lower income workers

If we look at the last recession, the overwhelming majority of job losses were targeted in lower paying jobs (service jobs, manufacturing, etc…). Don’t get me wrong there were some huge middle class impacts in real estate and finance, but the job losses were typically concentrated at the lower pay scales. This led to a very rapid decline in the economy as lower paid workers typically have less economic “cushion” than higher paid workers.

A recent study from the Federal Reserve concluded that 6 in 10 households do not have enough liquid assets to cover three months’ worth of expenses. The impending recession is likely to last longer than three months; the average duration of a recession between 1945 and 2001 was 10 months.

Middle income is getting hit hardest in this cycle:

Many low-income households, benefiting from exceptionally low unemployment rates, have found jobs and experienced wage increases that lifted income more than the cost of living, according to studies by the Congressional Budget Office and others. Many were also bolstered by federal payments during the pandemic.

At the high end, many households have seen big losses in stock and bond markets, but their income and savings were large enough that they were able to keep spending aggressively.

The middle has been in a vise. Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the CBO study. A growing share of middle-income households say they are having more trouble making ends meet, according to Census Bureau surveys.

Xavier Jaravel, an associate economics professor at the London School of Economics, found that middle-income households experienced inflation well over 15% from 2020 to 2022, compared with 14% and lower for the highest- and lowest-income households. That is mainly because of the middle’s exposure to cars and gasoline, where price increases were especially pronounced. In earlier cycles, low-income households tended to experience higher inflation.

Current layoff announcements are higher income/middle class workers

Fast forward 15 years and the new economy looks radically different. The largest layoffs have been in very well paid positions at Google, Microsoft, Goldman Sachs, Apple, Amazon, etc.. which are hitting a radically different demographic than the last recession. This is leaving many in the middle class in a precarious situation with rising costs on everything from mortgages to food and declining real purchasing power.

Target is the epitome of this change. If you look at the recent retail sales, Walmart is outperforming Target which squarely targets the middle class. Middle class buyers are trading down while higher end spenders are unfazed by the recent inflation.

Unfortunately we are just at the beginning of this cycle and middle class workers will be the target in this recession. With remote work, many middle class jobs can more easily be outsourced than hourly front line workers. For example if there is a finance guy working in Denver for a company in California, the same job could be done in Kansas or some other considerably lower cost area. The huge rise in remote work is a double edged sword that will ultimately reduce the wage gains of the middle class.

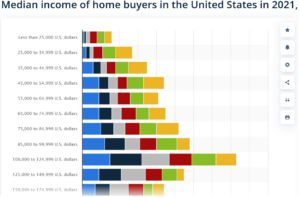

Middle class largest portion of homebuyers

About 14 percent of homebuyers in the United States in 2021 had a median household income between 100,000 and 124,999 U.S dollars. This was the median income range with the largest share of homebuyers in the United States that year. Furthermore, about 90% of all homebuyers make greater than 55k/year.

What does a middle class recession mean for real estate?

With the middle class making up the overwhelming majority of homebuyers, if this group struggles then real estate will be severely impacted. We are already seeing this in higher cost markets like Denver where middle class salaries are not coming close to keeping up with the cash flow that is needed to buy the median home. This is leading to increasing inventories and reduced prices

The good news on real estate: With values skyrocketing over the last three years. Most middle class homebuyers have built up substantial equity which will allow them to sell (if needed) and still come out much farther ahead. The average middle class homebuyer is equity rich which will help prevent a 2008 rerun.

The bad news on a middle class recession: With the middle class making up the largest prospective buyers, there is only one way for sales to go, down. With rising interest rates and lagging salaries, many existing homebuyers will not be trading up which will severely impact sales volume. Realtors, bankers, mortgage brokers, etc… are dependent on volume to drive their revenues. With the middle class on the sidelines it is going to be a rough patch for the real estate industry regardless of whether prices fall.

Summary:

Although this recession is the most “predicted” recession in history, it will not happen exactly as people think. One of the twists will be a “middle class” recession where the high and lower end of the market drastically outperform the middle class. I have not seen this occur in a recession nor can I find any historical reference to what we are about to see.

It will be important to watch how this plays out as we are already seeing indications of the impacts from a middle-class recession when areas like Denver see a reset in prices and middle-class targeted retailers like Target begin having issues. Look for real estate to underperform in this cycle with volumes plummeting, inventory rising, and ultimately prices softening as demand wanes. I don’t see a 08 rerun, but without historical reference there are bound to be some surprises.

Additional reading/resources

- https://www.wsj.com/articles/inflation-takes-biggest-bite-from-middle-income-households-11672246653?st=kvgenoqcocmu221&reflink=share_mobilewebshare

- https://www.statista.com/statistics/448308/median-income-home-buyers-usa-by-generation/

- https://www.brookings.edu/blog/up-front/2020/03/26/the-middle-class-is-not-ready-for-the-looming-recession/

- https://www.wsj.com/articles/wage-inequality-may-be-starting-to-reverse-11672339062?mod=hp_lead_pos12

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender